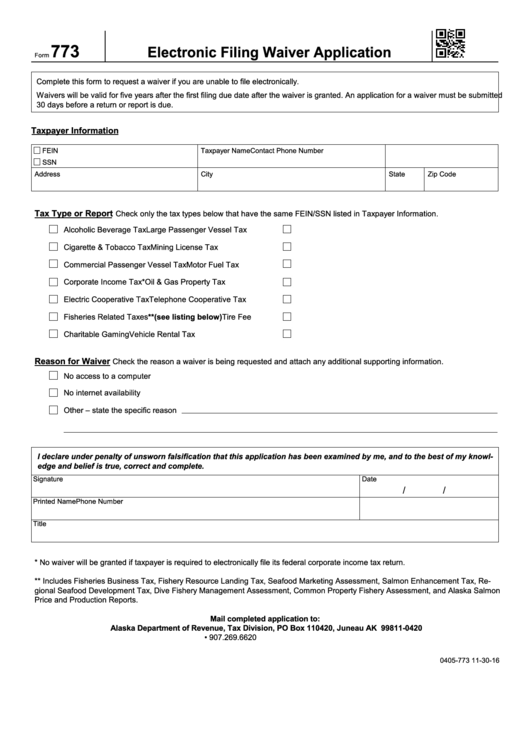

Form 773 - Electronic Filing Waiver Application

ADVERTISEMENT

773

Electronic Filing Waiver Application

Form

Complete this form to request a waiver if you are unable to file electronically.

Waivers will be valid for five years after the first filing due date after the waiver is granted. An application for a waiver must be submitted

30 days before a return or report is due.

Taxpayer Information

FEIN

Taxpayer Name

Contact Phone Number

SSN

Address

City

State

Zip Code

Tax Type or Report

Check only the tax types below that have the same FEIN/SSN listed in Taxpayer Information.

Alcoholic Beverage Tax

Large Passenger Vessel Tax

Cigarette & Tobacco Tax

Mining License Tax

Commercial Passenger Vessel Tax

Motor Fuel Tax

Corporate Income Tax*

Oil & Gas Property Tax

Electric Cooperative Tax

Telephone Cooperative Tax

Fisheries Related Taxes** (see listing below)

Tire Fee

Charitable Gaming

Vehicle Rental Tax

Reason for Waiver

Check the reason a waiver is being requested and attach any additional supporting information.

No access to a computer

No internet availability

Other – state the specific reason

I declare under penalty of unsworn falsification that this application has been examined by me, and to the best of my knowl-

edge and belief is true, correct and complete.

Signature

Date

/

/

Printed Name

Phone Number

Title

* No waiver will be granted if taxpayer is required to electronically file its federal corporate income tax return.

** Includes Fisheries Business Tax, Fishery Resource Landing Tax, Seafood Marketing Assessment, Salmon Enhancement Tax, Re-

gional Seafood Development Tax, Dive Fishery Management Assessment, Common Property Fishery Assessment, and Alaska Salmon

Price and Production Reports.

Mail completed application to:

Alaska Department of Revenue, Tax Division, PO Box 110420, Juneau AK 99811-0420

• 907.269.6620

0405-773 11-30-16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1