Form K-18 - Fiduciary Report Of Nonresident Beneficiary Tax Withheld - 2010

ADVERTISEMENT

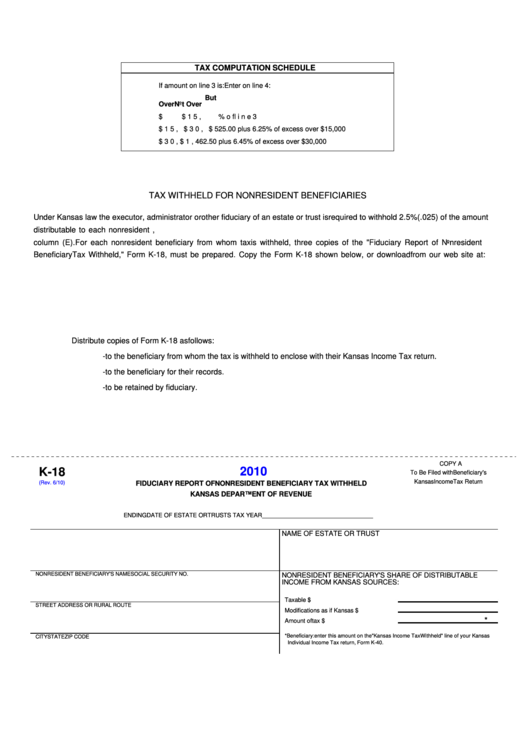

TAX COMPUTATION SCHEDULE

If amount on line 3 is:

Enter on line 4:

But

Over

Not Over

$

0. . . . . $15,000. . . . .

3.50% of line 3

$15,000. . . . . $30,000. . . . . $ 525.00 plus 6.25% of excess over $15,000

$30,000. . . . . . . . . . . . . . . . .$1,462.50 plus 6.45% of excess over $30,000

TAX WITHHELD FOR NONRESIDENT BENEFICIARIES

Under Kansas law the executor, administrator or other fiduciary of an estate or trust is required to withhold 2.5% (.025) of the amount

distributable to each nonresident beneficiary. The amount to be withheld from each nonresident beneficiary is shown on Part IV,

column (E). For each nonresident beneficiary from whom tax is withheld, three copies of the "Fiduciary Report of Nonresident

Beneficiary Tax Withheld," Form K-18, must be prepared. Copy the Form K-18 shown below, or download from our web site at:

Distribute copies of Form K-18 as follows:

-to the beneficiary from whom the tax is withheld to enclose with their Kansas Income Tax return.

-to the beneficiary for their records.

-to be retained by fiduciary.

COPY A

2010

K-18

To Be Filed with Beneficiary's

Kansas Income Tax Return

(Rev. 6/10)

FIDUCIARY REPORT OF NONRESIDENT BENEFICIARY TAX WITHHELD

KANSAS DEPARTMENT OF REVENUE

ENDING DATE OF ESTATE OR TRUSTS TAX YEAR__________________________________

NAME OF ESTATE OR TRUST

NONRESIDENT BENEFICIARY'S NAME

SOCIAL SECURITY NO.

NONRESIDENT BENEFICIARY'S SHARE OF DISTRIBUTABLE

INCOME FROM KANSAS SOURCES:

Taxable income......................................$

STREET ADDRESS OR RURAL ROUTE

Modifications as if Kansas resident........$

*

Amount of tax withheld...........................$

*Beneficiary: enter this amount on the "Kansas Income Tax Withheld" line of your Kansas

CITY

STATE

ZIP CODE

Individual Income Tax return, Form K-40.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3