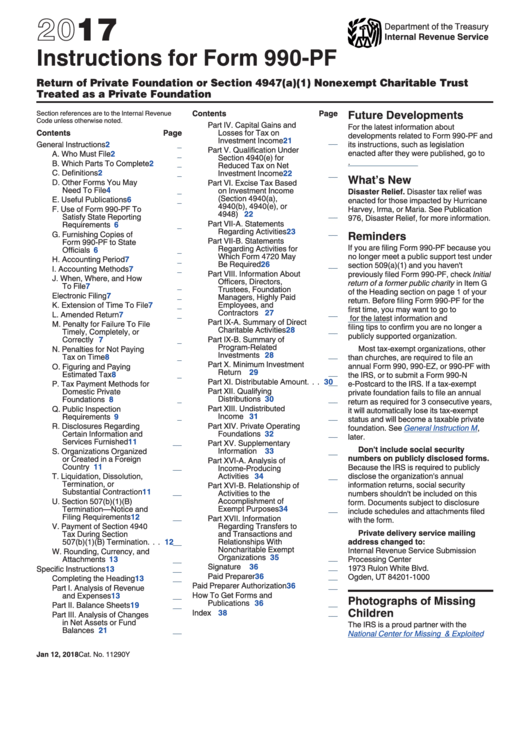

Instructions For Form 990-Pf - Return Of Private Foundation Or Section 4947(A)(1) Nonexempt Charitable Trust Treated As A Private Foundation - 2017

ADVERTISEMENT

2017

Department of the Treasury

Internal Revenue Service

Instructions for Form 990-PF

Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust

Treated as a Private Foundation

Future Developments

Contents

Page

Section references are to the Internal Revenue

Code unless otherwise noted.

Part IV. Capital Gains and

For the latest information about

Contents

Page

Losses for Tax on

developments related to Form 990-PF and

Investment Income . . . . . . .

21

General Instructions . . . . . . . . . . . . .

2

its instructions, such as legislation

Part V. Qualification Under

enacted after they were published, go to

A. Who Must File . . . . . . . . . . . .

2

Section 4940(e) for

IRS.gov/Form990PF.

B. Which Parts To Complete . . . .

2

Reduced Tax on Net

C. Definitions . . . . . . . . . . . . . .

2

Investment Income . . . . . . .

22

What’s New

D. Other Forms You May

Part VI. Excise Tax Based

Need To File . . . . . . . . . . . .

4

on Investment Income

Disaster Relief. Disaster tax relief was

(Section 4940(a),

E. Useful Publications

. . . . . . . .

6

enacted for those impacted by Hurricane

4940(b), 4940(e), or

F. Use of Form 990-PF To

Harvey, Irma, or Maria. See Publication

4948) . . . . . . . . . . . . . . . .

22

Satisfy State Reporting

976, Disaster Relief, for more information.

Part VII-A. Statements

Requirements . . . . . . . . . . . .

6

Regarding Activities . . . . . . .

23

Reminders

G. Furnishing Copies of

Part VII-B. Statements

Form 990-PF to State

If you are filing Form 990-PF because you

Regarding Activities for

Officials . . . . . . . . . . . . . . . .

6

Which Form 4720 May

no longer meet a public support test under

H. Accounting Period . . . . . . . . .

7

Be Required . . . . . . . . . . . .

26

section 509(a)(1) and you haven't

I. Accounting Methods . . . . . . . .

7

Part VIII. Information About

previously filed Form 990-PF, check Initial

J. When, Where, and How

Officers, Directors,

return of a former public charity in Item G

To File . . . . . . . . . . . . . . . .

7

Trustees, Foundation

of the Heading section on page 1 of your

Electronic Filing . . . . . . . . . . . .

7

Managers, Highly Paid

return. Before filing Form 990-PF for the

K. Extension of Time To File . . . .

7

Employees, and

first time, you may want to go to

Contractors . . . . . . . . . . . .

27

L. Amended Return . . . . . . . . . .

7

IRS.gov/EO

for the latest information and

Part IX-A. Summary of Direct

M. Penalty for Failure To File

filing tips to confirm you are no longer a

Charitable Activities . . . . . . .

28

Timely, Completely, or

publicly supported organization.

Correctly . . . . . . . . . . . . . . .

7

Part IX-B. Summary of

Program-Related

Most tax-exempt organizations, other

N. Penalties for Not Paying

Investments . . . . . . . . . . . .

28

Tax on Time . . . . . . . . . . . . .

8

than churches, are required to file an

Part X. Minimum Investment

annual Form 990, 990-EZ, or 990-PF with

O. Figuring and Paying

Return . . . . . . . . . . . . . . .

29

Estimated Tax . . . . . . . . . . .

8

the IRS, or to submit a Form 990-N

Part XI. Distributable Amount . . .

30

P. Tax Payment Methods for

e-Postcard to the IRS. If a tax-exempt

Part XII. Qualifying

Domestic Private

private foundation fails to file an annual

Foundations . . . . . . . . . . . . .

8

Distributions . . . . . . . . . . . .

30

return as required for 3 consecutive years,

Part XIII. Undistributed

Q. Public Inspection

it will automatically lose its tax-exempt

Requirements . . . . . . . . . . . .

9

Income . . . . . . . . . . . . . . .

31

status and will become a taxable private

Part XIV. Private Operating

R. Disclosures Regarding

foundation. See

General Instruction

M,

Certain Information and

Foundations . . . . . . . . . . . .

32

later.

Services Furnished . . . . . . .

11

Part XV. Supplementary

Don’t include social security

S. Organizations Organized

Information . . . . . . . . . . . .

33

numbers on publicly disclosed forms.

or Created in a Foreign

Part XVI-A. Analysis of

Country . . . . . . . . . . . . . . .

11

Because the IRS is required to publicly

Income-Producing

T. Liquidation, Dissolution,

Activities . . . . . . . . . . . . . .

34

disclose the organization's annual

Termination, or

information returns, social security

Part XVI-B. Relationship of

Substantial Contraction

. . . .

11

Activities to the

numbers shouldn't be included on this

U. Section 507(b)(1)(B)

Accomplishment of

form. Documents subject to disclosure

Termination—Notice and

Exempt Purposes . . . . . . . .

34

include schedules and attachments filed

Filing Requirements . . . . . . .

12

Part XVII. Information

with the form.

V. Payment of Section 4940

Regarding Transfers to

Private delivery service mailing

and Transactions and

Tax During Section

Relationships With

address changed to:

507(b)(1)(B) Termination

. . .

12

Noncharitable Exempt

Internal Revenue Service Submission

W. Rounding, Currency, and

Organizations . . . . . . . . . . .

35

Attachments . . . . . . . . . . . .

13

Processing Center

Signature

. . . . . . . . . . . . . . .

36

1973 Rulon White Blvd.

Specific Instructions . . . . . . . . . . . .

13

Paid Preparer . . . . . . . . . . . . .

36

Ogden, UT 84201-1000

Completing the Heading . . . . . .

13

Paid Preparer Authorization . . . . . . .

36

Part I. Analysis of Revenue

and Expenses . . . . . . . . . .

13

How To Get Forms and

Photographs of Missing

Publications . . . . . . . . . . . . . .

36

Part II. Balance Sheets . . . . . . .

19

Children

Index . . . . . . . . . . . . . . . . . . . . .

38

Part III. Analysis of Changes

in Net Assets or Fund

The IRS is a proud partner with the

Balances . . . . . . . . . . . . . .

21

National Center for Missing & Exploited

Jan 12, 2018

Cat. No. 11290Y

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38