Form Dr-601c - Florida Intangible Personal Property Tax Return For Corporation, Partnership, And Fiduciary Filers - 2006 Page 2

ADVERTISEMENT

DR-601C

R. 01/06

Important Information Requested

1. If this is your first time filing an intangible tax return, complete the following:

M M D D Y Y Y Y

Date of incorporation . ...........................

Month Day

Year

0 6 1 0 2 0 0 5

Example:

M M D D Y Y Y Y

Date you began business in Florida . ....

2. If your filing status has changed, enter the previous

Filing Status

FEIN, the new FEIN, and the new filing status:

n

n

Fiduciary

Final Return

n

n

Affiliated Group of Corporations

Information Return Only

(Must Submit List, See Page 10)

(Filed Under

n

Partnership

SSN____________________)

Previous FEIN

New FEIN

n

n

Corporation

Trustee

3.

If your name/mailing address has changed or is incorrect, complete the following:

Name of

Attention or

Taxpayer(s) _______________________________________________ In Care of __________________________________________________

New Address ______________________________________________ City/State/ZIP _______________________________________________

Telephone Number (________) ________________________________ Signature _ __________________________________________________

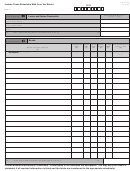

Tax Credit Worksheet

Tax Calculation Worksheet

(See Instructions, Page 8.)

A. Intangible Tax Paid to Another State

A.

1. Enter Total Taxable Intangible Assets

from Schedule A, Line 6

$

Identify State:

B. Cleanup of Contaminated Dry-Cleaning/

B.

2. Corporations, partnerships, affiliated groups

-$250,000

Brownfield Sites (if credit not taken on F-1120)

and estates - Subtract Standard Exemption

(Trusts filing on DR-601C are not allowed

C. Total Credit (Line A plus Line B)

C.

an exemption.)

Enter on Schedule A, Line 8

601-C

3. Taxable Assets

$

4. Multiply by Tax Rate

x .0005

5. Tax Due

Carry Amount to Schedule A, Line 7

If Tax Due is less than $60,

you do not need to file or pay unless

you elect to file for your shareholders.

$

Is the Corporation Filing as Agent for its Shareholders?

If yes, complete Schedule E and attach a copy of the notice used to inform the shareholders of this election. If no tax is

due, do not mail this return. Notify the Department of your election by TeleFile or by Internet. (See Instructions, Page 5.)

Make check payable to: Florida Department of Revenue

Neither foreign currency nor funds drawn on other than

(Include FEIN on check)

U.S. banks will be accepted.

State law requires a service fee for returned checks or

Mail to:

Florida Department of Revenue

drafts of $15 or 5% of the face amount, whichever is

5050 W Tennessee St

greater, not to exceed $150 [s. 215.34(2), F.S.].

Tallahassee FL 32399-0140

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4