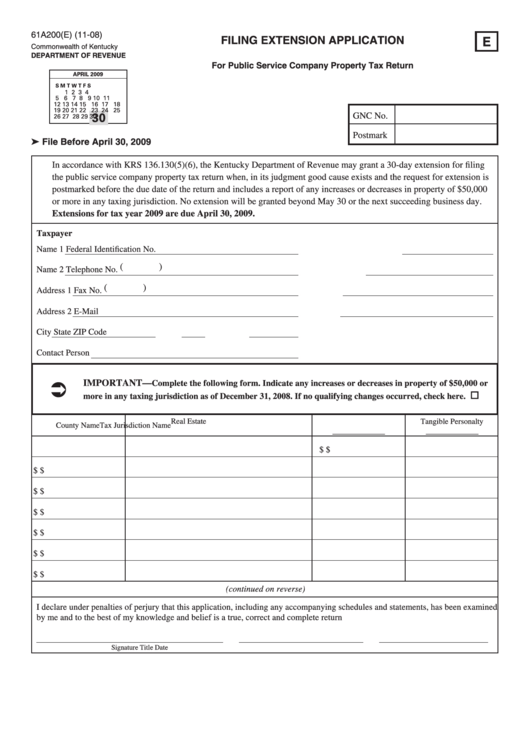

Form 61a200(E) - Filing Extension Application

ADVERTISEMENT

61A200(E) (11-08)

FILING EXTENSION APPLICATION

E

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

For Public Service Company Property Tax Return

APRIL 2009

s

m

t

w

t

f

s

1

2

3 4

5

6

7 8

9 10 11

12 13 14 15 16 17 18

19 20 21 22 23 24 25

30

GNC No.

26 27 28 29 30

Postmark

➤ File Before April 30, 2009

In accordance with KRS 136.130(5)(6), the Kentucky Department of Revenue may grant a 30-day extension for filing

the public service company property tax return when, in its judgment good cause exists and the request for extension is

postmarked before the due date of the return and includes a report of any increases or decreases in property of $50,000

or more in any taxing jurisdiction. No extension will be granted beyond May 30 or the next succeeding business day.

Extensions for tax year 2009 are due April 30, 2009.

Taxpayer

Name 1

Federal Identification No.

(

)

Name 2

Telephone No.

(

)

Address 1

Fax No.

Address 2

E-Mail

City

State

ZIP Code

Contact Person

IMPORTANT—

Complete the following form. Indicate any increases or decreases in property of $50,000 or

more in any taxing jurisdiction as of December 31, 2008. If no qualifying changes occurred, check here.

Real Estate

Tangible Personalty

County Name

Tax Jurisdiction Name

____________

____________

$

$

$

$

$

$

$

$

$

$

$

$

$

$

(continued on reverse)

I declare under penalties of perjury that this application, including any accompanying schedules and statements, has been examined

by me and to the best of my knowledge and belief is a true, correct and complete return

Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2