Form 720s, 725 Or 765 Instructions For Schedule Nol

ADVERTISEMENT

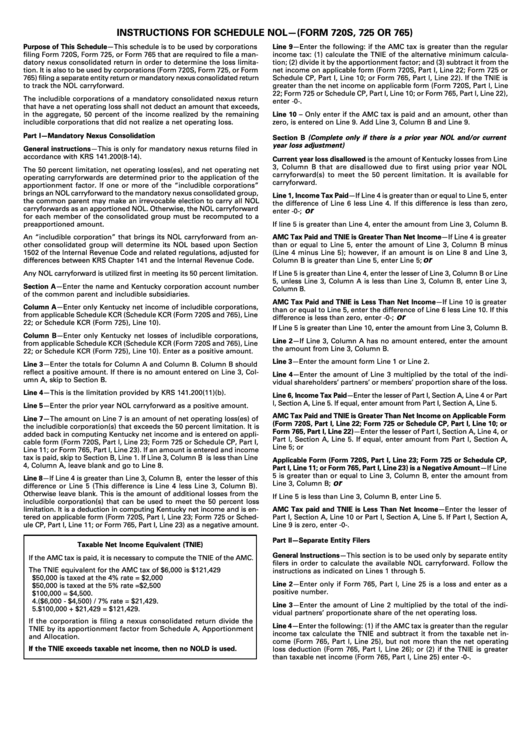

INSTRUCTIONS FOR SCHEDULE NOL—(FORM 720S, 725 OR 765)

Purpose of This Schedule—This schedule is to be used by corporations

Line 9—Enter the following: if the AMC tax is greater than the regular

filing Form 720S, Form 725, or Form 765 that are required to file a man-

income tax: (1) calculate the TNIE of the alternative minimum calcula-

datory nexus consolidated return in order to determine the loss limita-

tion; (2) divide it by the apportionment factor; and (3) subtract it from the

tion. It is also to be used by corporations (Form 720S, Form 725, or Form

net income on applicable form (Form 720S, Part I, Line 22; Form 725 or

765) filing a separate entity return or mandatory nexus consolidated return

Schedule CP, Part I, Line 10; or Form 765, Part I, Line 22). If the TNIE is

to track the NOL carryforward.

greater than the net income on applicable form (Form 720S, Part I, Line

22; Form 725 or Schedule CP, Part I, Line 10; or Form 765, Part I, Line 22),

The includible corporations of a mandatory consolidated nexus return

enter -0-.

that have a net operating loss shall not deduct an amount that exceeds,

in the aggregate, 50 percent of the income realized by the remaining

Line 10 – Only enter if the AMC tax is paid and an amount, other than

includible corporations that did not realize a net operating loss.

zero, is entered on Line 9. Add Line 3, Column B and Line 9.

Part I—Mandatory Nexus Consolidation

Section B (Complete only if there is a prior year NOL and/or current

year loss adjustment)

General instructions—This is only for mandatory nexus returns filed in

accordance with KRS 141.200(8-14).

Current year loss disallowed is the amount of Kentucky losses from Line

3, Column B that are disallowed due to first using prior year NOL

The 50 percent limitation, net operating loss(es), and net operating net

carryforward(s) to meet the 50 percent limitation. It is available for

operating carryforwards are determined prior to the application of the

carryforward.

apportionment factor. If one or more of the “includible corporations”

brings an NOL carryforward to the mandatory nexus consolidated group,

Line 1, Income Tax Paid—If Line 4 is greater than or equal to Line 5, enter

the common parent may make an irrevocable election to carry all NOL

the difference of Line 6 less Line 4. If this difference is less than zero,

carryforwards as an apportioned NOL. Otherwise, the NOL carryforward

or

enter -0-;

for each member of the consolidated group must be recomputed to a

preapportioned amount.

If line 5 is greater than Line 4, enter the amount from Line 3, Column B.

An “includible corporation” that brings its NOL carryforward from an-

AMC Tax Paid and TNIE is Greater Than Net Income—If Line 4 is greater

other consolidated group will determine its NOL based upon Section

than or equal to Line 5, enter the amount of Line 3, Column B minus

1502 of the Internal Revenue Code and related regulations, adjusted for

(Line 4 minus Line 5); however, if an amount is on Line 8 and Line 3,

or

differences between KRS Chapter 141 and the Internal Revenue Code.

Column B is greater than Line 5, enter Line 5;

Any NOL carryforward is utilized first in meeting its 50 percent limitation.

If Line 5 is greater than Line 4, enter the lesser of Line 3, Column B or Line

5, unless Line 3, Column A is less than Line 3, Column B, enter Line 3,

Section A—Enter the name and Kentucky corporation account number

Column B.

of the common parent and includible subsidiaries.

AMC Tax Paid and TNIE is Less Than Net Income—If Line 10 is greater

Column A—Enter only Kentucky net income of includible corporations,

than or equal to Line 5, enter the difference of Line 6 less Line 10. If this

from applicable Schedule KCR (Schedule KCR (Form 720S and 765), Line

or

difference is less than zero, enter -0-;

22; or Schedule KCR (Form 725), Line 10).

If Line 5 is greater than Line 10, enter the amount from Line 3, Column B.

Column B—Enter only Kentucky net losses of includible corporations,

Line 2—If Line 3, Column A has no amount entered, enter the amount

from applicable Schedule KCR (Schedule KCR (Form 720S and 765), Line

the amount from Line 3, Column B.

22; or Schedule KCR (Form 725), Line 10). Enter as a positive amount.

Line 3—Enter the amount form Line 1 or Line 2.

Line 3—Enter the totals for Column A and Column B. Column B should

reflect a positive amount. If there is no amount entered on Line 3, Col-

Line 4—Enter the amount of Line 3 multiplied by the total of the indi-

umn A, skip to Section B.

vidual shareholders’ partners’ or members’ proportion share of the loss.

Line 4—This is the limitation provided by KRS 141.200(11)(b).

Line 6, Income Tax Paid—Enter the lesser of Part I, Section A, Line 4 or Part

I, Section A, Line 5. If equal, enter amount from Part I, Section A, Line 5.

Line 5—Enter the prior year NOL carryforward as a positive amount.

AMC Tax Paid and TNIE is Greater Than Net Income on Applicable Form

Line 7—The amount on Line 7 is an amount of net operating loss(es) of

(Form 720S, Part I, Line 22; Form 725 or Schedule CP, Part I, Line 10; or

the includible corporation(s) that exceeds the 50 percent limitation. It is

Form 765, Part I, Line 22)—Enter the lesser of Part I, Section A, Line 4, or

added back in computing Kentucky net income and is entered on appli-

Part I, Section A, Line 5. If equal, enter amount from Part I, Section A,

cable form (Form 720S, Part I, Line 23; Form 725 or Schedule CP, Part I,

Line 5; or

Line 11; or Form 765, Part I, Line 23). If an amount is entered and income

tax is paid, skip to Section B, Line 1. If Line 3, Column B is less than Line

Applicable Form (Form 720S, Part I, Line 23; Form 725 or Schedule CP,

4, Column A, leave blank and go to Line 8.

Part I, Line 11; or Form 765, Part I, Line 23) is a Negative Amount—If Line

5 is greater than or equal to Line 3, Column B, enter the amount from

Line 8—If Line 4 is greater than Line 3, Column B, enter the lesser of this

or

Line 3, Column B;

difference or Line 5 (This difference is Line 4 less Line 3, Column B).

Otherwise leave blank. This is the amount of additional losses from the

If Line 5 is less than Line 3, Column B, enter Line 5.

includible corporation(s) that can be used to meet the 50 percent loss

limitation. It is a deduction in computing Kentucky net income and is en-

AMC Tax paid and TNIE is Less Than Net Income—Enter the lesser of

tered on applicable form (Form 720S, Part I, Line 23; Form 725 or Sched-

Part I, Section A, Line 10 or Part I, Section A, Line 5. If Part I, Section A,

ule CP, Part I, Line 11; or Form 765, Part I, Line 23) as a negative amount.

Line 9 is zero, enter -0-.

Part II—Separate Entity Filers

Taxable Net Income Equivalent (TNIE)

General Instructions—This section is to be used only by separate entity

If the AMC tax is paid, it is necessary to compute the TNIE of the AMC.

filers in order to calculate the available NOL carryforward. Follow the

The TNIE equivalent for the AMC tax of $6,000 is $121,429

instructions as indicated on Lines 1 through 5.

1. First $50,000 is taxed at the 4% rate = $2,000

Line 2—Enter only if Form 765, Part I, Line 25 is a loss and enter as a

2. The next $50,000 is taxed at the 5% rate =$2,500

positive number.

3. The tax for the first $100,000 = $4,500.

4. ($6,000 - $4,500) / 7% rate = $21,429.

Line 3—Enter the amount of Line 2 multiplied by the total of the indi-

5. $100,000 + $21,429 = $121,429.

vidual partners’ proportionate share of the net operating loss.

If the corporation is filing a nexus consolidated return divide the

Line 4—Enter the following: (1) if the AMC tax is greater than the regular

TNIE by its apportionment factor from Schedule A, Apportionment

income tax calculate the TNIE and subtract it from the taxable net in-

and Allocation.

come (Form 765, Part I, Line 25), but not more than the net operating

If the TNIE exceeds taxable net income, then no NOLD is used.

loss deduction (Form 765, Part I, Line 26); or (2) if the TNIE is greater

than taxable net income (Form 765, Part I, Line 25) enter -0-.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1