Form Bc-1040 - Individual Return Resident And Nonresident Instructions - Income Tax Division City Of Battle Creek - 2006 Page 5

ADVERTISEMENT

RESIDENT FILING INSTRUCTIONS

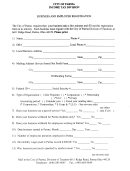

INSTRUCTIONS FOR COMPLETING PAGE 1

OF YOUR BC-1040 RETURN, LINES 1 - 13C

(5) Expenses reimbursed under an expense account or other arrangement with your

employer, if the reimbursement has been included in gross earnings reported.

INCOME

(ATTACH A COPY OF FORM BC 2106).

All income (with the exceptions noted in the “General Instructions”) included on your

(D) Moving Expenses that qualify under the Federal Internal Revenue Code, Section 217, as

Federal Income Tax return which was received while residing in the City of Battle Creek

a deduction from Federal Gross Income may be deducted on your Battle Creek return,

regardless of the location where It was earned, must be included on your BC-1040 return,

(Moving Into City Only). (ATTACH A COPY OF YOUR FEDERAL FORM 3903.)

completed and filed with the City of Battle Creek.

(E) Alimony (CHILD SUPPORT IS NOT DEDUCTIBLE) deducted on your 2006 Federal return

is computed as follows:

LINE 1—TOTAL GROSS INCOME FROM EMPLOYERS

Enter the total of all wages, salaries, sick pay, tips, bonuses, profit sharing, severance

Battle Creek income (Line 4, Page 1 (Without alimony deduction)

pay, disability, etc., reported on W-2(s). ATTACH ALL W-2 FORMS PROVIDED BY ANY

__________________________ X Alimony Paid

EMPLOYER which show City of Battle Creek wages and/or city income tax withheld. Legible

Federal Adjusted Gross Income (Without alimony deduction)

copies of all other W-2 forms, regardless of whether city income tax was withheld, must also

be attached to your completed return.

(1 ) An individual may deduct alimony, separate maintenance payments and

principle sums payable in installments, to the extent includable in the spouse’s

LINE 2—ADDITIONS TO INCOME (GAINS)

adjusted gross income under the Federal Internal Revenue Code but only to the

(Do Not Include Losses; See Subtractions)

extent deductible by the individual under the Federal Internal Revenue Code. (To

All other taxable income reported on your 2006 Federal Income Tax return which increases

be allowed this deduction, the recipient's name, address and social security

your total Battle Creek taxable income should be included in the total entered on Line 2, (with

number must be supplied.)

the exceptions noted in the “General Instructions”).

The items to be included are as

Part-year residents must allocate deductions the same way they allocate income.

follows:

IMPORTANT:

A copy of the Federal schedule(s) and other requested documentations

(A) Interest—(ATTACH A COPY OF YOUR FEDERAL SCHEDULE B.)

suppor ting deductions must be attached. (FAILURE TO ATTACH CORRECT, COMPLETE

(B) Dividends—Include distributions from Sub Chapter S corporations taxed as dividends on

SCHEDULES AND DOCUMENTATION WILL RESULT IN DEDUCTIONS BEING DISALLOWED

your Federal Income Tax return (ATTACH A COPY OF YOUR FEDERAL SCHEDULE B.)

AND/OR DELAY THE PROCESSING OF YOUR RETURN UNTIL PROPER SUBSTANTIATION

(C) Profit from Business or Profession — (ATTACH A COPY OF YOUR FEDERAL SCHEDULE C.)

IS SUPPLIED.)

(D) Capital Gains from Sale or Exchange of Property — The amount subject to tax is

determined on the same basis as the Federal Internal Revenue Code. (ATTACH A COPY

RESIDENTS MUST ATTACH FIRST PAGE OF FEDERAL RETURN

OF YOUR FEDERAL SCHEDULE D.)

NOTE: The only exception is the sale of property purchased prior to July 1, 1967. Gains

CALCULATION OF TAX

or losses on property purchased prior to July 1, 1967 must be determined by one of the

following methods:

LINE 4—ADJUSTED INCOME

(1) The base may be the adjusted fair market value of the property on July 1, 1967 (June

Add Lines 1 (W-2 Income) and 2 (Additions to Income), subtract Line 3 (Subtractions from

30 closing price) for traded securities or;

Income) and enter the result on Line 4.

(2) Divide the number of months the property has been held since June 30,1967, by the

total number of months the property was held. Apply this fraction to the total gain or

LINE 5—EXEMPTIONS

loss as reported on your Federal Income Tax return.

Compute the exemption deduction by taking the total number of exemptions, multiply that

(E) Rents, Royalties, Partnerships, Estates, Trusts, etc., including any shares of partnership

number by $750.00 and enter the result on Line 5.

income. If you are claiming income from a partnership located outside of Battle Creek,

you must ATTACH A COPY OF YOUR FEDERAL SCHEDULE K-1.

LINE 6—TAXABLE INCOME

All partnerships located in the City of Rattle Creek must file a BC 1065 (PARTNERSHIP

Subtract the total amount for personal exemptions on Line 5 from Line 4 and enter remainder

RETURN). You must also ATTACH A COPY OF YOUR FEDERAL SCHEDULE E AND ALL

as total income subject to tax on Line 6.

OTHER SCHEDULES WHICH SUPPORT CLAIMED INCOME.

(F) Other Income—You must include distributions from employees’ stock purchase and

LINE 7—CALCULATION OF TAX DUE FOR RESIDENTS

profit sharing plans (which are classified as wages not subject to withholding), and

Multiply Line 6 by 1% (.01) to determine the City of Battle Creek tax and enter the tax on Line 7.

distributions which have been received from qualified trusts upon termination of employ-

ment and were treated as capital gains under the Federal Internal Revenue Code

LINES 8 THROUGH 13C

(G) Farm Income—(ATTACH A COPY OF YOUR FEDERAL SCHEDULE F.)

TO COMPLETE YOUR RETURN, FOLLOW THE INSTRUCTIONS LISTED UNDER “FILING

(H) Withdrawals and Distributions from Deferred Income Plans.

INSTRUCTIONS FOR PAGE 1” ON PAGE -I-.

(I) Alimony

(J) Sub Chapter S Corporation Distributions—All corporations taxable under the City Income

CREDIT FOR INCOME TAX PAID TO ANOTHER

Tax Ordinance must file as conventional corporations with the City of Battle Creek and

MICHIGAN MUNICIPALITY

pay their own income tax.

(K) Michigan State Lottery winnings.

FOR RESIDENTS (ONLY) who are responsible for nonresident taxes paid to another Michigan

Municipality.

LINE 3—DEDUCTIONS FROM INCOME (LOSSES)

All losses included on your Federal 1040 Return that are not specifically excluded by the City

To calculate the correct amount you are entitled to take on your Battle Creek City return: Start

of Battle Creek Income Tax Ordinance are reported here.

with your “nonresident” Michigan City tax return and W-2’s.

(A) I.R.A. contributions to your Individual Retirement Account, to the extent provided in

Sec tion 219 of the Federal Internal Revenue Code. (ATTACH PROOF OF PAYMENT.) Proof

1. Identical amount taxable to both Municipalities. ........................... $ _________________

of payment includes, but is not limited to, a copy of receipt(s) for I.R.A. contribution(s), a

(the nonresident Michigan income)

copy of the canceled check(s), etc., that clearly indicates it is for the purchase of an I.R.A.

2. Number of exemptions times $750.00 or the other City

(B) A Keogh Retirement Plan

exemption rate if greater than $750.00. ....................................... $ _________________

(C) Employee Business Expenses—These expenses are allowed only to the extent not paid

by your employer, only when incurred in the service of your employer and as a require-

3 Subtract line 2 from line 1. .......................................................... $ _________________

ment of your job, and are LIMITED TO THE FOLLOWING:

4. Multiply Line 3 by .005 (1/2 %).

(1) Expenses for travel, meals, and lodging while away from home.

Take this amount to the BC-1040 form, page 1, line 10. ............... $ _________________

(2) Expenses incurred as an outside salesperson who works away from his/her

employer’s place of business (does not include driver-salesperson whose primary

duty is service and delivery).

(3) Expenses of transportation (but not transportation to and from work).

(4) Federal Schedule 2106 line (4) Business expense not allowed on City returns - only

allowed on Federal.

- IV -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6