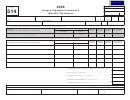

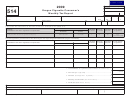

Instructions For Cigarette Manufacturer'S Monthly Distribution Report Rpd-41311 - 2007

ADVERTISEMENT

RPD-41311 instructions

State of New Mexico

Rev. 06/2007

Taxation and Revenue Department

CIGARETTE MANUFACTURER’S MONTHLY DISTRIBUTION REPORT

Instructions

If you have questions about completing this report, call the Special Tax Unit at (505) 827-6842.

Important: You must have a valid New Mexico Cigarette

and advertising, is likely to be offered to, or purchased by con-

Manufacturer’s License issued by the Taxation and Revenue

sumers as a cigarette, it is a cigarette for purposes of the

Cigarette Tax Act.

Department to manufacture cigarettes in New Mexico. See

Form RPD-41310, Application for Cigarette Distributor’s or

"Distributor" means a person licensed pursuant to the Ciga-

Manufacturer’s License, to obtain a license.

rette Tax Act to sell or distribute cigarettes in New Mexico.

"Distributor" does not include:

WHO MUST FILE - For each of its facilities, a manufacturer of

•

a retailer;

cigarettes in New Mexico must submit Form RPD-41311, Ciga-

•

a cigarette manufacturer, export warehouse proprietor or

rette Manufacturer’s Monthly Distribution Report, to the New

importer with a valid permit pursuant to 26 U.S.C. 5713, if

Mexico Taxation and Revenue Department.

that person sells cigarettes in New Mexico only to distribu-

tors who hold valid licenses under the laws of a state or sells

Important: Before completing Form RPD-41311, see Important

to an export warehouse proprietor or to another manufac-

Definitions in these instructions.

turer; or

•

a common or contract carrier transporting cigarettes pursu-

WHEN TO FILE - To avoid penalties, Form RPD-41311, Ciga-

ant to a bill of lading or freight bill, or a person who ships

rette Manufacturer’s Monthly Distribution Report, must be sub-

cigarettes through the state by a common or contract

mitted to the Department on or before the 25th day of the month

carrier pursuant to a bill of lading or freight bill.

following the close of the report period. A reporting period is a

“Distributed” means sold or otherwise transferred to another

full calendar month.

person or facility.

"Manufacturer" means a person who manufactures, fabri-

Effective May 17, 2006, changes to the Cigarette Tax Act en-

cates, assembles, processes or labels a cigarette or imports

acted by the 2006 Legislature with House Bill 617 (Chapter 91)

from outside the United States, directly or indirectly, a finished

changed monthly reporting requirements for cigarette distribu-

cigarette for sale or distribution in the United States.

tors and manufacturers. See New Mexico Bulletin B-500.31,

“Retailer” means a person, whether located within or outside

Important Legislative Changes to the Cigarette Tax Act, for

of New Mexico, who sells cigarettes at retail to a consumer in

other important changes.

New Mexico when the sale is not for resale.

“Brand Family” means all styles of cigarettes sold under the

Effective June 15, 2007, revisions to the Cigarette Tax Act en-

same trademark and includes cigarettes differentiated from one

acted by the 2007 Legislature with House Bill 984 changed the

another by means of additional modifiers or descriptors, in-

definition of cigarette and are reflected in the definition below.

cluding, but not limited to, “menthol”, “lights”, “kings” and “100s”.

The bill also expanded the definition of contraband cigarettes

to include cigarettes sold in packages other than 5, 10, 20 or

Manufacturer’s License - A person may not manufacture ciga-

25, and changed the tax rate for cigarettes sold in packages of

rettes in New Mexico unless licensed by the New Mexico Taxa-

5 and 10 so that the 20-stick stamp is required to be affixed.

tion and Revenue Department. A person licensed to manufac-

See New Mexico Bulletin B-500.33, Cigarette Tax Act Amended,

ture cigarettes in New Mexico is authorized to:

for a complete description of the impact of these important

•

manufacture, produce and package cigarettes;

changes.

•

receive imported cigarettes;

IMPORTANT DEFINITIONS

•

sell unstamped cigarettes to a distributor, another manufac-

“Package” means an individual pack, box or other container,

turer or an export warehouse proprietor, and

and does not include a container that itself contains other con-

•

sell unstamped cigarettes outside of New Mexico.

tainers, such as a carton of cigarettes.

“Cigarette” means any roll of tobacco or any substitute for

HOW TO COMPLETE THE FORM -

tobacco wrapped in paper or other substance not containing

To complete Form RPD-41311, Cigarette Manufacturer’s

tobacco; or a roll of tobacco that is wrapped in any substance

Monthly Distribution Report, enter the report period and com-

containing tobacco, other than 100% natural leaf tobacco, and

plete the name and address block. You must enter the name,

which because of its appearance, the type of tobacco used in

address, identification numbers and New Mexico cigarette

the filler, its packaging and labeling, or its marketing and ad-

manufacturer’s license number for the reporting manufacturer’s

vertising, is likely to be offered to, or purchased by consumers

facility. Include the contact information. Follow the line instruc-

as a cigarette, and includes bidis and kreteks. “Cigarette” in-

tions for the reports and attachments. Sign and date the form

cludes certain small cigars sold in packages similar to ciga-

and mail to: New Mexico Taxation and Revenue Department,

rettes. If a small cigar is wrapped in something other than 100%

Cigarette Tax Unit, P.O. Box 25123, Santa Fe, New Mexico

tobacco, or because of its appearance, the type of tobacco

87504-5123. For assistance, call (505) 827-6842.

used in the filler, its packaging and labeling, or its marketing

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2