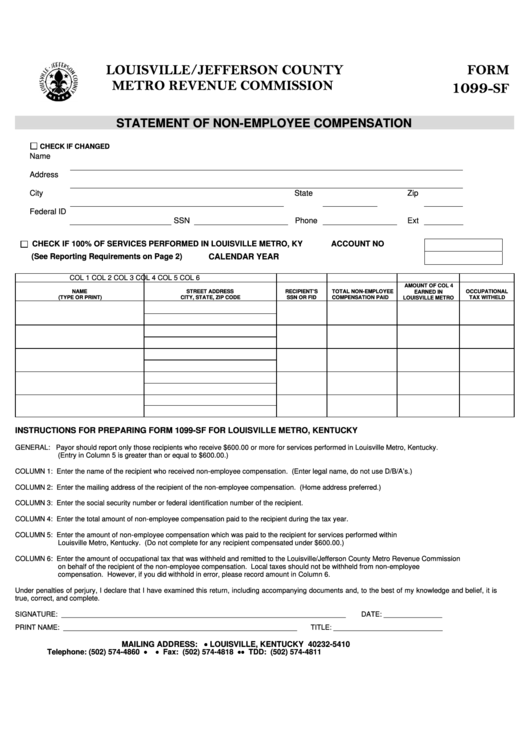

LOUISVILLE/JEFFERSON COUNTY

FORM

METRO REVENUE COMMISSION

1099

-SF

STATEMENT OF NON-EMPLOYEE COMPENSATION

CHECK IF CHANGED

Name

Address

City

State

Zip

Federal ID

SSN

Phone

Ext

CHECK IF 100% OF SERVICES PERFORMED IN LOUISVILLE METRO, KY

ACCOUNT NO

(See Reporting Requirements on Page 2)

CALENDAR YEAR

COL 1

COL 2

COL 3

COL 4

COL 5

COL 6

AMOUNT OF COL 4

NAME

STREET ADDRESS

RECIPIENT’S

TOTAL NON-EMPLOYEE

OCCUPATIONAL

EARNED IN

(TYPE OR PRINT)

CITY, STATE, ZIP CODE

SSN OR FID

COMPENSATION PAID

TAX WITHELD

LOUISVILLE METRO

INSTRUCTIONS FOR PREPARING FORM 1099-SF FOR LOUISVILLE METRO, KENTUCKY

GENERAL: Payor should report only those recipients who receive $600.00 or more for services performed in Louisville Metro, Kentucky.

(Entry in Column 5 is greater than or equal to $600.00.)

COLUMN 1: Enter the name of the recipient who received non-employee compensation. (Enter legal name, do not use D/B/A’s.)

COLUMN 2: Enter the mailing address of the recipient of the non-employee compensation. (Home address preferred.)

COLUMN 3: Enter the social security number or federal identification number of the recipient.

COLUMN 4: Enter the total amount of non-employee compensation paid to the recipient during the tax year.

COLUMN 5: Enter the amount of non-employee compensation which was paid to the recipient for services performed within

Louisville Metro, Kentucky. (Do not complete for any recipient compensated under $600.00.)

COLUMN 6: Enter the amount of occupational tax that was withheld and remitted to the Louisville/Jefferson County Metro Revenue Commission

on behalf of the recipient of the non-employee compensation. Local taxes should not be withheld from non-employee

compensation. However, if you did withhold in error, please record amount in Column 6.

Under penalties of perjury, I declare that I have examined this return, including accompanying documents and, to the best of my knowledge and belief, it is

true, correct, and complete.

SIGNATURE: _________________________________________________________________________

DATE: _______________

PRINT NAME: ____________________________________________________________

TITLE: ____________________________

MAILING ADDRESS: P.O. BOX 35410 • LOUISVILLE, KENTUCKY 40232-5410

Telephone: (502) 574-4860 •

• Fax: (502) 574-4818 • • TDD: (502) 574-4811

1

1