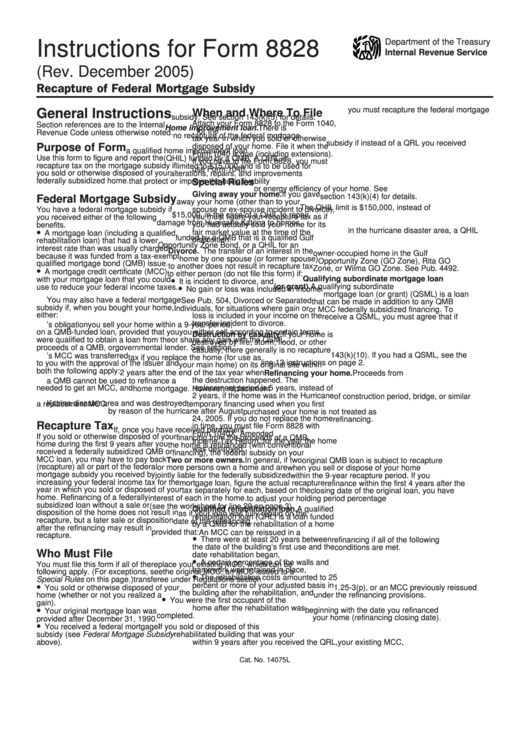

Instructions For Form 8828 - Recapture Of Federal Mortgage Subsidy - Department Of Treasury

ADVERTISEMENT

Department of the Treasury

Instructions for Form 8828

Internal Revenue Service

(Rev. December 2005)

Recapture of Federal Mortgage Subsidy

you must recapture the federal mortgage

General Instructions

When and Where To File

subsidy. See section 143(k)(5) for details.

Attach your Form 8828 to the Form 1040,

Section references are to the Internal

Home improvement loan. There is

U.S. Individual Income Tax Return, for the

Revenue Code unless otherwise noted.

no recapture of the federal mortgage

tax year in which you sold or otherwise

subsidy if instead of a QRL you received

Purpose of Form

disposed of your home. File it when the

a qualified home improvement loan

Form 1040 is due (including extensions).

Use this form to figure and report the

(QHIL) funded by a QMB. A QHIL is

If you have to file Form 8828, you must

recapture tax on the mortgage subsidy if

limited to $15,000 and is to be used for

use Form 1040.

you sold or otherwise disposed of your

alterations, repairs, and improvements

federally subsidized home.

that protect or improve the basic livability

Special Rules

or energy efficiency of your home. See

Giving away your home. If you gave

section 143(k)(4) for details.

Federal Mortgage Subsidy

away your home (other than to your

The QHIL limit is $150,000, instead of

You have a federal mortgage subsidy if

spouse or ex-spouse incident to divorce),

$15,000, in the case of a QHIL to repair

you must figure your recapture tax as if

you received either of the following

damage from Hurricane Katrina to homes

benefits.

you had actually sold your home for its

•

in the hurricane disaster area, a QHIL

fair market value at the time of the

A mortgage loan (including a qualified

funded by a QMB that is a qualified Gulf

disposition.

rehabilitation loan) that had a lower

Opportunity Zone Bond, or a QHIL for an

interest rate than was usually charged

Divorce. The transfer of an interest in the

owner-occupied home in the Gulf

because it was funded from a tax-exempt

home by one spouse (or former spouse)

Opportunity Zone (GO Zone), Rita GO

qualified mortgage bond (QMB) issue.

to another does not result in recapture tax

•

Zone, or Wilma GO Zone. See Pub. 4492.

A mortgage credit certificate (MCC)

to either person (do not file this form) if:

•

Qualifying subordinate mortgage loan

with your mortgage loan that you could

It is incident to divorce, and

•

(or grant). A qualifying subordinate

use to reduce your federal income taxes.

No gain or loss was included in income.

mortgage loan (or grant) (QSML) is a loan

You may also have a federal mortgage

See Pub. 504, Divorced or Separated

that can be made in addition to any QMB

subsidy if, when you bought your home,

Individuals, for situations where gain or

or MCC federally subsidized financing. To

either:

loss is included in your income on the

receive a QSML, you must agree that if

transfer incident to divorce.

1. You assumed the seller’s obligation

you sell your home within a 9-year period,

on a QMB-funded loan, provided that you

you either sell according to certain terms

Destruction by casualty. If your home is

were qualified to obtain a loan from the

or share any gain with the QSML

destroyed by fire, storm, flood, or other

proceeds of a QMB, or

governmental lender. See section

casualty, there generally is no recapture

143(k)(10). If you had a QSML, see the

2. The seller’s MCC was transferred

tax if you replace the home (for use as

line 13 instructions on page 2.

to you with the approval of the issuer and

your main home) on its original site within

both the following apply:

2 years after the end of the tax year when

Refinancing your home. Proceeds from

a. You met the eligibility requirements

the destruction happened. The

a QMB cannot be used to refinance a

needed to get an MCC, and

replacement period is 5 years, instead of

home mortgage. However, replacement

2 years, if the home was in the Hurricane

of construction period, bridge, or similar

b. The issuer of the MCC issued you

Katrina disaster area and was destroyed

a replacement MCC.

temporary financing used when you first

by reason of the hurricane after August

purchased your home is not treated as

24, 2005. If you do not replace the home

refinancing.

Recapture Tax

in time, you must file Form 8828 with

If, once you have received permanent

Form 1040X, Amended U.S. Individual

If you sold or otherwise disposed of your

financing from the proceeds of a QMB,

Income Tax Return, for the year the home

home during the first 9 years after you

the home is refinanced (with conventional

was destroyed.

received a federally subsidized QMB or

financing), the federal subsidy on your

MCC loan, you may have to pay back

Two or more owners. In general, if two

original QMB loan is subject to recapture

(recapture) all or part of the federal

or more persons own a home and are

when you sell or dispose of your home

mortgage subsidy you received by

jointly liable for the federally subsidized

within the 9-year recapture period. If you

increasing your federal income tax for the

mortgage loan, figure the actual recapture

refinance within the first 4 years after the

year in which you sold or disposed of your

tax separately for each, based on the

closing date of the original loan, you have

home. Refinancing of a federally

interest of each in the home.

to adjust your holding period percentage

subsidized loan without a sale or

(see the worksheet for line 20 on page 3)

Qualified rehabilitation loan. A qualified

disposition of the home does not result in

as if your loan was fully repaid on the

rehabilitation loan (QRL) is a loan funded

recapture, but a later sale or disposition

date of the refinancing.

by a QMB for the rehabilitation of a home

after the refinancing may result in

provided that:

An MCC can be reissued in a

recapture.

•

There were at least 20 years between

refinancing if all of the following

the date of the building’s first use and the

conditions are met.

Who Must File

date rehabilitation began,

1. The issuer reissues an MCC to

•

A certain percentage of the walls and

You must file this form if all of the

replace your existing MCC, which can be

framework was retained in place,

following apply. (For exceptions, see

the original MCC, an MCC issued to a

•

The rehabilitation costs amounted to 25

Special Rules on this page.)

transferee under Regulations section

•

percent or more of your adjusted basis in

1.25-3(p), or an MCC previously reissued

You sold or otherwise disposed of your

the building after the rehabilitation, and

under the refinancing provisions.

home (whether or not you realized a

•

You were the first occupant of the

gain).

2. The reissued MCC takes effect

•

home after the rehabilitation was

beginning with the date you refinanced

Your original mortgage loan was

completed.

your home (refinancing closing date).

provided after December 31, 1990.

•

3. The reissued MCC:

You received a federal mortgage

If you sold or disposed of this

subsidy (see Federal Mortgage Subsidy

rehabilitated building that was your home

a. Applies to the same property as

above).

within 9 years after you received the QRL,

your existing MCC,

Cat. No. 14075L

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3