Instruction For Form 5310-A - Notice Of Plan Merger Or Consolidation, Spinoff, Or Transfer Of Plan Assets Or Liabilities; Notice Of Qualified Separate Lines Of Business

ADVERTISEMENT

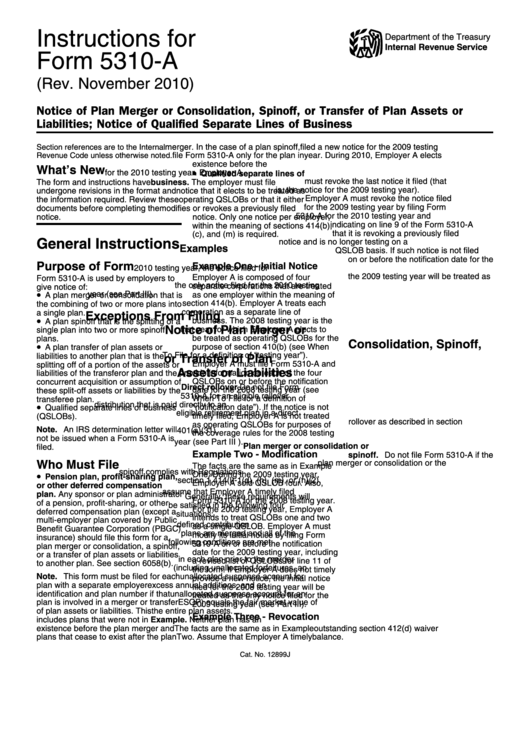

Instructions for

Department of the Treasury

Internal Revenue Service

Form 5310-A

(Rev. November 2010)

Notice of Plan Merger or Consolidation, Spinoff, or Transfer of Plan Assets or

Liabilities; Notice of Qualified Separate Lines of Business

merger. In the case of a plan spinoff,

filed a new notice for the 2009 testing

Section references are to the Internal

file Form 5310-A only for the plan in

year. During 2010, Employer A elects

Revenue Code unless otherwise noted.

existence before the spinoff.

not to treat itself as operating QSLOBs

What’s New

•

for the 2010 testing year. Employer A

Qualified separate lines of

must revoke the last notice it filed (that

business. The employer must file

The form and instructions have

is, the notice for the 2009 testing year).

undergone revisions in the format and

notice that it elects to be treated as

Employer A must revoke the notice filed

the information required. Review these

operating QSLOBs or that it either

for the 2009 testing year by filing Form

documents before completing the

modifies or revokes a previously filed

5310-A for the 2010 testing year and

notice.

notice. Only one notice per employer,

indicating on line 9 of the Form 5310-A

within the meaning of sections 414(b),

that it is revoking a previously filed

(c), and (m) is required.

General Instructions

notice and is no longer testing on a

Examples

QSLOB basis. If such notice is not filed

on or before the notification date for the

Purpose of Form

Example One - Initial Notice

2010 testing year, the notice filed for

the 2009 testing year will be treated as

Employer A is composed of four

Form 5310-A is used by employers to

the only notice filed for the 2010 testing

separate corporations that are treated

give notice of:

•

year (see Part III).

as one employer within the meaning of

A plan merger or consolidation that is

section 414(b). Employer A treats each

the combining of two or more plans into

corporation as a separate line of

a single plan.

Exceptions From Filing

•

business. The 2008 testing year is the

A plan spinoff that is the splitting of a

Notice of Plan Merger or

first year for which Employer A elects to

single plan into two or more spinoff

be treated as operating QSLOBs for the

plans.

Consolidation, Spinoff,

•

purpose of section 410(b) (see When

A plan transfer of plan assets or

To File for a definition of “testing year”).

liabilities to another plan that is the

or Transfer of Plan

Employer A must file Form 5310-A and

splitting off of a portion of the assets or

Assets or Liabilities

provide information on each of the four

liabilities of the transferor plan and the

QSLOBs on or before the notification

concurrent acquisition or assumption of

Direct rollover. Do not file Form

date for the 2008 testing year (see

these split-off assets or liabilities by the

5310-A for an eligible rollover

When To File for a definition of

transferee plan.

distribution that is paid directly to an

•

“notification date”). If the notice is not

Qualified separate lines of business

eligible retirement plan in a direct

timely filed, Employer A is not treated

(QSLOBs).

rollover as described in section

as operating QSLOBs for purposes of

Note. An IRS determination letter will

401(a)(31).

the coverage rules for the 2008 testing

not be issued when a Form 5310-A is

year (see Part III ).

Plan merger or consolidation or

filed.

Example Two - Modification

spinoff. Do not file Form 5310-A if the

Who Must File

plan merger or consolidation or the

The facts are the same as in Example

spinoff complies with Regulations

•

One. During the 2009 testing year,

Pension plan, profit-sharing plan,

section 1.414(l)-1(d), (h), (m), or (n)(2).

Employer A sold QSLOB four. Also,

or other deferred compensation

assume that Employer A timely filed

plan. Any sponsor or plan administrator

Generally, these requirements will

Form 5310-A for the 2008 testing year.

of a pension, profit-sharing, or other

be satisfied in the following four

For the 2009 testing year, Employer A

deferred compensation plan (except a

situations:

intends to treat QSLOBs one and two

multi-employer plan covered by Public

1. Two or more defined contribution

as a single QSLOB. Employer A must

Benefit Guarantee Corporation (PBGC)

plans are merged and all of the

modify its initial notice by filing Form

insurance) should file this form for a

following conditions are met:

5310-A on or before the notification

plan merger or consolidation, a spinoff,

a. The sum of the account balances

date for the 2009 testing year, including

or a transfer of plan assets or liabilities

in each plan prior to the merger

a revised list of QSLOBs for line 11 of

to another plan. See section 6058(b).

(including unallocated forfeitures, an

the form. If Employer A does not timely

Note. This form must be filed for each

unallocated suspense account for

provide a new notice, the initial notice

plan with a separate employer

excess annual additions, and an

filed for the 2008 testing year will be

identification and plan number if that

unallocated suspense account for an

treated as the only notice filed for the

plan is involved in a merger or transfer

ESOP) equals the fair market value of

2009 testing year (see Part III).

of plan assets or liabilities. This

the entire plan assets.

Example Three - Revocation

includes plans that were not in

Example. Neither plan has an

existence before the plan merger and

The facts are the same as in Example

outstanding section 412(d) waiver

plans that cease to exist after the plan

Two. Assume that Employer A timely

balance.

Cat. No. 12899J

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5