Form Bc-1040 - Individual Return Resident And Nonresident Instructions - Income Tax Division City Of Battle Creek - 2006 Page 2

ADVERTISEMENT

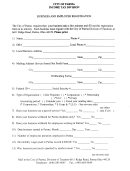

INSTRUCTIONS FOR PAGE 1

RESIDENCY STATUS

14

Line 10—If you are a Battle Creek resident subject to a city income tax in another

1

(A) If you were a resident of the City of Battle Creek during all of 2006 or if you were

Michigan city, you may claim a credit for the amount paid to the other city during 2006. (YOU

a part-year resident and did not work in the City of Battle Creek for the part of the year that

MUST ATTACH A COPY OF THE CITY INCOME TAX RETURN YOU FILED WITH THE OTHER

you were a nonresident, check the top box: “RESIDENT.”

CITY). Enter on Line 10 the credit you are claiming for income taxes paid to the other city.

(B) If you were a nonresident of the City of Battle Creek during 2006, but worked in the

This credit may not exceed what a nonresident of Battle Creek would pay on the same

City of Battle Creek, check the middle box: “NONRESIDENT.”

income earned in Battle Creek. Any payments made in your behalf by a Partnership should

(C) If you were a part-year resident who worked in Battle Creek as both a resident and

also be entered on Line 10. (CLEARLY PRINT OR TYPE THE NAME OF THE CITY AND/OR

nonresident, check the bottom box: “PART-YEAR RESIDENT.”

PARTNERSHIP FOR WHOM THE CREDIT OR PAYMENT WOULD APPLY.)

14

Line 11—Add the total payments and credits on Lines 8, 9 and 10 and enter the sum

SOCIAL SECURITY NUMBER(S)

on Line 11.

2

The social security number of a single individual should be entered in the first desig-

nated area located near the top left corner of the form. If a joint return is filed, and both names

TAX DUE

are entered, the husband’s social security number is entered in the first designated area and

15

Line 12—Subtract the total amount of payments and credits on Line 11 from the tax due

the wife’s is entered in the second designated area where ‘’Spouse” is indicated. (MAKE

on Line 7. If after computing your Battle Creek tax and deducting your payments and credits you

SURE YOUR NUMBER(S) ARE LEGIBLE AND CORRECT ON YOUR RETURN, ON THE AT-

TACHED W-2 FORMS, AND ON ALL SCHEDULES.)

have a balance due the City of Battle Creek, enter that amount on Line 12. If the amount is one

dollar ($1.00) or more, it must be paid when filing this return. Make check or money order

NAME(S) OF FILING TAXPAYERS

payable to: Battle Creek City Treasurer. Mail to: Battle Creek City Treasurer, PO. Box 1982, Battle

3

If you are filing as a single individual, your first name and middle initial are entered

Creek, Michigan 49016-1982. If your Tax is over $100.00 see declaration of estimated tax

below your social security number, your last name is entered to the right in the designated

instructions.

area. If you are filing a joint return, and both names are shown, the husband’s first name and

initial should be listed first followed by the wife’s first name and initial then the last name.

OVERPAID (REFUNDED OR CREDITED) (Note: Refunds or Credits of less

than one dollar($1.00) cannot be made)

ADDRESS AT WHICH YOU PRESENTLY RESIDE

16

If Line 11 (Total Payments and Credits) is larger then Line 7 (Tax), you have overpaid

4

Your complete current street address (house number, street name and apartment

your tax for 2006. You may select from 3 refund/credit options:

number, if you have one) should be listed on the first line of the address area. If you have a

Line 13A—If you want your overpayment refunded by check, enter amount here.

Post Office Box, enter it after your current residence address. The city, state and zip code are

Line 13B—If you want your overpayment to be credited on your 2007 estimated tax, enter

listed on the second line of the address area. (IT IS IMPORTANT TO CHECK THIS INFORMA-

the amount of the refund here.

TION TO MAKE SURE IT IS CORRECT AND LEGIBLE.)

Line 13C—If you want to have your overpayment Directly Deposited into your account at

your Financial Institution, enter the amount here. You MUST provide the name of the Finan-

FILING INFORMATION PRESENTLY ON FILE

5

If you filed a Battle Creek City Income Tax Return for 2005, check the (YES) box. If 2006

cial Institution, the Routing/Transit Number, and your account number. If your deposit is

is the first tax return that you have been required to file a Battle Creek City return, check the (NO)

going to a checking account, enter the account number from the check rather than from a

box.

deposit ticket or statement, as some institutions use different numbers for these documents.

If you filed a 2005 return, but the name or address shown on that return was not the same as

Check with your financial institution if you are unsure of which number to use. If any neces-

it appears on the 2006 return, check the (NO) box.

sary information is incorrect or missing, you will receive your refund as a check, and your

refund could be delayed.

PRESENT EMPLOYER AT TIME OF FILING

6

The name(s) of your present employer(s) is to be listed on this line.

IT IS IMPORTANT THAT YOU CHECK YOUR COMPLETED BATTLE CREEK

RETURN AND ALL ATTACHMENTS FOR ACCURACY AND LEGIBILITY AND

FILING STATUS USED FOR THIS RETURN

MAKE SURE ALL SCHEDULES, W-2 FORMS AND ANY DOCUMENTATION

7

Check the appropriate box for your individual filing status. a) Persons who file a joint

IS ATTACHED.

return check the first box. (If you are a nonresident working in the City of Battle Creek, and

your spouse is not working in Battle Creek and has no taxable Battle Creek income, the joint

SIGN AND DATE YOUR RETURN.

filing status entitles you to the spouse’s exemption.) The spouse’s social security number

17

Be sure that your return is signed. If you are filing jointly, or if an unemployed spouse

and signature must appear in the proper areas provided for each on the return, in order for the

has agreed to have you include his/her personal exemption on your return, the spouse must

exemption to be allowed. b) Married persons wishing to file two (2) separate Battle Creek

sign on the second line designated for signatures.

returns should check the second box and enter the name and social security number of the

spouse who is filing separate. c) A single individual checks the third box.

18

Mail this return requesting a refund or credit to: Battle Creek City Income Tax, PO. Box

1657, Battle Creek, Michigan 49016-1657.

EXEMPTIONS

19

If a person other than yourself has prepared this Battle Creek City return, that person

8

The same rules that apply under the Federal Internal Revenue Code are used in

must sign this form and include their business name, address, identification number and the

determining exemptions for the City of Battle Creek, with the following amendment: addi-

business telephone number.

tional $750.00 exemptions may be claimed for persons who are 65 years of age and older;

1

blind; deaf or suffer some sort of major paralysis or who are totally and permanently dis-

abled. (A doctor’s statement must be attached to your return when claiming any/all disabili-

2

ties.) Also an individual who is claimed as a dependent on another taxpayer’s Federal in-

3

come tax return, (example: children 14 years of age and under) is entitled to take a $750.00

exemption on the City of Battle Creek income tax return when they have taxable income. The

4

total number of exemptions listed and taken credit for on line 5 of your BC-1040 return must

6

not exceed the total number of personal exemptions allowed under the Battle Creek City

5

Income Tax Ordinance. If you are required to complete and file form 8332 (Release of Claim

8

to Exemption for a Child of Divorced or Separated Parents) with your 2006 Federal return, a

copy of that form must be filed with your Battle Creek return. Check the box(s) that apply to

7

yourself. When filing a joint return, check the box(s) that apply to your spouse. List your

dependent children, then other dependent persons. Complete all the information requested,

including birthdates and social security numbers.

9

10

9

THROUGH 13

REFER TO RESIDENT OR NONRESIDENT INSTRUCTIONS.

11

12

PAYMENTS AND CREDITS

13

14

Line 8—Enter the amount of Battle Creek tax withheld as shown on your W-2

statement(s). The employer-supplied City Copy of your W-2, showing clearly the amount of

14

Battle Creek tax withheld, must be submitted with your return before credit can be

15

allowed for Battle Creek tax withheld. (ATTACH W-2 COPIES TO THE BC1040 ON PAGE 2

ALONG THE LOWER LEFT MARGIN WHERE INDICATED.)

16

14

Line 9—Enter the amount of any payment(s) made on a 2006 City of Battle Creek

Declaration of Estimated Tax, (including credits from 2005 overpayment that were ap-

plied to 2006 estimated tax from Line 13B of your 2005 Battle Creek Tax return). Also

19

17

included on Line 9; any City of Battle Creek income tax payments made on a tentative return,

18

filed with a request for an extension of time for filing your City of Battle Creek return.

-I-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6