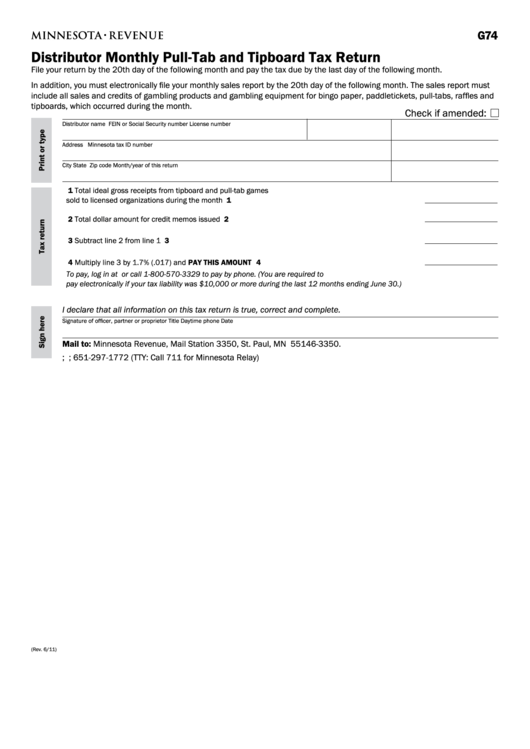

G74

Distributor Monthly Pull-Tab and Tipboard Tax Return

File your return by the 20th day of the following month and pay the tax due by the last day of the following month.

In addition, you must electronically file your monthly sales report by the 20th day of the following month. The sales report must

include all sales and credits of gambling products and gambling equipment for bingo paper, paddletickets, pull-tabs, raffles and

tipboards, which occurred during the month.

Check if amended:

Distributor name

FEIN or Social Security number

License number

Address

Minnesota tax ID number

City

State

Zip code

Month/year of this return

1 Total ideal gross receipts from tipboard and pull-tab games

sold to licensed organizations during the month . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Total dollar amount for credit memos issued . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Multiply line 3 by 1.7% (.017) and PAY THIS AMOUNT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

To pay, log in at or call 1-800-570-3329 to pay by phone. (You are required to

pay electronically if your tax liability was $10,000 or more during the last 12 months ending June 30.)

I declare that all information on this tax return is true, correct and complete.

Signature of officer, partner or proprietor

Title

Daytime phone

Date

Mail to: Minnesota Revenue, Mail Station 3350, St. Paul, MN 55146-3350.

; lawfulgambling.taxes@state.mn.us; 651-297-1772 (TTY: Call 711 for Minnesota Relay)

(Rev. 6/11)

1

1