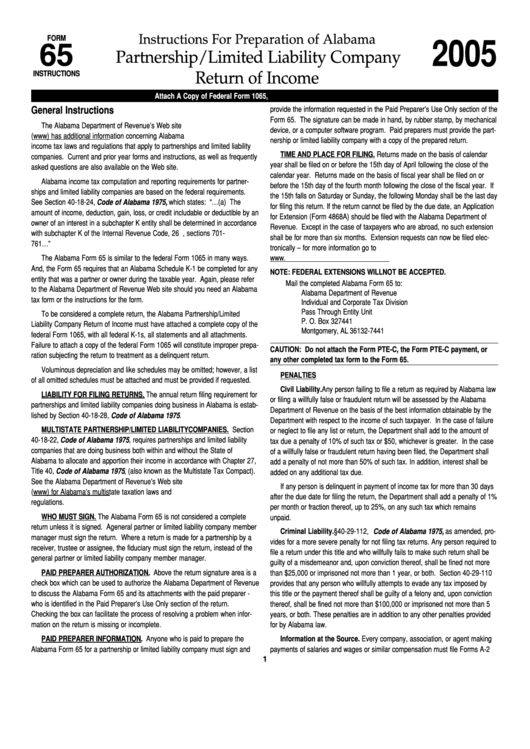

Instructions For Preparation Of Alabama Partnership/limited Liability Company Return Of Income - 2005

ADVERTISEMENT

Instructions For Preparation of Alabama

FORM

2005

65

Partnership/Limited Liability Company

INSTRUCTIONS

Return of Income

Attach A Copy of Federal Form 1065, U.S. Corporation Return of Income

General Instructions

provide the information requested in the Paid Preparer’s Use Only section of the

Form 65. The signature can be made in hand, by rubber stamp, by mechanical

The Alabama Department of Revenue’s Web site

device, or a computer software program. Paid preparers must provide the part-

( ) has additional information concerning Alabama

nership or limited liability company with a copy of the prepared return.

income tax laws and regulations that apply to partnerships and limited liability

TIME AND PLACE FOR FILING. Returns made on the basis of calendar

companies. Current and prior year forms and instructions, as well as frequently

year shall be filed on or before the 15th day of April following the close of the

asked questions are also available on the Web site.

calendar year. Returns made on the basis of fiscal year shall be filed on or

Alabama income tax computation and reporting requirements for partner-

before the 15th day of the fourth month following the close of the fiscal year. If

ships and limited liability companies are based on the federal requirements.

the 15th falls on Saturday or Sunday, the following Monday shall be the last day

See Section 40-18-24, Code of Alabama 1975, which states: “…(a) The

for filing this return. If the return cannot be filed by the due date, an Application

amount of income, deduction, gain, loss, or credit includable or deductible by an

for Extension (Form 4868A) should be filed with the Alabama Department of

owner of an interest in a subchapter K entity shall be determined in accordance

Revenue. Except in the case of taxpayers who are abroad, no such extension

with subchapter K of the Internal Revenue Code, 26 U.S.C., sections 701-

shall be for more than six months. Extension requests can now be filed elec-

761…”

tronically – for more information go to

The Alabama Form 65 is similar to the federal Form 1065 in many ways.

And, the Form 65 requires that an Alabama Schedule K-1 be completed for any

NOTE: FEDERAL EXTENSIONS WILL NOT BE ACCEPTED.

entity that was a partner or owner during the taxable year. Again, please refer

Mail the completed Alabama Form 65 to:

to the Alabama Department of Revenue Web site should you need an Alabama

Alabama Department of Revenue

tax form or the instructions for the form.

Individual and Corporate Tax Division

Pass Through Entity Unit

To be considered a complete return, the Alabama Partnership/Limited

P. O. Box 327441

Liability Company Return of Income must have attached a complete copy of the

Montgomery, AL 36132-7441

federal Form 1065, with all federal K-1s, all statements and all attachments.

Failure to attach a copy of the federal Form 1065 will constitute improper prepa-

CAUTION: Do not attach the Form PTE-C, the Form PTE-C payment, or

ration subjecting the return to treatment as a delinquent return.

any other completed tax form to the Form 65.

Voluminous depreciation and like schedules may be omitted; however, a list

PENALTIES

of all omitted schedules must be attached and must be provided if requested.

Civil Liability. Any person failing to file a return as required by Alabama law

LIABILITY FOR FILING RETURNS. The annual return filing requirement for

or filing a willfully false or fraudulent return will be assessed by the Alabama

partnerships and limited liability companies doing business in Alabama is estab-

Department of Revenue on the basis of the best information obtainable by the

lished by Section 40-18-28, Code of Alabama 1975 .

Department with respect to the income of such taxpayer. In the case of failure

MULTISTATE PARTNERSHIP/LIMITED LIABILITY COMPANIES. Section

or neglect to file any list or return, the Department shall add to the amount of

40-18-22, Code of Alabama 1975 , requires partnerships and limited liability

tax due a penalty of 10% of such tax or $50, whichever is greater. In the case

companies that are doing business both within and without the State of

of a willfully false or fraudulent return having been filed, the Department shall

Alabama to allocate and apportion their income in accordance with Chapter 27,

add a penalty of not more than 50% of such tax. In addition, interest shall be

Title 40, Code of Alabama 1975 , (also known as the Multistate Tax Compact).

added on any additional tax due.

See the Alabama Department of Revenue’s Web site

If any person is delinquent in payment of income tax for more than 30 days

( ) for Alabama’s multistate taxation laws and

after the due date for filing the return, the Department shall add a penalty of 1%

regulations.

per month or fraction thereof, up to 25%, on any such tax which remains

WHO MUST SIGN. The Alabama Form 65 is not considered a complete

unpaid.

return unless it is signed. A general partner or limited liability company member

Criminal Liability. §40-29-112, Code of Alabama 1975, as amended, pro-

manager must sign the return. Where a return is made for a partnership by a

vides for a more severe penalty for not filing tax returns. Any person required to

receiver, trustee or assignee, the fiduciary must sign the return, instead of the

file a return under this title and who willfully fails to make such return shall be

general partner or limited liability company member manager.

guilty of a misdemeanor and, upon conviction thereof, shall be fined not more

PAID PREPARER AUTHORIZATION. Above the return signature area is a

than $25,000 or imprisoned not more than 1 year, or both. Section 40-29-110

check box which can be used to authorize the Alabama Department of Revenue

provides that any person who willfully attempts to evade any tax imposed by

to discuss the Alabama Form 65 and its attachments with the paid preparer -

this title or the payment thereof shall be guilty of a felony and, upon conviction

who is identified in the Paid Preparer’s Use Only section of the return.

thereof, shall be fined not more than $100,000 or imprisoned not more than 5

Checking the box can facilitate the process of resolving a problem when infor-

years, or both. These penalties are in addition to any other penalties provided

mation on the return is missing or incomplete.

for by Alabama law.

PAID PREPARER INFORMATION. Anyone who is paid to prepare the

Information at the Source. Every company, association, or agent making

Alabama Form 65 for a partnership or limited liability company must sign and

payments of salaries and wages or similar compensation must file Forms A-2

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5