Form 320-A - Request For Assignment Of Production Unit Number Gross Production Registration - 2011 Page 2

ADVERTISEMENT

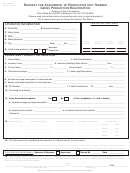

Request for Assignment of Production Unit Number Gross Production Registration

Instructions

To be completed by the operator for each well drilled producing oil or gas

1. Provide the name of the lease.

2. Provide the name of the well and well number.

3. Provide Incentive Code:

6 = Horizontally Drilled Wells

8 = Ultra Deep Wells 15,000 to 17,499

9 = Ultra Deep Wells equal to or greater than 17,500 feet

4. Provide Incentive Qualification Date, Month, Year. If the well existed prior to July 1, 2011, please provide the date of

first sales as the qualifying date.

5. Provide the name of the county(ies) where the lease is located. If the lease is located within two (2) counties, pro-

vide both county names and provide the percentage of the lease contained in each county.

6. Provide the total lease acreage that the well holds.

7. Provide the legal description of the the lease by section, township and range. Provide the acreage description in

quarter sections.

8. Provide the Surface hole legal description for horizontal wells by section, township and range. Provide the acreage

description in quarter sections (10 acre well spot).

9. Provide the Bottom hole legal description for horizontal wells by section, township and range. Provide the acreage

description in quarter sections.

10. Provide the A.P.I. (American Petroleum Institute) Number.

11. Specify the well classification (oil or gas). The classification is determined by the Gas Oil Ratio. (GOR)

If a well produces from one (1) to fifteen thousand (15,000) cubic feet of gas to each barrel of oil, the well classifica-

tion is on oil well. If the gas production exceeds fifteen thousand (15,000) cubic feet to one (1) barrel of oil, the clas-

sification is a gas well.

12. Provide the formation name that the well is producing from.

13. Specify if the well is spaced. If yes, complete items a., b. and c.

a. Provide the spaced acreage and the legal description described by section, township and range. The acreage

description should be equal to the spaced acreage.

b. Also provide the spacing order number.

c. If the well is an additional completion to an existing spaced formation, provide the increased density order

number.

14. Provide:

a. Product code: 1 = oil or condensate

5 = natural or casinghead gas

6 = gas constituents - any liquid hydrocarbon, carbon dioxide, hydrogen sulphide, helium, nitro-

gen or other gas constituents extracted from the gas stream wherein the proceeds of such

products are allocated back to lease operator or interest owner

b. Name of company purchasing each product.

c. OTC assigned reporting number.

d. Enter the OTC assigned reporting number of who will be remitting taxes.

NOTE: See Item 15 for operator approval to remit tax.

e. Enter the date of first sale for type of product.

15. Oklahoma Law (O.S. 68, Sec 1009d) requires the first purchaser to remit the tax. OTC approval must be obtained before

an operator may report and remit production taxes.

16. Operator information and signature are required before form can be approved.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2