Instructions For Cigarette Manufacturer'S Monthly Distribution Report Rpd-41311 - 2007 Page 2

ADVERTISEMENT

RPD-41311 instructions

State of New Mexico

Rev. 06/2007

Taxation and Revenue Department

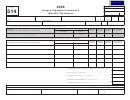

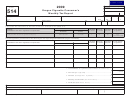

CIGARETTE MANUFACTURER’S MONTHLY DISTRIBUTION REPORT

Instructions

lishments were made during the report month.

LINE INSTRUCTIONS FOR FORM RPD-41311, Cigarette

Non-participating Manufacturer (NPM) reporting. Manu-

Manufacturer’s Monthly Distribution Report.

facturers who purchase tobacco products made by non-par-

Cigarette manufacturers must report the quantities of pack-

ticipating manufacturers (NPM), identified by the Tobacco Mas-

ages of cigarettes distributed inside New Mexico during the

ter Settlement Agreement (MSA), must also complete Form

report period, and the name and address of persons to whom

RPD-41188, Non-participating Manufacturer Brand Ciga-

the cigarettes were distributed or sold. Report only the pack-

rettes Distributed or Sold, when you have sold or distributed

ages of cigarettes distributed or sold to a New Mexico loca-

“roll-your-own” tobacco made by an NPM to which you have

tion.

paid the tobacco excise tax to the Taxation and Revenue De-

partment. Attach a completed Form 41188, Non-participating

By brand family and name and address of the business in New

Manufacturer Brand Cigarettes Distributed or Sold, to Form

Mexico to whom the cigarettes were distributed or sold, enter

RPD-41311, reporting the ounces of roll-your-own tobacco dis-

the quantities of packages of cigarettes distributed or sold dur-

tributed or sold inside the state of New Mexico.

ing the reporting period. For each entry, enter the proper Dis-

tributed Code from the Distributed Code Table below.

Obsolete Forms.

Effective with the May 2006 report period, Forms RPD-41235,

Distributed Code. Enter a Distributed Code (listed below) for

Distributor’s Cigarette Stamp Inventory Report, RPD-41087,

each itemized entry. The Distributed Code describes the type

Report of Distributor’s Cigarette Sales to Indian Tribes, Pueb-

of entity of the recipient of the cigarettes distributed or sold by

los or Smokeshops, and RPD-41240, Report of Imported Ciga-

the manufacturer. For each itemized entry, enter from the table

rettes, are no longer required.

below the Distributed Code that best applies to the person to

whom the cigarettes were distributed or sold.

Penalty for Failure to Report.

The Department may revoke or suspend the New Mexico Ciga-

If more than one page is needed, complete the supplemental

rette Manufacturer’s Licenses of manufacturers who knowingly

page for this report. Total the quantities from all pages on page

fail to file timely the reports described in these instructions.

one of Form RPD-41311, Cigarette Manufacturer’s Monthly Dis-

tribution Report.

A penalty may be assessed for a manufacturer who knowingly

fails, neglects or refuses to report as required by the Cigarette

Other Reporting Requirements.

Tax Act. For a first offense, a penalty of up to $1,000 may be

Manufacturers who sell cigarettes to a retail only business lo-

imposed. For a second offense, a penalty of not less than

cated in New Mexico, or who sell cigarettes at retail from the

$1,500 and no more than $2,500 may be imposed. For a third

reporting facility, must also complete Form RPD-41183, Re-

or subsequent offense, a penalty of not less than $5,000 may

port of Cigarette Sales in New Mexico Counties and Mu-

be imposed.

nicipalities, even if no retail sales or sales to retail only estab-

DISTRIBUTED CODE TABLE

Code

Distributed or sold:

N ................

to an Indian nation, tribe or pueblo in New Mexico,

or to a tribal member located on an Indian nation,

tribe or pueblo in New Mexico who is another manu-

facturer, distributor or export warehouse proprietor.

F ................

to another facility in New Mexico of the same manu-

facturer.

NM .............

to another manufacturer, distributor or export ware-

house proprietor in New Mexico.

- 2 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2