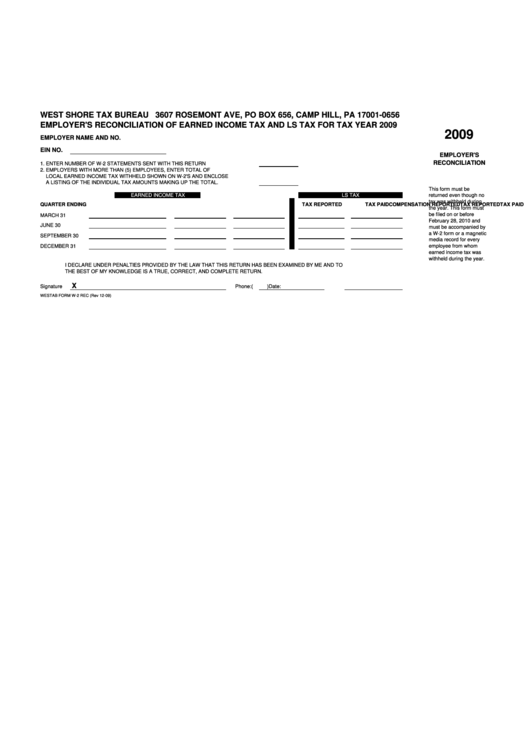

Employer'S Reconciliation Of Earned Income Tax And Ls Tax For Tax Year 2009

ADVERTISEMENT

WEST SHORE TAX BUREAU

3607 ROSEMONT AVE, PO BOX 656, CAMP HILL, PA 17001-0656

EMPLOYER'S RECONCILIATION OF EARNED INCOME TAX AND LS TAX FOR TAX YEAR 2009

2009

EMPLOYER NAME AND NO.

EIN NO.

EMPLOYER'S

RECONCILIATION

1. ENTER NUMBER OF W-2 STATEMENTS SENT WITH THIS RETURN

2. EMPLOYERS WITH MORE THAN (5) EMPLOYEES, ENTER TOTAL OF

LOCAL EARNED INCOME TAX WITHHELD SHOWN ON W-2'S AND ENCLOSE

A LISTING OF THE INDIVIDUAL TAX AMOUNTS MAKING UP THE TOTAL.

This form must be

EARNED INCOME TAX

LS TAX

returned even though no

tax was withheld during

QUARTER ENDING

COMPENSATION REPORTED

TAX REPORTED

TAX PAID

TAX REPORTED

TAX PAID

the year. This form must

be filed on or before

MARCH 31

February 28, 2010 and

JUNE 30

must be accompanied by

a W-2 form or a magnetic

SEPTEMBER 30

media record for every

DECEMBER 31

employee from whom

earned income tax was

withheld during the year.

I DECLARE UNDER PENALTIES PROVIDED BY THE LAW THAT THIS RETURN HAS BEEN EXAMINED BY ME AND TO

THE BEST OF MY KNOWLEDGE IS A TRUE, CORRECT, AND COMPLETE RETURN.

X

Signature

Phone:

(

)

Date:

WESTAB FORM W-2 REC (Rev 12-09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1