Restaurant Tourism Tax Return Form - City Of St. Charles, Missouri

ADVERTISEMENT

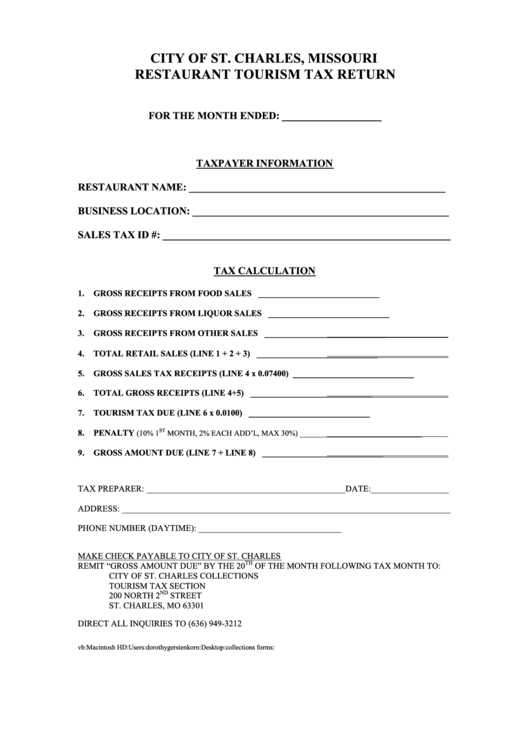

CITY OF ST. CHARLES, MISSOURI

RESTAURANT TOURISM TAX RETURN

FOR THE MONTH ENDED: ___________________

TAXPAYER INFORMATION

RESTAURANT NAME: _________________________________________________

BUSINESS LOCATION: _________________________________________________

SALES TAX ID #: _______________________________________________________

TAX CALCULATION

1.

GROSS RECEIPTS FROM FOOD SALES

____________________________

2.

GROSS RECEIPTS FROM LIQUOR SALES

____________________________

3.

GROSS RECEIPTS FROM OTHER SALES

____________________________

4.

TOTAL RETAIL SALES (LINE 1 + 2 + 3)

____________________________

5.

GROSS SALES TAX RECEIPTS (LINE 4 x 0.07400)

____________________________

6.

TOTAL GROSS RECEIPTS (LINE 4+5)

____________________________

7.

TOURISM TAX DUE (LINE 6 x 0.0100)

____________________________

ST

8.

PENALTY

(10% 1

MONTH, 2% EACH ADD’L, MAX 30%)

_______________________________

9.

GROSS AMOUNT DUE (LINE 7 + LINE 8)

____________________________

TAX PREPARER: ______________________________________________DATE:__________________

ADDRESS: ____________________________________________________________________________

PHONE NUMBER (DAYTIME): _________________________________

MAKE CHECK PAYABLE TO CITY OF ST. CHARLES

TH

REMIT “GROSS AMOUNT DUE” BY THE 20

OF THE MONTH FOLLOWING TAX MONTH TO:

CITY OF ST. CHARLES COLLECTIONS

TOURISM TAX SECTION

ND

200 NORTH 2

STREET

ST. CHARLES, MO 63301

DIRECT ALL INQUIRIES TO (636) 949-3212

vb:Macintosh HD:Users:dorothygerstenkorn:Desktop:collections forms:TourismReturn-Restaurant.doc

Rev 06/04

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1