Lodging Tax - City Of Athens, Al

ADVERTISEMENT

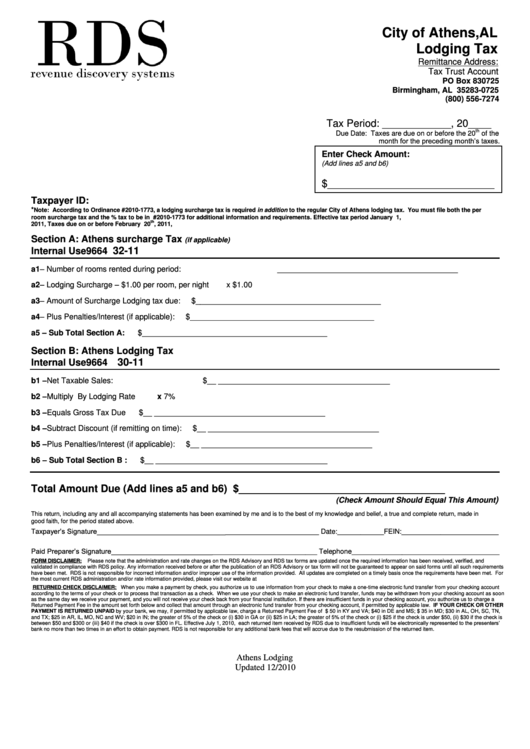

City of Athens,AL

Lodging Tax

Remittance Address:

Tax Trust Account

PO Box 830725

Birmingham, AL 35283-0725

(800) 556-7274

Tax Period: ____________, 20____

th

Due Date: Taxes are due on or before the 20

of the

month for the preceding month’s taxes.

Enter Check Amount:

(Add lines a5 and b6)

$_____________________________

______

Taxpayer ID:

*

Note: According to Ordinance #2010-1773, a lodging surcharge tax is required in addition to the regular City of Athens lodging tax. You must file both the per

room surcharge tax and the % tax to be in compliance. See Ordinance #2010-1773 for additional information and requirements. Effective tax period January 1,

th

2011, Taxes due on or before February 20

, 2011,

Section A: Athens surcharge Tax

(if applicable)

32-11

Internal Use 9664

a1 – Number of rooms rented during period:

_________________________________________

a2 – Lodging Surcharge – $1.00 per room, per night

x $1.00

a3 – Amount of Surcharge Lodging tax due:

$__________________________________________

a4 – Plus Penalties/Interest (if applicable):

$__________________________________________

a5 – Sub Total Section A:

$__________________________________________

Section B: Athens Lodging Tax

30-11

Internal Use 9664

b1 –Net Taxable Sales:

$__ _______________________________________

b2 – Multiply By Lodging Rate

x 7%

b3 – Equals Gross Tax Due

$__ _______________________________________

b4 – Subtract Discount (if remitting on time):

$__ _______________________________________

b5 – Plus Penalties/Interest (if applicable):

$__ _______________________________________

b6 – Sub Total Section B :

$__ _______________________________________

Total Amount Due (Add lines a5 and b6)

$____________________________________

)

(Check Amount Should Equal This Amount

This return, including any and all accompanying statements has been examined by me and is to the best of my knowledge and belief, a true and complete return, made in

good faith, for the period stated above.

Taxpayer’s Signature_________________________________________________________ Date:____________FEIN:_________________________

Paid Preparer’s Signature_____________________________________________________ Telephone______________________________________

FORM DISCLAIMER:

Please note that the administration and rate changes on the RDS Advisory and RDS tax forms are updated once the required information has been received, verified, and

validated in compliance with RDS policy. Any information received before or after the publication of an RDS Advisory or tax form will not be guaranteed to appear on said forms until all such requirements

have been met. RDS is not responsible for incorrect information and/or improper use of the information provided. All updates are completed on a timely basis once the requirements have been met. For

the most current RDS administration and/or rate information provided, please visit our website at

RETURNED CHECK DISCLAIMER: When you make a payment by check, you authorize us to use information from your check to make a one-time electronic fund transfer from your checking account

according to the terms of your check or to process that transaction as a check. When we use your check to make an electronic fund transfer, funds may be withdrawn from your checking account as soon

as the same day we receive your payment, and you will not receive your check back from your financial institution. If there are insufficient funds in your checking account, you authorize us to charge a

Returned Payment Fee in the amount set forth below and collect that amount through an electronic fund transfer from your checking account, if permitted by applicable law. IF YOUR CHECK OR OTHER

PAYMENT IS RETURNED UNPAID by your bank, we may, if permitted by applicable law, charge a Returned Payment Fee of $ 50 in KY and VA; $40 in DE and MS; $ 35 in MD; $30 in AL, OH, SC, TN,

and TX; $25 in AR, IL, MO, NC and WV; $20 in IN; the greater of 5% of the check or (i) $30 in GA or (ii) $25 in LA; the greater of 5% of the check or (i) $25 if the check is under $50, (ii) $30 if the check is

between $50 and $300 or (iii) $40 if the check is over $300 in FL. Effective July 1, 2010, each returned item received by RDS due to insufficient funds will be electronically represented to the presenters’

bank no more than two times in an effort to obtain payment. RDS is not responsible for any additional bank fees that will accrue due to the resubmission of the returned item.

Athens Lodging

Updated 12/2010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1