Form Ib-53 - Gross Premium Tax Return - Self-Insured Workers' Compensation Group - 2006

ADVERTISEMENT

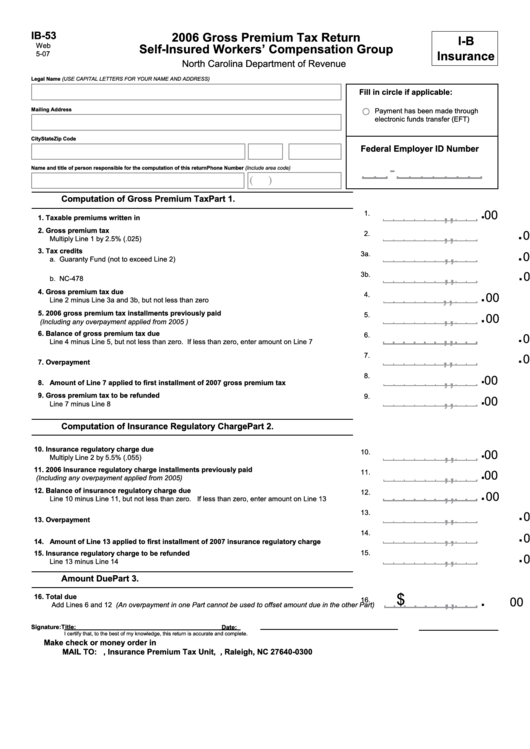

IB-53

2006 Gross Premium Tax Return

I-B

Web

Self-Insured Workers’ Compensation Group

Insurance

5-07

North Carolina Department of Revenue

Legal Name (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Fill in circle if applicable:

Mailing Address

Payment has been made through

electronic funds transfer (EFT)

City

State

Zip Code

Federal Employer ID Number

Name and title of person responsible for the computation of this return

Phone Number (Include area code)

(

)

Part 1.

Computation of Gross Premium Tax

.

,

,

00

1.

1. Taxable premiums written in N.C. during calendar year

.

,

,

2. Gross premium tax

00

2.

Multiply Line 1 by 2.5% (.025)

.

,

,

3. Tax credits

00

3a.

a. Guaranty Fund (not to exceed Line 2)

.

,

,

00

3b.

b. NC-478

.

,

,

4. Gross premium tax due

00

4.

Line 2 minus Line 3a and 3b, but not less than zero

.

,

,

5. 2006 gross premium tax installments previously paid

5.

00

(Including any overpayment applied from 2005 )

.

,

,

6. Balance of gross premium tax due

6.

00

Line 4 minus Line 5, but not less than zero. If less than zero, enter amount on Line 7

.

,

,

7.

00

7. Overpayment

.

,

,

8.

00

8. Amount of Line 7 applied to first installment of 2007 gross premium tax

.

,

,

9. Gross premium tax to be refunded

9.

00

Line 7 minus Line 8

Part 2.

Computation of Insurance Regulatory Charge

.

,

,

10. Insurance regulatory charge due

00

10.

Multiply Line 2 by 5.5% (.055)

.

,

,

11. 2006 Insurance regulatory charge installments previously paid

00

11.

(Including any overpayment applied from 2005)

.

,

,

12. Balance of insurance regulatory charge due

12.

00

Line 10 minus Line 11, but not less than zero. If less than zero, enter amount on Line 13

.

,

,

13.

00

13. Overpayment

.

,

,

14.

00

14. Amount of Line 13 applied to first installment of 2007 insurance regulatory charge

.

,

,

15. Insurance regulatory charge to be refunded

15.

00

Line 13 minus Line 14

Part 3.

Amount Due

.

,

,

$

16. Total due

00

16.

Add Lines 6 and 12 (An overpayment in one Part cannot be used to offset amount due in the other Part)

Signature:

Title:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

Make check or money order in U.S. currency payable to N.C. Department of Revenue. This return is due by March 15th.

MAIL TO: N.C. Department of Revenue, Insurance Premium Tax Unit, P.O. Box 25000, Raleigh, NC 27640-0300

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1