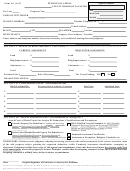

COUNTY BOARD OF TAXATION

INSTRUCTIONS FOR PREPARING PETITION OF APPEAL

ADDED OR OMITTED ASSESSMENT

1. FILING DATE

Your appeal must be received (not merely postmarked) by the County Tax Board on or before December 1 of the tax year. An

appeal received after the close of business hours on December 1 is untimely filed and will result in dismissal of the appeal. If

the last day for filing an appeal falls on a Saturday, Sunday or legal holiday, the last day shall be extended to the first

succeeding business day.

2. SEPARATE APPEALS

Separate appeals must be filed for each taxed parcel unless prior approval is granted by the County Tax Administrator.

3. FILING OF PETITION

(a) The original petition must be filed with the County Tax Board.

(b) A copy must be served upon the Assessor of the municipality in which the property is located, or, in the event of a

municipal appeal, served upon the taxpayer.

(c) A copy must be served upon the Clerk of the municipality in which the property is located, or in the event of a municipal

appeal, served upon the taxpayer.

(d) A copy should be retained by the petitioner.

(e) Any supporting documents attached to the original petition shall also be attached to the Assessor and Clerk copies.

4.

FILING FEES (Must accompany original petition of appeal)

(a) Prorated Assessed Valuation less than $150,000...................................................$5.00

1. $150,000 or more, but less than $500,000...............................................$25.00

2. $500,000 or more, but less than $1,000,000..........................................$100.00

3. $1,000,000 or more........................................... ...................... ..............$150.00

(b) Appeal on Classification.......................................................................................$25.00

(c) Appeal on Valuation and Classification...................................................Sum of a and b

(d) Appeal not covered by a, b, or c............................................................................$25.00

Check should be made payable to County Tax Administrator.

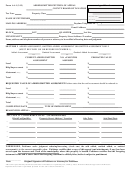

5. ADJOURNMENTS

No adjournments will be granted except for extraordinary reasons.

6. REPRESENTATION AT HEARING

(a) A taxpayer must be present at the hearing or be represented by an Attorney-At-Law admitted to practice in the State of

New Jersey.

(b) In the event the petitioner is a corporation, its appeal must be prosecuted by an Attorney-At-Law admitted to practice in

the State of New Jersey.

7. DISCRIMINATION

N.J.S.A. 54:3-22(c) to (f) requires that whenever the County Board finds that the ratio of assessed value to true value of

property under appeal exceeds the upper limit or falls below the lower limit by 15% of the average ratio for each municipality,

the County Board shall revise the assessment by applying the average ratio to the true value of the property.

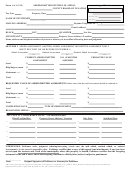

8. SUPPORTING PROOF AND PROCEDURES

If you are appealing the value of an Added Assessment, you will be required, at the time of the hearing, to present testimony

from which the Board can determine the market value of your property as it stood on October 1st of the pre-tax year and the

market value it would have had if the new improvements were completed at that time. The Added Assessment should reflect

the difference between the two values prorated for the number of full months remaining in the tax year after completion.

If you are appealing the value of an Omitted Assessment, you will be required to present testimony on the value of the

property as of October 1st of the pre-tax year.

(a) APPRAISALS

1. A party intending to rely on expert testimony shall furnish to the Board a written appraisal report for the Tax

Administrator and each Commissioner and shall furnish one copy of the report to each opposing party at least

seven calendar days prior to the hearing. If an appraisal is to be used as evidence, the appraiser must be present to

testify to his report.

2. If the municipality intends to rely on its Assessor or a representative of a revaluation company as its expert and if

such testimony will involve data and analysis which is not reflected on the property record card, the municipality shall

furnish to the Board for the Tax Administrator and each Commissioner copies of a written report reflecting such data

and analysis and shall furnish one copy of the report to each opposing party at least seven calendar days prior to the

hearing.

3. The Board in its discretion and in the interest of justice may waive the requirements for the submission of

written reports.

4. At the request of the taxpayer-party, the municipality shall also furnish that party with a copy of the property

record card for the property under appeal at least seven calendar days prior to the hearing.

(con't)

1

1 2

2 3

3