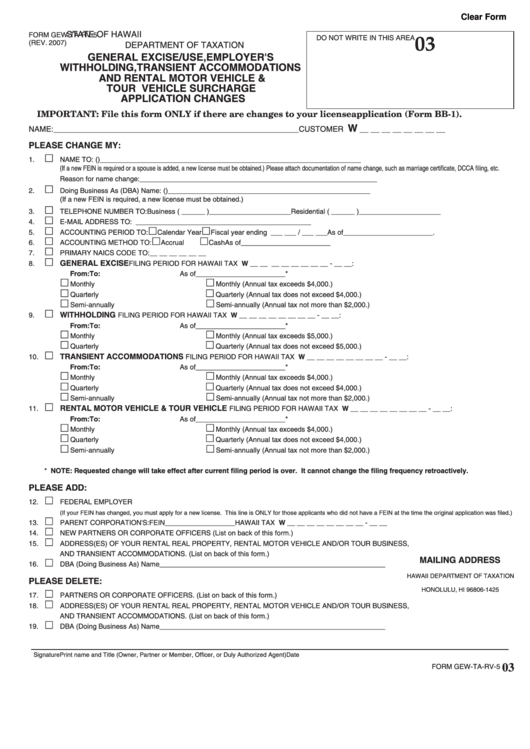

Clear Form

STATE OF HAWAII

FORM GEW-TA-RV-5

DO NOT WRITE IN THIS AREA

03

(REV. 2007)

DEPARTMENT OF TAXATION

GENERAL EXCISE/USE, EMPLOYER'S

WITHHOLDING, TRANSIENT ACCOMMODATIONS

AND RENTAL MOTOR VEHICLE &

TOUR VEHICLE SURCHARGE

APPLICATION CHANGES

IMPORTANT: File this form ONLY if there are changes to your license application (Form BB-1).

W

NAME: ________________________________________________________ CUSTOMER I.D. No.

__ __ __ __ __ __ __ __

PLEASE CHANGE MY:

£

1.

NAME TO: (

) ___________________________________________________________________

(If a new FEIN is required or a spouse is added, a new license must be obtained.) Please attach documentation of name change, such as marriage certificate, DCCA filing, etc.

Reason for name change: _____________________________________________________________

£

2.

Doing Business As (DBA) Name: (

) ____________________________________________________

(If a new FEIN is required, a new license must be obtained.)

£

3.

TELEPHONE NUMBER TO:

Business ( ______ ) _____________________ Residential ( ______ ) _____________________

£

4.

E-MAIL ADDRESS TO: _____________________________________________

£

£

£

5.

ACCOUNTING PERIOD TO:

Calendar Year

Fiscal year ending ___ ___ / ___ ___

As of_______________________.

£

£

£

6.

ACCOUNTING METHOD TO:

Accrual

Cash

As of_______________________

£

7.

PRIMARY NAICS CODE TO: __ __ __ __ __ __

£

GENERAL EXCISE

8.

FILING PERIOD FOR HAWAII TAX I.D. NO. W __ __ __ __ __ __ __ __ - __ __:

From:

To:

As of_______________________*

£

£

Monthly

Monthly (Annual tax exceeds $4,000.)

£

£

Quarterly

Quarterly (Annual tax does not exceed $4,000.)

£

£

Semi-annually

Semi-annually (Annual tax not more than $2,000.)

£

WITHHOLDING

9.

FILING PERIOD FOR HAWAII TAX I.D. NO. W __ __ __ __ __ __ __ __ - __ __:

From:

To:

As of_______________________*

£

£

Monthly

Monthly (Annual tax exceeds $5,000.)

£

£

Quarterly

Quarterly (Annual tax does not exceed $5,000.)

£

TRANSIENT ACCOMMODATIONS

10.

FILING PERIOD FOR HAWAII TAX I.D. NO. W __ __ __ __ __ __ __ __ - __ __:

From:

To:

As of_______________________*

£

£

Monthly

Monthly (Annual tax exceeds $4,000.)

£

£

Quarterly

Quarterly (Annual tax does not exceed $4,000.)

£

£

Semi-annually

Semi-annually (Annual tax not more than $2,000.)

£

RENTAL MOTOR VEHICLE & TOUR VEHICLE

11.

FILING PERIOD FOR HAWAII TAX I.D. NO. W __ __ __ __ __ __ __ __ - __ __:

From:

To:

As of_______________________*

£

£

Monthly

Monthly (Annual tax exceeds $4,000.)

£

£

Quarterly

Quarterly (Annual tax does not exceed $4,000.)

£

£

Semi-annually

Semi-annually (Annual tax not more than $2,000.)

* NOTE: Requested change will take effect after current filing period is over. It cannot change the filing frequency retroactively.

PLEASE ADD:

£

12.

FEDERAL EMPLOYER I.D. NO.___________________________________________________________

(If your FEIN has changed, you must apply for a new license. This line is ONLY for those applicants who did not have a FEIN at the time the original application was filed.)

£

13.

PARENT CORPORATION'S:

FEIN __________________

HAWAII TAX I.D. NO. W __ __ __ __ __ __ __ __ - __ __

£

14.

NEW PARTNERS OR CORPORATE OFFICERS (List on back of this form.)

£

15.

ADDRESS(ES) OF YOUR RENTAL REAL PROPERTY, RENTAL MOTOR VEHICLE AND/OR TOUR BUSINESS,

AND TRANSIENT ACCOMMODATIONS. (List on back of this form.)

£

MAILING ADDRESS

16.

DBA (Doing Business As) Name __________________________________________________________

HAWAII DEPARTMENT OF TAXATION

PLEASE DELETE:

P.O. BOX 1425

HONOLULU, HI 96806-1425

£

17.

PARTNERS OR CORPORATE OFFICERS. (List on back of this form.)

£

18.

ADDRESS(ES) OF YOUR RENTAL REAL PROPERTY, RENTAL MOTOR VEHICLE AND/OR TOUR BUSINESS,

AND TRANSIENT ACCOMMODATIONS. (List on back of this form.)

£

19.

DBA (Doing Business As) Name __________________________________________________________

Signature

Print name and Title (Owner, Partner or Member, Officer, or Duly Authorized Agent)

Date

03

FORM GEW-TA-RV-5

1

1 2

2