628, Page 2

INSTRUCTIONS: This side is to be completed by the assessor.

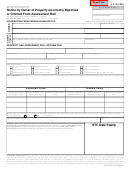

SUPPLEMENTAL TAX RATE INFORMATION

If this notice is for either of the tax years immediately preceding the current year, the assessor shall list for each year the total tax rate

levied in the city or township in which the property is located. The total annual tax rate levied must include the total village tax rate, if

applicable. The listing must reflect any millage reduction due to the Principal Residence Exemption, the Qualified Agricultural

Exemption, the Qualified Forest Exemption, the Industrial Facilities Exemption, the Commercial Personal Property Exemption or the

Industrial Personal Property Exemption. If this notice is for omitted real property upon which "millage rate" special assessments were

levied, list those rates separately below. Do not include special assessments levied in specific dollar amounts.

Year Covered By Notice

SUMMER

WINTER

Total Annual Tax Rate Levied

Total Tax Rate Levied

Total Tax Rate Levied

SPECIAL ASSESSMENT RATES. Complete lines below for special assessment millage rates only

Year Covered By Notice

SUMMER

WINTER

Total Annual

Special Assessment Rate Levied

Special Assessment Rate Levied

Special Assessment Rate Levied

Is this property assessed on the Industrial Facilities Tax Assessment Roll, the Commercial Facilities Tax Assessment Roll, the Technology Park

Facilities Assessment Roll, the Neighborhood Enterprise Zone Assessment Roll, the Renaissance Zone assessment or as an Act 189 of 1953

assessment?

If yes, specify which roll:_______________________________________________

Yes

No

PERSONAL PROPERTY NOTICES ONLY: Did the owner complete and deliver a personal property statement (L-4175) for each year that this notice

covers that was:

Timely Filed? (Accepted as filed and actually used in the assessment that was confirmed by the Board of Review?)

OR

Estimated/Not filed? If estimated or not filed, indicate years:_______________________________

CONCURRENCE OR DISAGREEMENT WITH THIS REQUEST

This section must be completed by the assessor or equalization director.

I AGREE with this request for corrected Assessed Value and/or Taxable Value.

I DO NOT AGREE with this request for corrected Assessed Value and/or Taxable Value. The assessor or equalization director who checks

this box must submit to the State Tax Commission an explanation of the reason for not concurring.

Name of Assessor or Equalization Director

Title

Assessor Certification Number

Address (Number, Street, City, State and ZIP Code)

Signature of Assessor or Equalization Director

Date

Telephone Number

Comments or Explanations

Assessor or Equalization Director Email Address

Return this completed form to:

State Tax Commission

Michigan Department of Treasury

P.O. Box 30471

Lansing, MI 48909-7971

1

1 2

2