Form M1pr - Minnesota Property Tax Refund Return Instructions - 2005 Page 26

ADVERTISEMENT

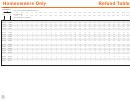

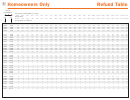

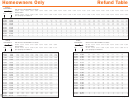

Homeowner Schedule for 2005

(Filing in 2006/ Fiscal Year 2007)

Income

Income Range

Threshold

Copay

Maximum

Midpoint

$

0

— $1,349

1.0%

15%

$1,640

$ 675

1,350

—

2,689

1.1%

15%

1,640

2,020

2,690

—

4,069

1.2%

15%

1,600

3,380

4,070

—

5,419

1.3%

20%

1,600

4,745

5,420

—

6,769

1.4%

20%

1,540

6,095

6,770

—

8,119

1.5%

20%

1,540

7,445

8,120

—

9,479

1.5%

20%

1,540

8,800

9,480

— 10,819

1.6%

25%

1,480

10,150

10,820

— 12,179

1.7%

25%

1,480

11,500

12,180

— 13,529

1.8%

25%

1,430

12,855

13,530

— 14,879

1.9%

30%

1,430

14,205

14,880

— 16,249

2.0%

30%

1,370

15,565

16,250

— 17,599

2.1%

30%

1,370

16,925

17,600

— 18,949

2.1%

30%

1,370

18,275

18,950

— 20,299

2.2%

35%

1,310

19,625

20,300

— 21,649

2.3%

35%

1,310

20,975

21,650

— 23,009

2.4%

35%

1,260

22,330

23,010

— 24,359

2.5%

40%

1,260

23,685

24,360

— 25,709

2.5%

40%

1,260

25,035

25,710

— 27,069

2.5%

40%

1,260

26,390

27,070

— 28,419

2.5%

40%

1,260

27,745

28,420

— 29,769

2.6%

40%

1,210

29,095

29,770

— 31,129

2.6%

40%

1,210

30,450

31,130

— 32,469

2.6%

40%

1,210

31,800

32,470

— 33,829

2.7%

40%

1,210

33,150

33,830

— 35,179

2.7%

40%

1,210

34,505

35,180

— 36,529

2.7%

40%

1,210

35,855

36,530

— 37,889

2.7%

40%

1,210

37,210

37,890

— 39,239

2.7%

40%

1,210

38,565

39,240

— 40,589

2.7%

40%

1,210

39,915

40,590

— 41,949

2.8%

45%

1,100

41,270

41,950

— 43,299

2.8%

45%

1,100

42,625

43,300

— 44,649

2.8%

45%

1,100

43,975

44,650

— 46,009

2.8%

45%

1,100

45,330

46,010

— 47,349

2.8%

45%

1,100

46,680

47,350

— 48,709

3.0%

45%

1,100

48,030

48,710

— 50,069

3.0%

45%

1,100

49,390

50,070

— 51,419

3.0%

45%

1,100

50,745

51,420

— 52,769

3.0%

45%

1,100

52,095

52,770

— 54,119

3.0%

45%

1,100

53,445

Continued

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27