Reset Form

Michigan Department of Treasury

state use Only

4507 (Rev. 06-09)

Application Number

Date Received

LUCI Code

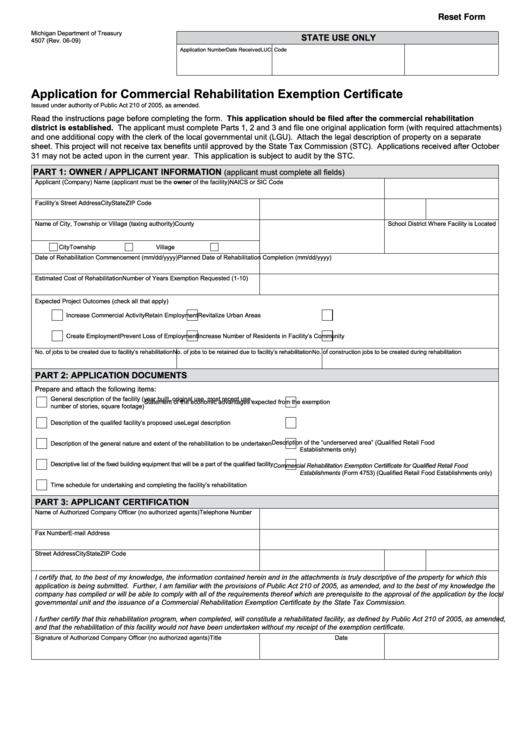

Application for Commercial Rehabilitation Exemption Certificate

Issued under authority of Public Act 210 of 2005, as amended.

Read the instructions page before completing the form. This application should be filed after the commercial rehabilitation

district is established. The applicant must complete Parts 1, 2 and 3 and file one original application form (with required attachments)

and one additional copy with the clerk of the local governmental unit (LGU). Attach the legal description of property on a separate

sheet. This project will not receive tax benefits until approved by the State Tax Commission (STC). Applications received after October

31 may not be acted upon in the current year. This application is subject to audit by the STC.

Part 1: Owner / aPPlicant infOrmatiOn

(applicant must complete all fields)

Applicant (Company) Name (applicant must be the owner of the facility)

NAICS or SIC Code

Facility’s Street Address

City

State

ZIP Code

Name of City, Township or Village (taxing authority)

County

School District Where Facility is Located

City

Township

Village

Date of Rehabilitation Commencement (mm/dd/yyyy)

Planned Date of Rehabilitation Completion (mm/dd/yyyy)

Estimated Cost of Rehabilitation

Number of Years Exemption Requested (1-10)

Expected Project Outcomes (check all that apply)

Increase Commercial Activity

Retain Employment

Revitalize Urban Areas

Create Employment

Prevent Loss of Employment

Increase Number of Residents in Facility’s Community

No. of jobs to be created due to facility’s rehabilitation No. of jobs to be retained due to facility’s rehabilitation No. of construction jobs to be created during rehabilitation

Part 2: aPPlicatiOn dOcuments

Prepare and attach the following items:

General description of the facility (year built, original use, most recent use,

Statement of the economic advantages expected from the exemption

number of stories, square footage)

Description of the qualifed facility’s proposed use

Legal description

Description of the “underserved area” (Qualified Retail Food

Description of the general nature and extent of the rehabilitation to be undertaken

Establishments only)

Descriptive list of the fixed building equipment that will be a part of the qualified facility

Commercial Rehabilitation Exemption Certiificate for Qualified Retail Food

Establishments (Form 4753) (Qualified Retail Food Establishments only)

Time schedule for undertaking and completing the facility’s rehabilitation

Part 3: aPPlicant certificatiOn

Name of Authorized Company Officer (no authorized agents)

Telephone Number

Fax Number

E-mail Address

Street Address

City

State

ZIP Code

I certify that, to the best of my knowledge, the information contained herein and in the attachments is truly descriptive of the property for which this

application is being submitted. Further, I am familiar with the provisions of Public Act 210 of 2005, as amended, and to the best of my knowledge the

company has complied or will be able to comply with all of the requirements thereof which are prerequisite to the approval of the application by the local

governmental unit and the issuance of a Commercial Rehabilitation Exemption Certificate by the State Tax Commission.

I further certify that this rehabilitation program, when completed, will constitute a rehabilitated facility, as defined by Public Act 210 of 2005, as amended,

and that the rehabilitation of this facility would not have been undertaken without my receipt of the exemption certificate.

Signature of Authorized Company Officer (no authorized agents)

Title

Date

1

1 2

2 3

3