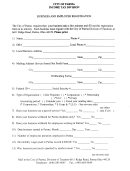

Form Bc-1040 - Individual Return Resident And Nonresident Instructions - Income Tax Division City Of Battle Creek - 2006 Page 6

ADVERTISEMENT

WHAT IS TAXABLE INCOME

(This list is meant to be a guide and is not all inclusive)

Battle Creek residents are required to report the following kinds of income, regardless of where earned.

(

same extent, and on the same basis, as under the Federal Internal

A) Wages, salaries, bonuses, commissions, fees, tips, gratuities, sick

Revenue Code.

pay, disability pay, vacation pay and severance pay.

(I)

Rents and royalties from property, patents and copy-rights.

(B) Compensation received in the form of merchandise or services,

(J) Distributions from employees savings or retirement stock purchase

including meals or lodging if at the employee’s option. The fair

and profit sharing plans.

market value must be determined and reported.

(K) I.R.A. distributions, when the taxpayer is under 59 1/2 years old,

(C) Net profits from the operation of an unincorporated business or

deferred compensation (residents only), distributions, and other

profession, regardless of where conducted.

income to the extent that, and on the same basis that, such in-

(D) Your share of partnership profits, regardless of where business is

come is subject to taxation under the Federal Internal Revenue

conducted.

Code.

(E) Income from an estate or trust (but not distributions of the prin-

(L) Alimony, separate maintenance payments and principle sums pay-

ciple, which are a gift, bequest, or inheritance).

able in installments to the extent includable in income under the

(F) Interest from bank accounts, credit unions, savings and loan asso-

Federal Internal Revenue Code.

ciations, land contracts, notes and bonds.

(M) All other income included in your Federal taxable income, that is

(G) Dividends.

not specifically excluded under the Battle Creek City Income Tax

(H) Gains from the sale or exchange of property, such as capital gain

Ordinance.

from the sale of stock or the sale of real estate, to the

(N) Michigan State Lottery winnings or any gambling winnings.

WHAT IS EXEMPT INCOME

(This is taken from Section 32 of the Ordinance)

(F) Interest from obligations of the United States, the states, or subor-

(A) Gifts, inheritances and bequests

dinate units of government of the states.

(B) Pensions and annuities, including disability pensions (issued by

(G) Social Security benefits, Railroad Retirement Act Benefits.

employers on a 1099-R - if code 1 in box 7 - then it is taxable).

(H) Dividends on an insurance policy (these are in effect partial re-

(C) Proceeds of insurance (except those payments from a health and

funds of premiums paid).

accident policy paid for by your employer are taxable the same as

(I)

Military pay of members of the armed forces of the United States,

other sick and/or disability pay), to the same extent as provided

including Reserve and National Guard pay.

by the Federal Internal Revenue Code.

(D) Unemployment compensation, supplemental unemployment ben-

efits, welfare relief payments.

(E) Workmen’s compensation, or similar payments for death, injury

or illness arising out of and in the course of an employee’s job.

DEDUCTIONS FROM INCOME

(This is taken from Sections 33 & 34 of the Ordinance)

Under the City of Battle Creek Income Tax ordinance no deductions are allowed for personal expenses such as taxes on your

home, sales tax, gasoline tax, church and charitable contributions and medical expenses.

The only deductions or exclusions are:

5.

Expenses reimbursed under an expense account or other

(A) Employee Business Expenses (as stated in sections 33 and 34 of

arrangement with your employer, if the reimbursement has

the City Ordinance). These expenses are allowed only

been included in gross earnings reported.

to the extent not paid by your employer and are limited to

(B) Self-employment Retirement Deduction in accordance with sec-

the following:

tion 404 of Federal Internal Revenue Code.

1.

Expenses of travel, meals and lodging while away from

(C) Individual Retirement Account in accordance with section 219 of

home.

Federal Internal Revenue Code (attach Form 5498, issued by your

2.

Expenses as an outside salesperson, who works away from

financial institution).

his/her employer’s place of business (does not include

(D) Moving Expenses (into the City of Battle Creek only).

driver-salesperson whose primary duty is service and de-

(E) Alimony, separate maintenance payments and principle sums pay-

livery).

able in installments to the extent includable in the spouse’s ad-

3.

Expenses of transportation (but not transportation to and

justed gross income under the Federal Internal Revenue Code.

from work).

4

Federal Schedule 2106 line (4) Business expense not

allowed on City returns - only allowed on Federal.

IMPORTANT: All of the deductions above are limited to the amount taken on your federal return and to the extent they apply to income

taxable under the Battle Creek City Ordinance. A copy of the federal schedule(s) supporting such deductions MUST be attached.

- V -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6