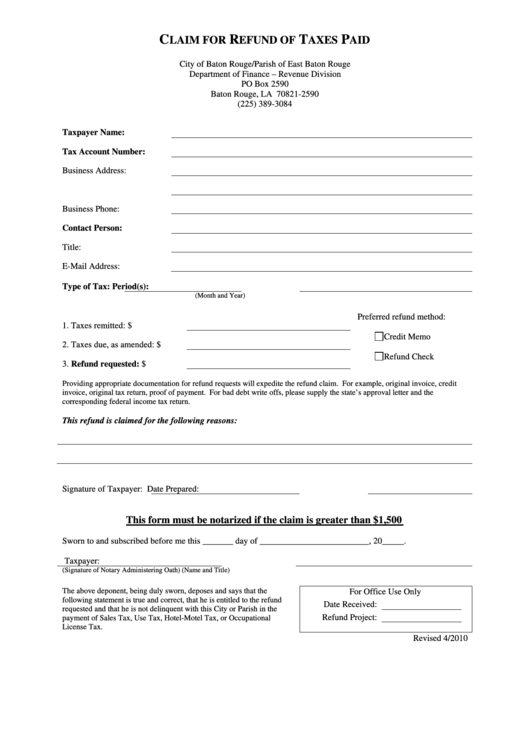

Claim For Refund Of Taxes Paid Form

ADVERTISEMENT

C

R

T

P

LAIM FOR

EFUND OF

AXES

AID

City of Baton Rouge/Parish of East Baton Rouge

Department of Finance – Revenue Division

PO Box 2590

Baton Rouge, LA 70821-2590

(225) 389-3084

Taxpayer Name:

Tax Account Number:

Business Address:

Business Phone:

Contact Person:

Title:

E-Mail Address:

Type of Tax:

Period(s):

(Month and Year)

Preferred refund method:

1.

Taxes remitted:

$

Credit Memo

2.

Taxes due, as amended:

$

Refund Check

3.

Refund requested:

$

Providing appropriate documentation for refund requests will expedite the refund claim. For example, original invoice, credit

invoice, original tax return, proof of payment. For bad debt write offs, please supply the state’s approval letter and the

corresponding federal income tax return.

This refund is claimed for the following reasons:

Signature of Taxpayer:

Date Prepared:

This form must be notarized if the claim is greater than $1,500

Sworn to and subscribed before me this _______ day of _________________________, 20_____.

Taxpayer:

(Signature of Notary Administering Oath)

(Name and Title)

The above deponent, being duly sworn, deposes and says that the

For Office Use Only

following statement is true and correct, that he is entitled to the refund

Date Received:

requested and that he is not delinquent with this City or Parish in the

Refund Project:

payment of Sales Tax, Use Tax, Hotel-Motel Tax, or Occupational

License Tax.

Revised 4/2010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1