Cigarette Tax Refund Application Form Page 2

ADVERTISEMENT

NYC DEPARTMENT OF FINANCE

ENFORCEMENT DIVISION

G

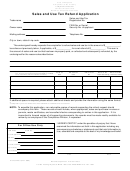

INSTRUCTIONS FOR COMPLETING

TM

THE CIGARETTE TAX REFUND APPLICATION

Finance

Mail completed application with all documents and required evidence attached to:

NYC Department of Finance, Cigarette Tax Unit, 30-10 Starr Avenue, Long Island City, NY 11101

S E C T I O N I - A P P L I C A N T I N F O R M A T I O N

Complete all items in this section and include the Employer Identification Number (EIN) or Social Security Number (SSN), as well as

the New York State and New York City License Numbers where indicated.

S E C T I O N I I - R E F U N D I N F O R M A T I O N A N D C A L C U L A T I O N S

Required Documents

Indicate the reason for the refund requested in Section II, Line 1,

by checking one of the choices provided.

This refund application cannot be processed without the required

evidence that supports this request. Check one of the choices

Itemize and total the required Cigarette Tax information in the des-

provided in Section II, Item 4.

ignated columns of the calculation table, to determine the amount

of refund you are requesting. This amount is comprised of the

See the following explanation of required evidence which must

purchase price, less commission.

accompany this application:

The following will assist in completing the refund calculation table,

K NYS Dept. of Taxation and Finance Verification Letter

Column A through Column G.

If you are a stamping agent who returned unused or damaged

tax stamps to the New York State Dept. of Taxation and

Column A - Tax Stamps Purchased Date

Finance for a refund, you must attach a copy of the verification

Enter the date the tax stamps were purchased from the bank.

letter signed by the State Tax Department which states the

Column B - Joint Tax Stamp Par Value (New York City

type, color and the number of stamps received and verified.

Portion Only)

K NYS Dept. of Taxation and Finance Inspection Report

The tax stamp par value in Column B became effective on July 2,

If the refund claim is for stamps affixed to packages of ciga-

2002. The par value of a 10-cigarette package is $0.75, the 20-

rettes that were returned to the manufacturer, you must notify

cigarette package is $1.50 and the 25-cigarette package is $1.88.

NYS Department of Taxation and Finance for inspection and

Column C - Number of Tax Stamps

approval prior to your shipment. You must include the original

Enter the number of tax stamps. List entries according to the

Manufacturer's Affidavit and Credit Memorandum from the

date of purchase and associated pack size.

manufacturer to support this claim. In addition, you must also

Column D - Total City Par Value

attach a copy of the New York State Dept. of Taxation and

Multiply the cigarette tax stamp par value in Column B by the

Finance inspection report, listing the type, color, and serial

number of cigarette stamps in Column C, and enter the result

numbers of the stamps and the stamp volume.

in Column D.

K NYS Dept. of Taxation and Finance “No Inspection Note”

Column E - Commission Rate

If the New York State Department of Taxation and Finance

Enter the commission rate that was received for the service

allowed your cigarettes to be returned without inspection, sub-

and expense of affixing the tax stamps, corresponding to the

mit a copy of such notification which lists the type, color, serial

date the stamps were purchased.

numbers of stamps and the stamp volume. You must include

the original Manufacturer's Affidavit and Credit Memorandum

Column F - Commission Amount

from the manufacturer to support this claim.

Multiply the Total City Par Value in Column D by the Commission

Rate in Column E, and enter the result in Column F.

K Other. Indicate other evidence you are attaching with this application.

Column G - Total City Par Value Less Commission

Application Filing Deadline

Subtract the Commission amount in Column F from the Total

An agent must submit all applications for redemption/refund of the

City Par Value in Column D, and enter the result in Column G.

New York City cigarette tax, less commission, within two years

Total Amount of Refund Claim: Add all entries in Column G and

after the cigarette tax stamps were purchased, specified in Section

enter the result.

II, Column A.

NOTE: The redemption/refund of the cigarette tax is based on the

rates in effect at the time the payment for the stamps was made.

S E C T I O N I I I - C E R T I F I C A T I O N

Applicant must certify the Cigarette Tax Refund Application by indicating name and title and signing on the signature line in the box provided.

FOR INTERNAL USE

Date Received:____________________ Refund Claim No.: __________________________ Checked by: ___________________________

Title:_______________________________________________________

Date: _________________________________________________

Remarks: _____________________________________________________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2