Instructions For Form 8615 - Tax For Certain Children Who Have Investment Income Of More Than 1,900 - Internal Revenue Service - 2011

ADVERTISEMENT

2011

Department of the Treasury

Internal Revenue Service

Instructions for Form 8615

Tax for Certain Children Who Have Investment Income of More Than $1,900

General Instructions

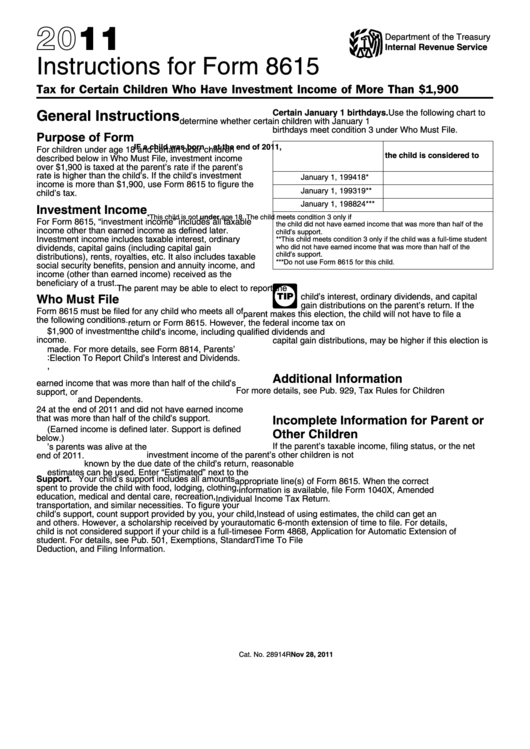

Certain January 1 birthdays. Use the following chart to

determine whether certain children with January 1

birthdays meet condition 3 under Who Must File.

Purpose of Form

IF a child was born on...

THEN, at the end of 2011,

For children under age 18 and certain older children

the child is considered to

described below in Who Must File, investment income

be...

over $1,900 is taxed at the parent’s rate if the parent’s

rate is higher than the child’s. If the child’s investment

January 1, 1994

18*

income is more than $1,900, use Form 8615 to figure the

January 1, 1993

19**

child’s tax.

January 1, 1988

24***

Investment Income

*This child is not under age 18. The child meets condition 3 only if

For Form 8615, “investment income” includes all taxable

the child did not have earned income that was more than half of the

income other than earned income as defined later.

child’s support.

Investment income includes taxable interest, ordinary

**This child meets condition 3 only if the child was a full-time student

dividends, capital gains (including capital gain

who did not have earned income that was more than half of the

child’s support.

distributions), rents, royalties, etc. It also includes taxable

***Do not use Form 8615 for this child.

social security benefits, pension and annuity income, and

income (other than earned income) received as the

beneficiary of a trust.

The parent may be able to elect to report the

Who Must File

child’s interest, ordinary dividends, and capital

TIP

gain distributions on the parent’s return. If the

Form 8615 must be filed for any child who meets all of

parent makes this election, the child will not have to file a

the following conditions.

return or Form 8615. However, the federal income tax on

1. The child had more than $1,900 of investment

the child’s income, including qualified dividends and

income.

capital gain distributions, may be higher if this election is

2. The child is required to file a tax return.

made. For more details, see Form 8814, Parents’

3. The child either:

Election To Report Child’s Interest and Dividends.

a. Was under age 18 at the end of 2011,

b. Was age 18 at the end of 2011 and did not have

Additional Information

earned income that was more than half of the child’s

For more details, see Pub. 929, Tax Rules for Children

support, or

and Dependents.

c. Was a full-time student over age 18 and under age

24 at the end of 2011 and did not have earned income

Incomplete Information for Parent or

that was more than half of the child’s support.

(Earned income is defined later. Support is defined

Other Children

below.)

If the parent’s taxable income, filing status, or the net

4. At least one of the child’s parents was alive at the

investment income of the parent’s other children is not

end of 2011.

5. The child does not file a joint return for 2011.

known by the due date of the child’s return, reasonable

estimates can be used. Enter “Estimated” next to the

Support. Your child’s support includes all amounts

appropriate line(s) of Form 8615. When the correct

spent to provide the child with food, lodging, clothing,

information is available, file Form 1040X, Amended U.S.

education, medical and dental care, recreation,

Individual Income Tax Return.

transportation, and similar necessities. To figure your

child’s support, count support provided by you, your child,

Instead of using estimates, the child can get an

and others. However, a scholarship received by your

automatic 6-month extension of time to file. For details,

child is not considered support if your child is a full-time

see Form 4868, Application for Automatic Extension of

student. For details, see Pub. 501, Exemptions, Standard

Time To File U.S. Individual Income Tax Return.

Deduction, and Filing Information.

Nov 28, 2011

Cat. No. 28914R

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5