Tobacco Excise Tax Return Form - City And Borough Of Juneau

ADVERTISEMENT

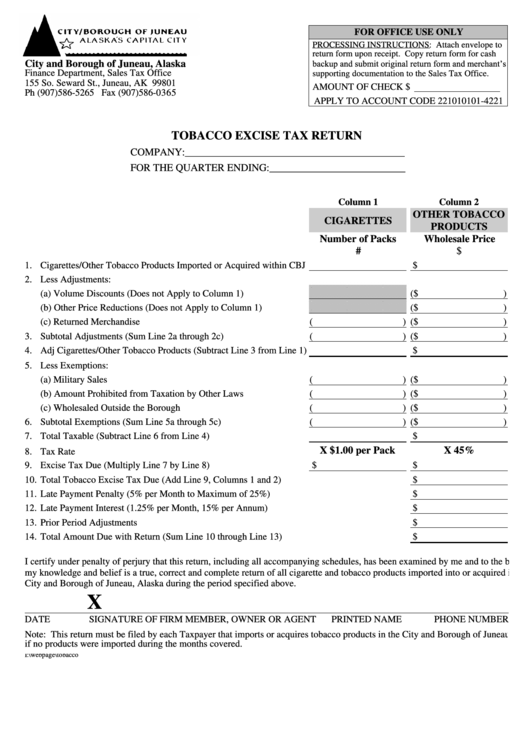

FOR OFFICE USE ONLY

PROCESSING INSTRUCTIONS: Attach envelope to

return form upon receipt. Copy return form for cash

backup and submit original return form and merchant’s

City and Borough of Juneau, Alaska

Finance Department, Sales Tax Office

supporting documentation to the Sales Tax Office.

155 So. Seward St., Juneau, AK 99801

AMOUNT OF CHECK $

Ph (907)586-5265 Fax (907)586-0365

APPLY TO ACCOUNT CODE 221010101-4221

TOBACCO EXCISE TAX RETURN

COMPANY:__________________________________________

FOR THE QUARTER ENDING:__________________________

Column 1

Column 2

OTHER TOBACCO

CIGARETTES

PRODUCTS

Number of Packs

Wholesale Price

#

$

1. Cigarettes/Other Tobacco Products Imported or Acquired within CBJ

$

2. Less Adjustments:

(a) Volume Discounts (Does not Apply to Column 1) .........................

($

)

(b) Other Price Reductions (Does not Apply to Column 1) ..................

($

)

(c) Returned Merchandise .................................................................... (

) ($

)

3. Subtotal Adjustments (Sum Line 2a through 2c).................................. (

) ($

)

4. Adj Cigarettes/Other Tobacco Products (Subtract Line 3 from Line 1)

$

5. Less Exemptions:

(a) Military Sales .................................................................................. (

) ($

)

(b) Amount Prohibited from Taxation by Other Laws.......................... (

) ($

)

(c) Wholesaled Outside the Borough .................................................... (

) ($

)

6. Subtotal Exemptions (Sum Line 5a through 5c) ................................... (

) ($

)

7. Total Taxable (Subtract Line 6 from Line 4) ........................................

$

X $1.00 per Pack

X 45%

8. Tax Rate ...............................................................................................

9. Excise Tax Due (Multiply Line 7 by Line 8) ........................................ $

$

10. Total Tobacco Excise Tax Due (Add Line 9, Columns 1 and 2) ..................................................... $

11. Late Payment Penalty (5% per Month to Maximum of 25%) .......................................................... $

12. Late Payment Interest (1.25% per Month, 15% per Annum) .......................................................... $

13. Prior Period Adjustments ................................................................................................................ $

14. Total Amount Due with Return (Sum Line 10 through Line 13) .................................................... $

I certify under penalty of perjury that this return, including all accompanying schedules, has been examined by me and to the best of

my knowledge and belief is a true, correct and complete return of all cigarette and tobacco products imported into or acquired in the

City and Borough of Juneau, Alaska during the period specified above.

X

DATE

SIGNATURE OF FIRM MEMBER, OWNER OR AGENT

PRINTED NAME

PHONE NUMBER

Note: This return must be filed by each Taxpayer that imports or acquires tobacco products in the City and Borough of Juneau, even

if no products were imported during the months covered.

I:\webpage\tobacco

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1