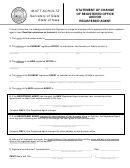

BOE-267-H (P3) REV. 08 (06-11)

INSTRUCTIONS FOR FILING

WELFARE EXEMPTION SUPPLEMENTAL AFFIDAVIT

HOUSING – ELDERLY OR HANDICAPPED FAMILIES

FILING OF AFFIDAVIT

This affidavit is required under the provisions of sections 214(f), 251, and 254.5 of the Revenue and Taxation code and must

be filed when seeking exemption on housing for elderly or handicapped families that is owned and operated by a nonprofit

organization or eligible limited liability company. A separate affidavit must be filed for each location and the income of the

occupants must not exceed certain limits (see section 3 of claim form). This affidavit supplements the claim for welfare

exemption and must be filed with the county assessor by February 15 to avoid a late filing penalty under section 270. If

you do not complete and file this form, you may be denied the exemption. The claimant should provide each family living

on the property with a copy of form BOE-267-H-A, Elderly and Handicapped Families, Family Household Income Reporting

Worksheet.

The organization keeps the completed, signed worksheet in case of further audit. Do not submit the worksheets with

your filing.

FISCAL YEAR

The fiscal year for which an exemption is sought must be entered correctly. The proper fiscal year follows the lien date (12:01

a.m., January 1) as of which the taxable or exempt status of the property is determined. For example, a person filing a timely

claim in February 20

would enter “20

-20

” on line four of the claim; a “20

-2011” entry on a claim filed in February

2011 would signify that a late claim was being filed for the preceding fiscal year.

SECTION 1. Identification of Applicant.

Identify the name of the organization seeking exemption on the elderly or handicapped housing property, corporate identification

number (or limited liability number if the organization is a limited liability company), and mailing address.

SECTION 2. Identification of Property.

Identify the location of the elderly or handicapped housing property, county in which the property is located, and the date the

property was acquired by the organization.

SECTION 3. Household Information.

Include a list of low and moderate-income elderly and handicapped families that qualify for exemption based on the maximum

income level for the county for the claim year where the property is located (see dollar amount on table).

OBTAINING CLAIM FORMS FROM THE STATE BOARD OF EQUALIZATION

Claim form BOE-277, Claim for Organizational Clearance Certificate – Welfare Exemption, is available on the Board’s website

( ) or you may request the form by contacting the Exemptions Section at 916-274-3430.

1

1 2

2 3

3