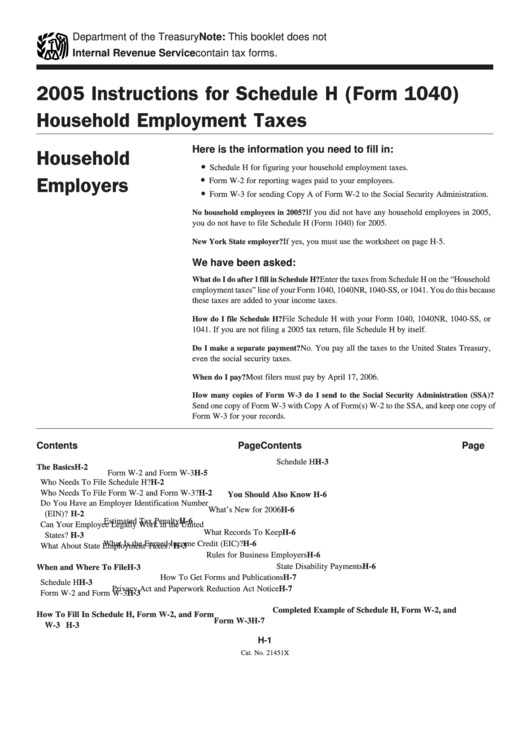

Instructions For Schedule H (Form 1040) Household Employment Taxes - 2005

ADVERTISEMENT

Department of the Treasury

Note: This booklet does not

Internal Revenue Service

contain tax forms.

2005 Instructions for Schedule H (Form 1040)

Household Employment Taxes

Here is the information you need to fill in:

Household

•

Schedule H for figuring your household employment taxes.

•

Form W-2 for reporting wages paid to your employees.

Employers

•

Form W-3 for sending Copy A of Form W-2 to the Social Security Administration.

If you did not have any household employees in 2005,

No household employees in 2005?

you do not have to file Schedule H (Form 1040) for 2005.

If yes, you must use the worksheet on page H-5.

New York State employer?

We have been asked:

What do I do after I fill in Schedule H?

Enter the taxes from Schedule H on the “Household

employment taxes” line of your Form 1040, 1040NR, 1040-SS, or 1041. You do this because

these taxes are added to your income taxes.

How do I file Schedule H?

File Schedule H with your Form 1040, 1040NR, 1040-SS, or

1041. If you are not filing a 2005 tax return, file Schedule H by itself.

Do I make a separate payment?

No. You pay all the taxes to the United States Treasury,

even the social security taxes.

When do I pay?

Most filers must pay by April 17, 2006.

How many copies of Form W-3 do I send to the Social Security Administration (SSA)?

Send one copy of Form W-3 with Copy A of Form(s) W-2 to the SSA, and keep one copy of

Form W-3 for your records.

Contents

Page

Contents

Page

Schedule H . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . H-3

The Basics . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . H-2

Form W-2 and Form W-3 . . . . . . . . . . . . . . . . . . . . . . . . H-5

Who Needs To File Schedule H? . . . . . . . . . . . . . . . . . . . H-2

Who Needs To File Form W-2 and Form W-3? . . . . . . . . . H-2

You Should Also Know . . . . . . . . . . . . . . . . . . . . . . . . . . H-6

Do You Have an Employer Identification Number

What’s New for 2006 . . . . . . . . . . . . . . . . . . . . . . . . . . . H-6

(EIN)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . H-2

Estimated Tax Penalty . . . . . . . . . . . . . . . . . . . . . . . . . . . H-6

Can Your Employee Legally Work in the United

What Records To Keep . . . . . . . . . . . . . . . . . . . . . . . . . . H-6

States? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . H-3

What Is the Earned Income Credit (EIC)? . . . . . . . . . . . . . H-6

What About State Employment Taxes? . . . . . . . . . . . . . . . H-3

Rules for Business Employers . . . . . . . . . . . . . . . . . . . . . H-6

State Disability Payments . . . . . . . . . . . . . . . . . . . . . . . . H-6

When and Where To File . . . . . . . . . . . . . . . . . . . . . . . . H-3

How To Get Forms and Publications . . . . . . . . . . . . . . . . H-7

Schedule H . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . H-3

Privacy Act and Paperwork Reduction Act Notice . . . . . . . H-7

Form W-2 and Form W-3 . . . . . . . . . . . . . . . . . . . . . . . . H-3

Completed Example of Schedule H, Form W-2, and

How To Fill In Schedule H, Form W-2, and Form

Form W-3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . H-7

W-3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . H-3

H-1

Cat. No. 21451X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10