Form Nyc-8cb - Claim For Refund Of General Corporation Tax From Carryback Of Net Operating Loss - 2010

ADVERTISEMENT

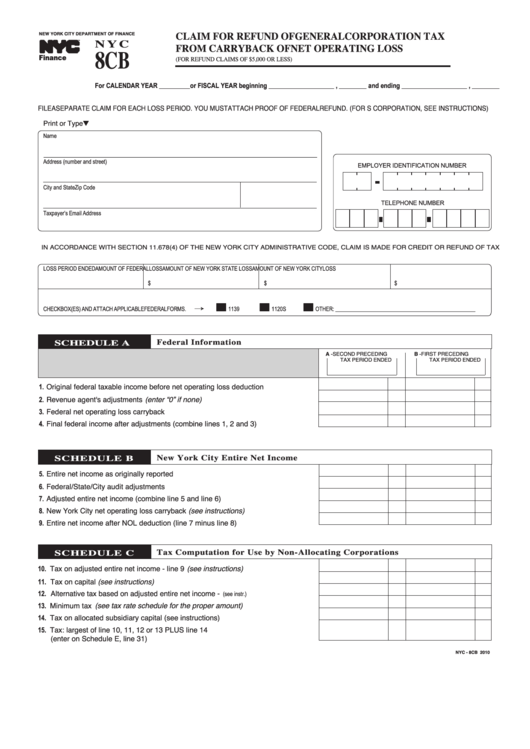

8CB

CLAIM FOR REFUND OF GENERAL CORPORATION TAX

N Y C

NEW YORK CITY DEPARTMENT OF FINANCE

FROM CARRYBACK OF NET OPERATING LOSS

TM

(FOR REFUND CLAIMS OF $5,000 OR LESS)

Finance

For CALENDAR YEAR _________or FISCAL YEAR beginning ___________________ , ________ and ending ___________________ , ________

FILE A SEPARATE CLAIM FOR EACH LOSS PERIOD. YOU MUST ATTACH PROOF OF FEDERAL REFUND. (FOR S CORPORATION, SEE INSTRUCTIONS)

Print or Type M

Name

Address (number and street)

EMPLOYER IDENTIFICATION NUMBER

City and State

Zip Code

TELEPHONE NUMBER

Taxpayer’s Email Address

IN ACCORDANCE WITH SECTION 11.678(4) OF THE NEW YORK CITY ADMINISTRATIVE CODE, CLAIM IS MADE FOR CREDIT OR REFUND OF TAX

LOSS PERIOD ENDED

AMOUNT OF FEDERAL LOSS

AMOUNT OF NEW YORK STATE LOSS

AMOUNT OF NEW YORK CITY LOSS

$

$

$

I I

I I

I I

¡

CHECK BOX(ES) AND ATTACH APPLICABLE FEDERAL FORMS.

1139

1120S

OTHER: __________________________________________________

Federal Information

SCHEDULE A

A -

B -

SECOND PRECEDING

FIRST PRECEDING

TAX PERIOD ENDED

TAX PERIOD ENDED

1. Original federal taxable income before net operating loss deduction

................................

2. Revenue agent's adjustments (enter “0” if none)

..........................................................................

3. Federal net operating loss carryback

...................................................................................................

4. Final federal income after adjustments (combine lines 1, 2 and 3)

...................................

New York City Entire Net Income

SCHEDULE B

5. Entire net income as originally reported

.............................................................................................

6. Federal/State/City audit adjustments

....................................................................................................

7. Adjusted entire net income (combine line 5 and line 6)

............................................................

8. New York City net operating loss carryback (see instructions)

..............................................

9. Entire net income after NOL deduction (line 7 minus line 8)

..................................................

Tax Computation for Use by Non-Allocating Corporations

SCHEDULE C

10. Tax on adjusted entire net income - line 9 (see instructions)

...............................................

11. Tax on capital (see instructions)

.............................................................................................................

12. Alternative tax based on adjusted entire net income -

(see instr.)

......................................................

13. Minimum tax (see tax rate schedule for the proper amount)

..............................................

14. Tax on allocated subsidiary capital (see instructions)

.............................................................

15. Tax: largest of line 10, 11, 12 or 13 PLUS line 14

(enter on Schedule E, line 31)

...............................................................................................................

NYC - 8CB 2010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2