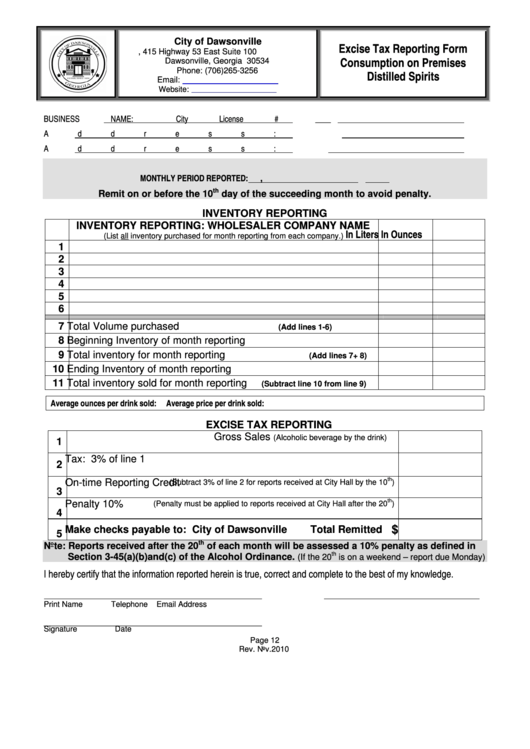

Inventory Reporting

ADVERTISEMENT

City of Dawsonville

Excise Tax Reporting Form

P.O. Box 6, 415 Highway 53 East Suite 100

Consumption on Premises

Dawsonville, Georgia 30534

Phone: (706)265-3256

Distilled Spirits

Email:

clerk@dawsonville-ga.gov

Website:

BUSINESS NAME:

City License #

____

Address:

State License #

____

Address:

Telephone:

____

MONTHLY PERIOD REPORTED:

,

th

Remit on or before the 10

day of the succeeding month to avoid penalty.

INVENTORY REPORTING

INVENTORY REPORTING: WHOLESALER COMPANY NAME

In Liters

In Ounces

(List all inventory purchased for month reporting from each company.)

1

2

3

4

5

6

7 Total Volume purchased

(Add lines 1-6)

8 Beginning Inventory of month reporting

9 Total inventory for month reporting

(Add lines 7+ 8)

10 Ending Inventory of month reporting

11 Total inventory sold for month reporting

(Subtract line 10 from line 9)

Average ounces per drink sold:

Average price per drink sold:

EXCISE TAX REPORTING

Gross Sales

(Alcoholic beverage by the drink)

1

Tax: 3% of line 1

2

On-time Reporting Credit

3

th

(Subtract 3% of line 2 for reports received at City Hall by the 10

)

Penalty 10%

4

th

(Penalty must be applied to reports received at City Hall after the 20

)

$

Make checks payable to: City of Dawsonville

Total Remitted

5

th

Note: Reports received after the 20

of each month will be assessed a 10% penalty as defined in

th

Section 3-45(a)(b)and(c) of the Alcohol Ordinance.

(If the 20

is on a weekend – report due Monday)

I hereby certify that the information reported herein is true, correct and complete to the best of my knowledge.

Print Name

Telephone

Email Address

__________________________________________________

Signature

Date

Page 12

Rev. Nov.2010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1