Instructions For Arizona Form A-4 - Annuitant'S Request For Voluntary Arizona Income Tax Withholding

ADVERTISEMENT

ARIZONA FORM

Annuitant’s Request for Voluntary

A-4P

Arizona Income Tax Withholding

If you would rather more closely approximate your tax liability from last year,

How do I Determine Which Percentage to Elect?

use your tax liability from your 2009 Arizona income tax return. Divide that

In an effort to assist annuitants in electing a withholding percentage, the

number by the number of distributions in calendar year 2010. This will be the

following simple examples are provided for general guidance. However,

amount of withholding you will try to have withheld out of each distribution. For

each annuitant must take into consideration the particular facts of their own

instance, if your 2009 tax liability was $1,800 and you receive a distribution

situation and adjust the calculation accordingly.

once a month (12 distributions a year) divide $1,800 by 12 (1,800 / 12 =

150.00). This is your withholding goal per distribution. Next, divide your

If you want to keep your withholding approximately the same as last year,

withholding goal by your taxable distribution amount, $6,000 in this example,

you can use your federal Form 1099-R for 2009 or your last distribution

to determine the percentage of withholding to taxable distribution (150.00 /

statement to calculate which withholding percentage to elect. For example,

6,000 = .025 or 2.5%). An election of 1.8% would result in $108.00 (6,000

if box 2a of federal Form 1099-R shows $36,000 in taxable distributions and

x 1.8% = 108) withheld for Arizona from each distribution ($1,296 annually),

box 10 shows $1,200 in state income tax withheld, divide box 10 by box 2a

while electing 2.7% would result in $162.00 (6,000 x 2.7% = 162) withheld for

to determine your withholding percentage (1,200 / 36,000 = .033 or 3.3%).

Arizona from each distribution ($1,944 annually). Be sure to take into account

In order to keep your withholding the same as 2009, choose 2.7% (36,000 x

any amount already withheld for 2010.

.027 = 972) and an additional $19.00 per monthly distribution (1,200 - 972 =

228 / 12 = 19.00). Be sure to take into account any amount already withheld

for 2010. If you want to withhold more, choose one of the higher percentages

or choose to have an additional amount withheld.

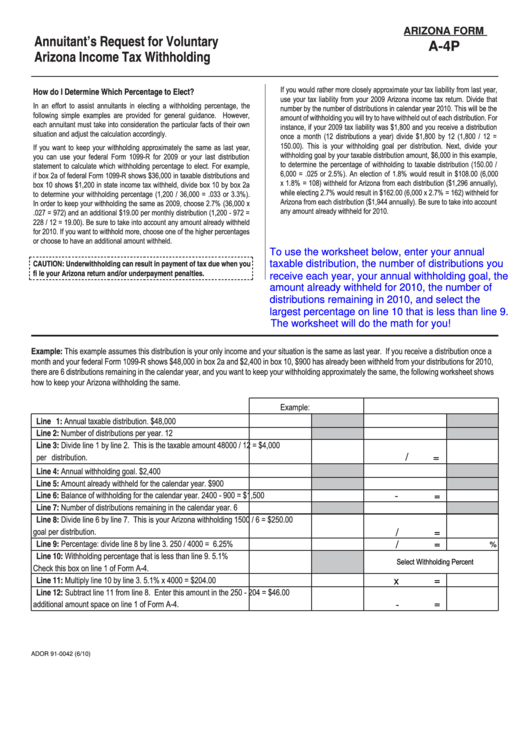

To use the worksheet below, enter your annual

CAUTION: Underwithholding can result in payment of tax due when you

taxable distribution, the number of distributions you

fi le your Arizona return and/or underpayment penalties.

receive each year, your annual withholding goal, the

amount already withheld for 2010, the number of

distributions remaining in 2010, and select the

largest percentage on line 10 that is less than line 9.

The worksheet will do the math for you!

Example: This example assumes this distribution is your only income and your situation is the same as last year. If you receive a distribution once a

month and your federal Form 1099-R shows $48,000 in box 2a and $2,400 in box 10, $900 has already been withheld from your distributions for 2010,

there are 6 distributions remaining in the calendar year, and you want to keep your withholding approximately the same, the following worksheet shows

how to keep your Arizona withholding the same.

Example:

Your Calculation:

Line 1: Annual taxable distribution.

$48,000

Line 2: Number of distributions per year.

12

Line 3: Divide line 1 by line 2. This is the taxable amount

48000 / 12 =

$4,000

per distribution.

/

=

Line 4: Annual withholding goal.

$2,400

Line 5: Amount already withheld for the calendar year.

$900

Line 6: Balance of withholding for the calendar year.

2400 - 900 =

$1,500

-

=

Line 7: Number of distributions remaining in the calendar year.

6

Line 8: Divide line 6 by line 7. This is your Arizona withholding

1500 / 6 =

$250.00

goal per distribution.

/

=

Line 9: Percentage: divide line 8 by line 3.

250 / 4000 =

6.25%

=

/

%

Line 10: Withholding percentage that is less than line 9.

5.1%

Select Withholding Percent

Check this box on line 1 of Form A-4.

Line 11: Multiply line 10 by line 3.

5.1% x 4000 =

$204.00

=

x

Line 12: Subtract line 11 from line 8. Enter this amount in the

250 - 204 =

$46.00

additional amount space on line 1 of Form A-4.

=

-

Return to Percent Election

ADOR 91-0042 (6/10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1