Form 8283-V - Payment Voucher For Filing Fee Under Section 170(F)(13)

ADVERTISEMENT

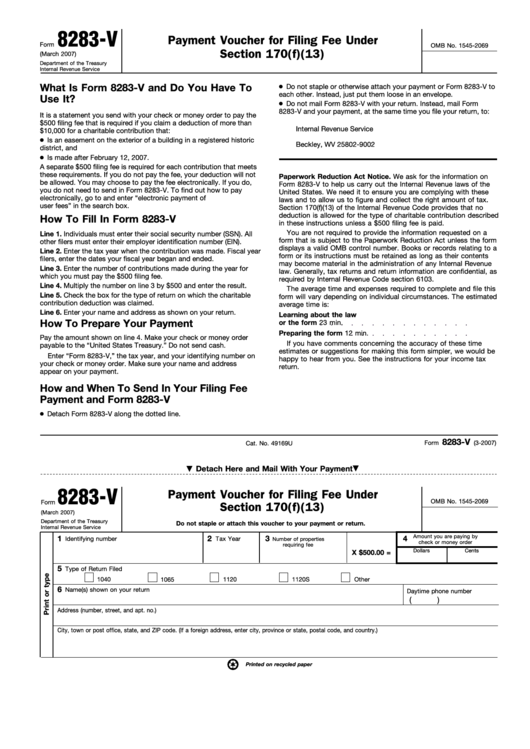

8283-V

Payment Voucher for Filing Fee Under

Form

OMB No. 1545-2069

Section 170(f)(13)

(March 2007)

Department of the Treasury

Internal Revenue Service

What Is Form 8283-V and Do You Have To

Do not staple or otherwise attach your payment or Form 8283-V to

each other. Instead, just put them loose in an envelope.

Use It?

Do not mail Form 8283-V with your return. Instead, mail Form

8283-V and your payment, at the same time you file your return, to:

It is a statement you send with your check or money order to pay the

$500 filing fee that is required if you claim a deduction of more than

Internal Revenue Service

$10,000 for a charitable contribution that:

P.O. Box 9002

Is an easement on the exterior of a building in a registered historic

Beckley, WV 25802-9002

district, and

Is made after February 12, 2007.

A separate $500 filing fee is required for each contribution that meets

these requirements. If you do not pay the fee, your deduction will not

Paperwork Reduction Act Notice. We ask for the information on

be allowed. You may choose to pay the fee electronically. If you do,

Form 8283-V to help us carry out the Internal Revenue laws of the

you do not need to send in Form 8283-V. To find out how to pay

United States. We need it to ensure you are complying with these

electronically, go to and enter “electronic payment of

laws and to allow us to figure and collect the right amount of tax.

user fees” in the search box.

Section 170(f)(13) of the Internal Revenue Code provides that no

deduction is allowed for the type of charitable contribution described

How To Fill In Form 8283-V

in these instructions unless a $500 filing fee is paid.

You are not required to provide the information requested on a

Line 1. Individuals must enter their social security number (SSN). All

form that is subject to the Paperwork Reduction Act unless the form

other filers must enter their employer identification number (EIN).

displays a valid OMB control number. Books or records relating to a

Line 2. Enter the tax year when the contribution was made. Fiscal year

form or its instructions must be retained as long as their contents

filers, enter the dates your fiscal year began and ended.

may become material in the administration of any Internal Revenue

Line 3. Enter the number of contributions made during the year for

law. Generally, tax returns and return information are confidential, as

which you must pay the $500 filing fee.

required by Internal Revenue Code section 6103.

Line 4. Multiply the number on line 3 by $500 and enter the result.

The average time and expenses required to complete and file this

Line 5. Check the box for the type of return on which the charitable

form will vary depending on individual circumstances. The estimated

contribution deduction was claimed.

average time is:

Line 6. Enter your name and address as shown on your return.

Learning about the law

How To Prepare Your Payment

or the form

23 min.

Preparing the form

12 min.

Pay the amount shown on line 4. Make your check or money order

If you have comments concerning the accuracy of these time

payable to the “United States Treasury.” Do not send cash.

estimates or suggestions for making this form simpler, we would be

Enter “Form 8283-V,” the tax year, and your identifying number on

happy to hear from you. See the instructions for your income tax

your check or money order. Make sure your name and address

return.

appear on your payment.

How and When To Send In Your Filing Fee

Payment and Form 8283-V

Detach Form 8283-V along the dotted line.

8283-V

Cat. No. 49169U

Form

(3-2007)

Detach Here and Mail With Your Payment

8283-V

Payment Voucher for Filing Fee Under

OMB No. 1545-2069

Form

Section 170(f)(13)

(March 2007)

Department of the Treasury

Do not staple or attach this voucher to your payment or return.

Internal Revenue Service

Amount you are paying by

1

2

3

4

Identifying number

Tax Year

Number of properties

check or money order

requiring fee

Dollars

Cents

X $500.00 =

5

Type of Return Filed

1040

1065

1120

1120S

Other

6

Name(s) shown on your return

Daytime phone number

(

)

Address (number, street, and apt. no.)

City, town or post office, state, and ZIP code. (If a foreign address, enter city, province or state, postal code, and country.)

Printed on recycled paper

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1