Transit Self-Employment Tax Apportionment Worksheet Instructions

ADVERTISEMENT

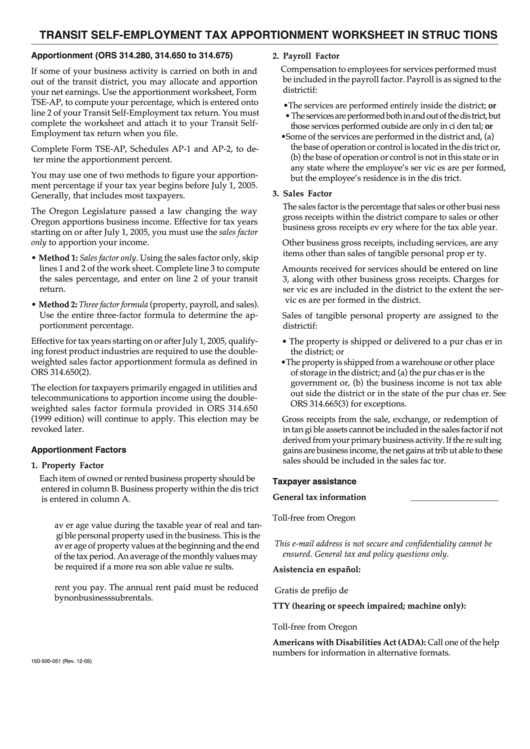

TRANSIT SELF-EMPLOYMENT TAX APPORTIONMENT WORKSHEET IN STRUC TIONS

Apportionment (ORS 314.280, 314.650 to 314.675)

2. Payroll Factor

Compensation to employees for services performed must

If some of your business activity is carried on both in and

be included in the payroll factor. Payroll is as signed to the

out of the transit district, you may allocate and apportion

dis trict if:

your net earnings. Use the apportionment worksheet, Form

TSE-AP, to compute your percentage, which is entered onto

• The services are performed entirely inside the district; or

line 2 of your Transit Self-Employment tax return. You must

• The services are performed both in and out of the dis trict, but

complete the worksheet and attach it to your Transit Self-

those services performed outside are only in ci den tal; or

Employment tax return when you file.

• Some of the services are performed in the district and, (a)

the base of operation or control is located in the dis trict or,

Complete Form TSE-AP, Schedules AP-1 and AP-2, to de-

(b) the base of operation or control is not in this state or in

ter mine the apportionment percent.

any state where the employee’s ser vic es are per formed,

You may use one of two methods to figure your apportion-

but the employee’s residence is in the dis trict.

ment percentage if your tax year begins before July 1, 2005.

3. Sales Factor

Generally, that includes most taxpayers.

The sales factor is the percentage that sales or other busi ness

The Oregon Legislature passed a law changing the way

gross receipts within the district compare to sales or other

Oregon apportions business income. Effective for tax years

business gross receipts ev ery where for the tax able year.

starting on or after July 1, 2005, you must use the sales factor

only to apportion your income.

Other business gross receipts, including services, are any

items other than sales of tangible personal prop er ty.

• Method 1: Sales factor only. Using the sales factor only, skip

lines 1 and 2 of the work sheet. Complete line 3 to compute

Amounts received for services should be entered on line

the sales percentage, and enter on line 2 of your transit

3, along with other business gross receipts. Charges for

return.

ser vic es are included in the district to the extent the ser-

vic es are per formed in the district.

• Method 2: Three factor formula (property, payroll, and sales).

Use the entire three-factor formula to determine the ap-

Sales of tangible personal property are assigned to the

portionment percentage.

dis trict if:

Effective for tax years starting on or after July 1, 2005, qualify-

• The property is shipped or delivered to a pur chas er in

ing forest product industries are required to use the double-

the district; or

weighted sales factor apportionment formula as defined in

• The property is shipped from a warehouse or other place

ORS 314.650(2).

of storage in the district; and (a) the pur chas er is the U.S.

government or, (b) the business income is not tax able

The election for taxpayers primarily engaged in utilities and

out side the district or in the state of the pur chas er. See

telecommunications to apportion income using the double-

ORS 314.665(3) for exceptions.

weighted sales factor formula provided in ORS 314.650

(1999 edition) will continue to apply. This election may be

Gross receipts from the sale, exchange, or redemption of

revoked later.

in tan gi ble assets cannot be included in the sales factor if not

derived from your primary business activity. If the re sult ing

Apportionment Factors

gains are business income, the net gains at trib ut able to these

sales should be included in the sales fac tor.

1. Property Factor

Each item of owned or rented business property should be

Taxpayer assistance

entered in column B. Business property within the dis trict

General tax information ....................

is entered in column A.

Salem ................................................................. 503-378-4988

1a. Owned property is valued at original cost. Show the

Toll-free from Oregon prefix..........................1-800-356-4222

av er age value during the taxable year of real and tan-

E-mail ............................................. tse.help.dor@state.or.us

gi ble personal property used in the business. This is the

This e-mail address is not secure and confidentiality cannot be

av er age of property values at the beginning and the end

ensured. General tax and policy questions only.

of the tax period. An average of the monthly values may

be required if a more rea son able value re sults.

Asistencia en español:

1b. Rented property is valued at eight times the annual

Salem ................................................................. 503-945-8618

rent you pay. The annual rent paid must be reduced

Gratis de prefi jo de Oregon......................... 1-800-356-4222

by non busi ness subrentals.

TTY (hearing or speech impaired; machine only):

1c. Enter the total of property factors on line 1c.

Salem ................................................................. 503-945-8617

Toll-free from Oregon prefix..................... 1-800-889-15204

Americans with Disabilities Act (ADA): Call one of the help

numbers for information in alternative formats.

150-500-051 (Rev. 12-05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1