pating manufacturers required to make quarterly deposits must do so by April 30, July 31, October 31, and January 31

respectively.

When is this certificate of compliance due?

This certificate of compliance is to be filed on or before April 30th of the year following the sales year.

For 1999, the sales year for tobacco products sold in Alabama is June 9, 1999 – December 31, 1999. After 1999, the sales

year is the calendar year, from January 1 through December 31.

If you have been required to make quarterly certifications, the certificates of compliance and bank verifications must be

provided to the Department no later than ten (10) days after each quarterly deposit date. Quarterly certificates of compli-

ance are to be filed on or before the following dates:

(1) May 10 for the January 1 through March 31 quarter

(2) August 10 for the April 1 through June 30 quarter

(3) November 10 for the July 1 through September 30 quarter

(4) February 10 for October 1 through December 31 quarter.

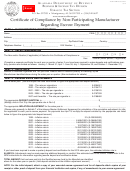

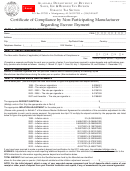

Specific Instructions:

Part 1: Manufacturer’s Identification: Write your name, FEIN, address, telephone number and fax number.

Part 2: Sales Year or Quarter: Write the sales year and check applicable quarter if you have been required to file

quarterly.

Part 3: Units Sold: Write the number of individual cigarettes and the amount of “roll-your-own” tobacco (.09 ounces con-

stitutes one cigarette) manufactured by you and distributed directly or through a distributor, retailer, or similar intermediary

or intermediaries during the sales year or quarter in Alabama.

Part 4: Escrow Rates and Payments: Multiply the units sold by the appropriate rate for the sales year or quarter and write

the result as your subtotal. Calculate the appropriate inflation adjustment and enter the amount. Add the subtotal and the

inflation adjustment amount to arrive at the total deposit to be paid into your qualified escrow account for the applicable

sales year or quarter.

Part 5: Financial Institution: Write the name and address of the financial institution holding your escrow account. Include

your escrow account number and State account number.

Part 6: Signature: An authorized notary public must also sign and date this certificate of compliance.

1

1 2

2 3

3 4

4