F-1193 - Application For Florida Renewable Energy Production Credit Allocation Form

ADVERTISEMENT

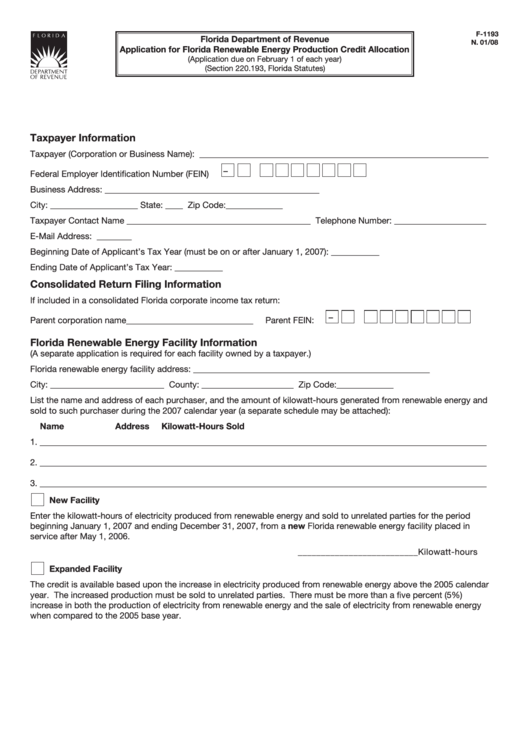

F-1193

Florida Department of Revenue

N. 01/08

Application for Florida Renewable Energy Production Credit Allocation

(Application due on February 1 of each year)

(Section 220.193, Florida Statutes)

Taxpayer Information

Taxpayer (Corporation or Business Name): __________________________________________________________________

–

Federal Employer Identification Number (FEIN)

Business Address: _________________________________________________

City: ____________________ State: ____ Zip Code:_____________

Taxpayer Contact Name __________________________________________ Telephone Number: _____________________

E-Mail Address: ________

Beginning Date of Applicant’s Tax Year (must be on or after January 1, 2007): ___________

Ending Date of Applicant’s Tax Year: ___________

Consolidated Return Filing Information

If included in a consolidated Florida corporate income tax return:

–

Parent corporation name_____________________________

Parent FEIN:

Florida Renewable Energy Facility Information

(A separate application is required for each facility owned by a taxpayer.)

Florida renewable energy facility address: ______________________________________________________

City: __________________________ County: _____________________ Zip Code:_____________

List the name and address of each purchaser, and the amount of kilowatt-hours generated from renewable energy and

sold to such purchaser during the 2007 calendar year (a separate schedule may be attached):

Name

Address

Kilowatt-Hours Sold

1. ______________________________________________________________________________________________________

2. ______________________________________________________________________________________________________

3. ______________________________________________________________________________________________________

New Facility

Enter the kilowatt-hours of electricity produced from renewable energy and sold to unrelated parties for the period

beginning January 1, 2007 and ending December 31, 2007, from a new Florida renewable energy facility placed in

service after May 1, 2006.

__________________________Kilowatt-hours

Expanded Facility

The credit is available based upon the increase in electricity produced from renewable energy above the 2005 calendar

year. The increased production must be sold to unrelated parties. There must be more than a five percent (5%)

increase in both the production of electricity from renewable energy and the sale of electricity from renewable energy

when compared to the 2005 base year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4