Form K-18 - Fiduciary Report Of Nonresident Beneficiary Tax Withheld - 1999

ADVERTISEMENT

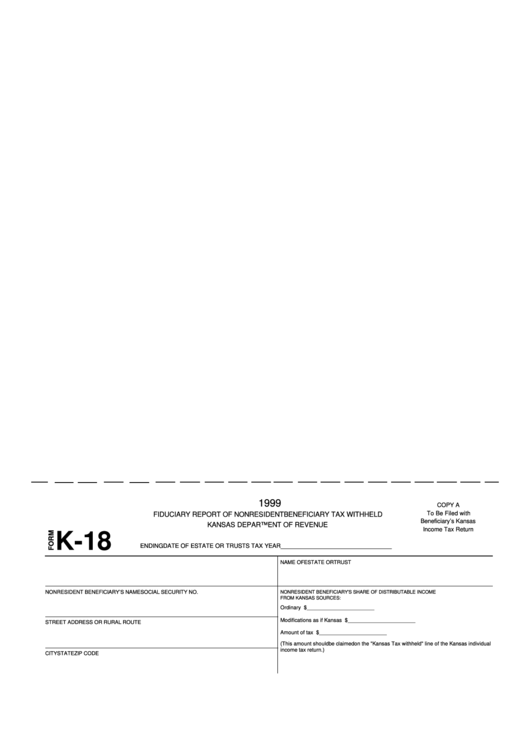

1999

COPY A

To Be Filed with

FIDUCIARY REPORT OF NONRESIDENT BENEFICIARY TAX WITHHELD

Beneficiary’s Kansas

KANSAS DEPARTMENT OF REVENUE

Income Tax Return

K-18

ENDING DATE OF ESTATE OR TRUSTS TAX YEAR__________________________________

NAME OF ESTATE OR TRUST

NONRESIDENT BENEFICIARY’S NAME

SOCIAL SECURITY NO.

NONRESIDENT BENEFICIARY’S SHARE OF DISTRIBUTABLE INCOME

FROM KANSAS SOURCES:

Ordinary income........................................$_______________________

Modifications as if Kansas resident...........$_______________________

STREET ADDRESS OR RURAL ROUTE

Amount of tax withheld..............................$_______________________

(This amount should be claimed on the "Kansas Tax withheld" line of the Kansas individual

income tax return.)

CITY

STATE

ZIP CODE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3