Alcoholic Beverage By The Drink Excise Tax Return Form - Department Of Finance Internal Audit & Licensing

ADVERTISEMENT

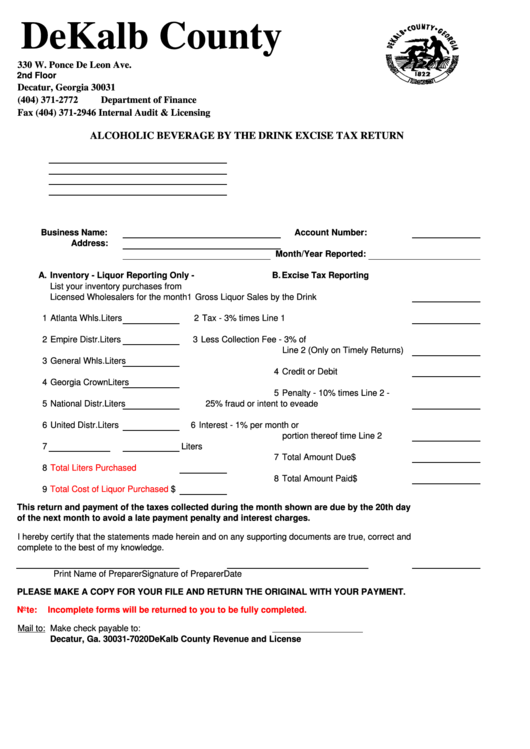

DeKalb County

330 W. Ponce De Leon Ave.

2nd Floor

Decatur, Georgia 30031

(404) 371-2772

Department of Finance

Fax (404) 371-2946

Internal Audit & Licensing

ALCOHOLIC BEVERAGE BY THE DRINK EXCISE TAX RETURN

Business Name:

Account Number:

Address:

Month/Year Reported:

A. Inventory - Liquor Reporting Only -

B. Excise Tax Reporting

List your inventory purchases from

Licensed Wholesalers for the month

1 Gross Liquor Sales by the Drink

1 Atlanta Whls.

Liters

2 Tax - 3% times Line 1

2 Empire Distr.

Liters

3 Less Collection Fee - 3% of

Line 2 (Only on Timely Returns)

3 General Whls.

Liters

4 Credit or Debit

4 Georgia Crown

Liters

5 Penalty - 10% times Line 2 -

5 National Distr.

Liters

25% fraud or intent to eveade

6 United Distr.

Liters

6 Interest - 1% per month or

portion thereof time Line 2

7

Liters

7 Total Amount Due

$

8

Total Liters Purchased

8 Total Amount Paid

$

Total Cost of Liquor Purchased

$

9

This return and payment of the taxes collected during the month shown are due by the 20th day

of the next month to avoid a late payment penalty and interest charges.

I hereby certify that the statements made herein and on any supporting documents are true, correct and

complete to the best of my knowledge.

Print Name of Preparer

Signature of Preparer

Date

PLEASE MAKE A COPY FOR YOUR FILE AND RETURN THE ORIGINAL WITH YOUR PAYMENT.

Note:

Incomplete forms will be returned to you to be fully completed.

Mail to: P.O. Box 100020

Make check payable to:

Decatur, Ga. 30031-7020

DeKalb County Revenue and License

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1