Instructions For Form 8900 - 2005

ADVERTISEMENT

2

Form 8900 (2005)

Page

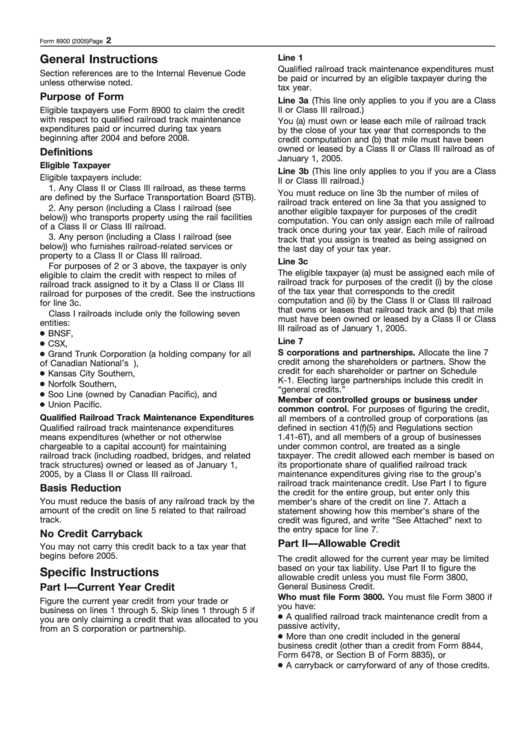

General Instructions

Line 1

Qualified railroad track maintenance expenditures must

Section references are to the Internal Revenue Code

be paid or incurred by an eligible taxpayer during the

unless otherwise noted.

tax year.

Purpose of Form

Line 3a (This line only applies to you if you are a Class

Eligible taxpayers use Form 8900 to claim the credit

II or Class III railroad.)

with respect to qualified railroad track maintenance

You (a) must own or lease each mile of railroad track

expenditures paid or incurred during tax years

by the close of your tax year that corresponds to the

beginning after 2004 and before 2008.

credit computation and (b) that mile must have been

owned or leased by a Class II or Class III railroad as of

Definitions

January 1, 2005.

Eligible Taxpayer

Line 3b (This line only applies to you if you are a Class

Eligible taxpayers include:

II or Class III railroad.)

1. Any Class II or Class III railroad, as these terms

You must reduce on line 3b the number of miles of

are defined by the Surface Transportation Board (STB).

railroad track entered on line 3a that you assigned to

2. Any person (including a Class I railroad (see

another eligible taxpayer for purposes of the credit

below)) who transports property using the rail facilities

computation. You can only assign each mile of railroad

of a Class II or Class III railroad.

track once during your tax year. Each mile of railroad

3. Any person (including a Class I railroad (see

track that you assign is treated as being assigned on

below)) who furnishes railroad-related services or

the last day of your tax year.

property to a Class II or Class III railroad.

Line 3c

For purposes of 2 or 3 above, the taxpayer is only

The eligible taxpayer (a) must be assigned each mile of

eligible to claim the credit with respect to miles of

railroad track for purposes of the credit (i) by the close

railroad track assigned to it by a Class II or Class III

of the tax year that corresponds to the credit

railroad for purposes of the credit. See the instructions

computation and (ii) by the Class II or Class III railroad

for line 3c.

that owns or leases that railroad track and (b) that mile

Class I railroads include only the following seven

must have been owned or leased by a Class II or Class

entities:

III railroad as of January 1, 2005.

● BNSF,

Line 7

● CSX,

● Grand Trunk Corporation (a holding company for all

S corporations and partnerships. Allocate the line 7

credit among the shareholders or partners. Show the

of Canadian National’s U.S. railroad operations),

credit for each shareholder or partner on Schedule

● Kansas City Southern,

K-1. Electing large partnerships include this credit in

● Norfolk Southern,

“general credits.”

● Soo Line (owned by Canadian Pacific), and

Member of controlled groups or business under

● Union Pacific.

common control. For purposes of figuring the credit,

Qualified Railroad Track Maintenance Expenditures

all members of a controlled group of corporations (as

defined in section 41(f)(5) and Regulations section

Qualified railroad track maintenance expenditures

means expenditures (whether or not otherwise

1.41-6T), and all members of a group of businesses

under common control, are treated as a single

chargeable to a capital account) for maintaining

taxpayer. The credit allowed each member is based on

railroad track (including roadbed, bridges, and related

track structures) owned or leased as of January 1,

its proportionate share of qualified railroad track

2005, by a Class II or Class III railroad.

maintenance expenditures giving rise to the group’s

railroad track maintenance credit. Use Part I to figure

Basis Reduction

the credit for the entire group, but enter only this

You must reduce the basis of any railroad track by the

member’s share of the credit on line 7. Attach a

amount of the credit on line 5 related to that railroad

statement showing how this member’s share of the

track.

credit was figured, and write “See Attached” next to

the entry space for line 7.

No Credit Carryback

Part II—Allowable Credit

You may not carry this credit back to a tax year that

begins before 2005.

The credit allowed for the current year may be limited

based on your tax liability. Use Part II to figure the

Specific Instructions

allowable credit unless you must file Form 3800,

Part I—Current Year Credit

General Business Credit.

Who must file Form 3800. You must file Form 3800 if

Figure the current year credit from your trade or

you have:

business on lines 1 through 5. Skip lines 1 through 5 if

● A qualified railroad track maintenance credit from a

you are only claiming a credit that was allocated to you

passive activity,

from an S corporation or partnership.

● More than one credit included in the general

business credit (other than a credit from Form 8844,

Form 6478, or Section B of Form 8835), or

● A carryback or carryforward of any of those credits.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2