Form M1pr - Minnesota Property Tax Refund Return Instructions - 2005 Page 22

ADVERTISEMENT

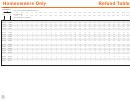

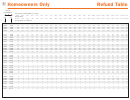

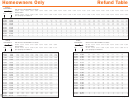

Homeowners Only

Refund Worksheet

For household incomes of $23,010 or more with property tax of $2,600 or more

1 Amount from line 13 of your Form M1PR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Total household income from line 8 of your Form M1PR . . . . . . . . . . . . . . . . . . . . .

Enter the decimal number for this step from the table below . . . . . . . . . . . . . . . . . .

Multiply step 2 by step 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Subtract step 4 from step 1 (if result is zero or less, stop here; you are not eligible for a refund) . . . . . . . . . . 5

6 Enter the decimal number for this step from the table below . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Multiply step 5 by step 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter the amount for this step from the table below . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Amount from step 7 or step 8, whichever is less.

Enter the amount here and on line 14 of your Form M1PR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Table for Homeowner’s Worksheet

If your total household

income on

step 2 above

is

but less

enter on

enter on

enter on

at least:

than:

step 3

step 6

step 8

$23,010

$28,420

0.025

0.60

1,260

28,420

32,470

0.026

0.60

1,210

32,470

40,590

0.027

0.60

1,210

40,590

47,350

0.028

0.55

1,100

47,350

54,120

0.030

0.55

1,100

54,120

60,900

0.032

0.55

990

60,900

67,660

0.035

0.50

880

67,660

74,430

0.040

0.50

770

74,430

78,490

0.040

0.50

660

78,490

81,210

0.040

0.50

540

81,210

84,490

0.040

0.50

440

84,490

87,780

0.040

0.50

330

87,780

& over

not eligible

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27