Instructions For Form 990-Pf - Return Of Private Foundation Or Section 4947(A)(1) Nonexempt Charitable Trust Treated As A Private Foundation - Internal Revenue Service - 2008

ADVERTISEMENT

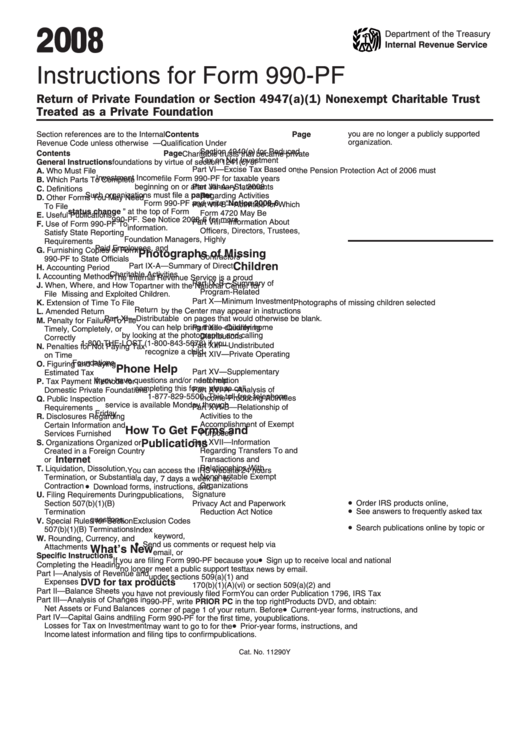

2 0 08

Department of the Treasury

Internal Revenue Service

Instructions for Form 990-PF

Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust

Treated as a Private Foundation

you are no longer a publicly supported

Section references are to the Internal

Contents

Page

organization.

Revenue Code unless otherwise noted.

Part V — Qualification Under

Section 4940(e) for Reduced

Contents

Page

Charitable trusts that became private

Tax on Net Investment Income . . . 18

General Instructions

foundations by virtue of section 1241(c) of

Part VI — Excise Tax Based on

the Pension Protection Act of 2006 must

A. Who Must File . . . . . . . . . . . . . . . . 2

Investment Income . . . . . . . . . . . . 18

file Form 990-PF for taxable years

B. Which Parts To Complete . . . . . . . . 2

beginning on or after January 1, 2008.

Part VII-A — Statements

C. Definitions . . . . . . . . . . . . . . . . . . . 2

Such organizations must file a paper

Regarding Activities . . . . . . . . . . . 19

D. Other Forms You May Need

Form 990-PF and write “Notice 2008-6

Part VII-B — Activities for Which

To File . . . . . . . . . . . . . . . . . . . . . . 3

status change ” at the top of Form

Form 4720 May Be Required . . . . . 20

E. Useful Publications . . . . . . . . . . . . . 4

990-PF. See Notice 2008-6 for more

Part VIII — Information About

F. Use of Form 990-PF To

information.

Officers, Directors, Trustees,

Satisfy State Reporting

Foundation Managers, Highly

Requirements . . . . . . . . . . . . . . . . . 4

Paid Employees, and

G. Furnishing Copies of Form

Photographs of Missing

Contractors . . . . . . . . . . . . . . . . . 22

990-PF to State Officials . . . . . . . . . 4

Children

Part IX-A — Summary of Direct

H. Accounting Period . . . . . . . . . . . . . 5

Charitable Activities . . . . . . . . . . . . 23

I. Accounting Methods . . . . . . . . . . . . 5

The Internal Revenue Service is a proud

Part IX-B — Summary of

J. When, Where, and How To

partner with the National Center for

Program-Related Investments

. . . 23

File . . . . . . . . . . . . . . . . . . . . . . . . 5

Missing and Exploited Children.

Part X — Minimum Investment

Photographs of missing children selected

K. Extension of Time To File . . . . . . . . 5

Return . . . . . . . . . . . . . . . . . . . . . 24

by the Center may appear in instructions

L. Amended Return . . . . . . . . . . . . . . 5

Part XI — Distributable Amount . . . . . 25

on pages that would otherwise be blank.

M. Penalty for Failure To File

You can help bring these children home

Part XII — Qualifying

Timely, Completely, or

by looking at the photographs and calling

Distributions . . . . . . . . . . . . . . . . . 25

Correctly . . . . . . . . . . . . . . . . . . . . 5

1-800-THE-LOST (1-800-843-5678) if you

Part XIII — Undistributed Income

. . . 26

N. Penalties for Not Paying Tax

recognize a child.

Part XIV — Private Operating

on Time . . . . . . . . . . . . . . . . . . . . . 6

Foundations . . . . . . . . . . . . . . . . . 27

O. Figuring and Paying

Phone Help

Part XV — Supplementary

Estimated Tax . . . . . . . . . . . . . . . . 6

If you have questions and/or need help

Information . . . . . . . . . . . . . . . . . . 27

P. Tax Payment Methods for

completing this form, please call

Part XVI-A — Analysis of

Domestic Private Foundations

. . . . 6

1-877-829-5500. This toll-free telephone

Income-Producing Activities . . . . . . 28

Q. Public Inspection

service is available Monday through

Requirements . . . . . . . . . . . . . . . . . 7

Part XVI-B — Relationship of

Friday.

Activities to the

R. Disclosures Regarding

Accomplishment of Exempt

Certain Information and

How To Get Forms and

Purposes . . . . . . . . . . . . . . . . . . . 28

Services Furnished . . . . . . . . . . . . . 9

Publications

Part XVII — Information

S. Organizations Organized or

Created in a Foreign Country

Regarding Transfers To and

Transactions and

Internet

or U.S. Possession . . . . . . . . . . . . . 9

Relationships With

T. Liquidation, Dissolution,

You can access the IRS website 24 hours

Noncharitable Exempt

Termination, or Substantial

a day, 7 days a week at to:

•

Organizations . . . . . . . . . . . . . . . . 29

Contraction . . . . . . . . . . . . . . . . . . . 9

Download forms, instructions, and

U. Filing Requirements During

Signature . . . . . . . . . . . . . . . . . . . . 30

publications,

•

Section 507(b)(1)(B)

Privacy Act and Paperwork

Order IRS products online,

•

See answers to frequently asked tax

Termination . . . . . . . . . . . . . . . . . 10

Reduction Act Notice . . . . . . . . . . . 30

questions,

V. Special Rules for Section

Exclusion Codes . . . . . . . . . . . . . . . 31

•

Search publications online by topic or

507(b)(1)(B) Terminations . . . . . . . 10

Index . . . . . . . . . . . . . . . . . . . . . . . . 32

keyword,

W. Rounding, Currency, and

•

Send us comments or request help via

Attachments . . . . . . . . . . . . . . . . . 10

What’s New

email, or

Specific Instructions

•

If you are filing Form 990-PF because you

Sign up to receive local and national

Completing the Heading . . . . . . . . . . 10

no longer meet a public support test

tax news by email.

Part I — Analysis of Revenue and

under sections 509(a)(1) and

Expenses . . . . . . . . . . . . . . . . . . . 11

DVD for tax products

170(b)(1)(A)(vi) or section 509(a)(2) and

Part II — Balance Sheets . . . . . . . . . . 15

you have not previously filed Form

You can order Publication 1796, IRS Tax

Part III — Analysis of Changes in

990-PF, write PRIOR PC in the top right

Products DVD, and obtain:

•

Net Assets or Fund Balances . . . . . 17

corner of page 1 of your return. Before

Current-year forms, instructions, and

Part IV — Capital Gains and

filing Form 990-PF for the first time, you

publications.

•

Losses for Tax on Investment

may want to go to /eo for the

Prior-year forms, instructions, and

Income . . . . . . . . . . . . . . . . . . . . . 17

latest information and filing tips to confirm

publications.

Cat. No. 11290Y

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32