Instructions For Form It-204-Ll - Limited Liability Company/limited Liability Partnership Filing Fee Payment Form - 1998

ADVERTISEMENT

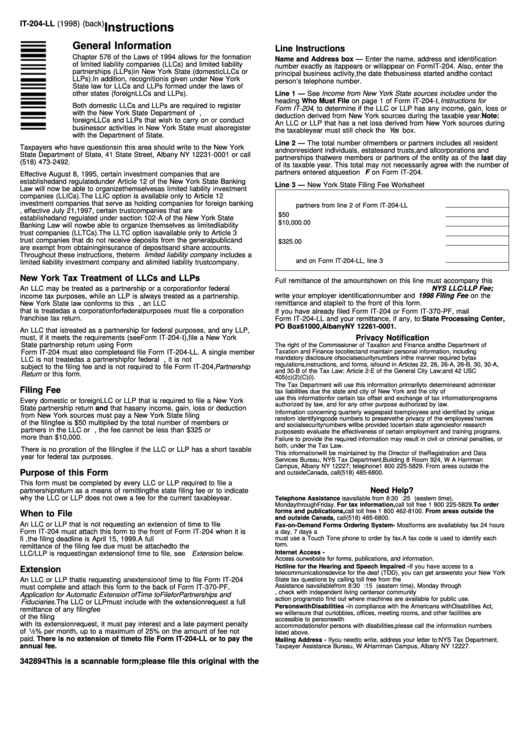

IT-204-LL (1998) (back)

Instructions

General Information

Line Instructions

Chapter 576 of the Laws of 1994 allows for the formation

Name and Address box — Enter the name, address and identification

of limited liability companies (LLCs) and limited liability

number exactly as it appears or will appear on Form IT-204. Also, enter the

partnerships (LLPs) in New York State (domestic LLCs or

principal business activity, the date the business started and the contact

LLPs). In addition, recognition is given under New York

person’s telephone number.

State law for LLCs and LLPs formed under the laws of

other states (foreign LLCs and LLPs).

Line 1 — See Income from New York State sources includes under the

heading Who Must File on page 1 of Form IT-204-I, Instructions for

Both domestic LLCs and LLPs are required to register

Form IT-204 , to determine if the LLC or LLP has any income, gain, loss or

with the New York State Department of State. In addition,

deduction derived from New York sources during the taxable year. Note:

foreign LLCs and LLPs that wish to carry on or conduct

An LLC or LLP that has a net loss derived from New York sources during

business or activities in New York State must also register

the taxable year must still check the Yes box.

with the Department of State.

Line 2 — The total number of members or partners includes all resident

Taxpayers who have questions in this area should write to the New York

and nonresident individuals, estates and trusts, and all corporations and

State Department of State, 41 State Street, Albany NY 12231-0001 or call

partnerships that were members or partners of the entity as of the last day

(518) 473-2492.

of its taxable year. This total may not necessarily agree with the number of

partners entered at question F on Form IT-204.

Effective August 8, 1995, certain investment companies that are

established and regulated under Article 12 of the New York State Banking

Line 3 — New York State Filing Fee Worksheet

Law will now be able to organize themselves as limited liability investment

companies (LLICs). The LLIC option is available only to Article 12

1. Enter total number of members or

investment companies that serve as holding companies for foreign banking

partners from line 2 of Form IT-204-LL . . . . . . . 1.

operations. Also, effective July 21, 1997, certain trust companies that are

2. Multiply line 1 by $50 . . . . . . . . . . . . . . . . . . . . . . . 2.

established and regulated under section 102-A of the New York State

$10,000.00

3. Maximum filing fee . . . . . . . . . . . . . . . . . . . . . . . . . 3.

Banking Law will now be able to organize themselves as limited liability

trust companies (LLTCs). The LLTC option is available only to Article 3

4. Enter the smaller of line 2 or line 3. . . . . . . . . . . . 4.

trust companies that do not receive deposits from the general public and

$325.00

5. Minimum filing fee. . . . . . . . . . . . . . . . . . . . . . . . . . 5.

are exempt from obtaining insurance of deposits and share accounts.

6. Enter the larger of line 4 or line 5 here

Throughout these instructions, the term limited liability company includes a

and on Form IT-204-LL, line 3 . . . . . . . . . . . . . . 6.

limited liability investment company and a limited liability trust company.

New York Tax Treatment of LLCs and LLPs

Full remittance of the amount shown on this line must accompany this

form. Make your check or money order payable to NYS LLC/LLP Fee;

An LLC may be treated as a partnership or a corporation for federal

write your employer identification number and 1998 Filing Fee on the

income tax purposes, while an LLP is always treated as a partnership.

remittance and staple it to the front of this form.

New York State law conforms to this federal treatment. Accordingly, an LLC

that is treated as a corporation for federal purposes must file a corporation

If you have already filed Form IT-204 or Form IT-370-PF, mail

franchise tax return.

Form IT-204-LL and your remittance, if any, to: State Processing Center,

PO Box 61000, Albany NY 12261-0001.

An LLC that is treated as a partnership for federal purposes, and any LLP,

must, if it meets the requirements (see Form IT-204-I), file a New York

Privacy Notification

State partnership return using Form IT-204. Any LLC or LLP required to file

The right of the Commissioner of Taxation and Finance and the Department of

Taxation and Finance to collect and maintain personal information, including

Form IT-204 must also complete and file Form IT-204-LL. A single member

mandatory disclosure of social security numbers in the manner required by tax

LLC is not treated as a partnership for federal purposes. Therefore, it is not

regulations, instructions, and forms, is found in Articles 22, 26, 26-A, 26-B, 30, 30-A,

subject to the filing fee and is not required to file Form IT-204, Partnership

and 30-B of the Tax Law; Article 2-E of the General City Law; and 42 USC

Return or this form.

405(c)(2)(C)(i).

The Tax Department will use this information primarily to determine and administer

Filing Fee

tax liabilities due the state and city of New York and the city of Yonkers. We will also

use this information for certain tax offset and exchange of tax information programs

Every domestic or foreign LLC or LLP that is required to file a New York

authorized by law, and for any other purpose authorized by law.

State partnership return and that has any income, gain, loss or deduction

Information concerning quarterly wages paid to employees and identified by unique

from New York sources must pay a New York State filing fee. The amount

random identifying code numbers to preserve the privacy of the employees’ names

of the filing fee is $50 multiplied by the total number of members or

and social security numbers will be provided to certain state agencies for research

partners in the LLC or LLP. However, the fee cannot be less than $325 or

purposes to evaluate the effectiveness of certain employment and training programs.

more than $10,000.

Failure to provide the required information may result in civil or criminal penalties, or

both, under the Tax Law.

There is no proration of the filing fee if the LLC or LLP has a short taxable

This information will be maintained by the Director of the Registration and Data

year for federal tax purposes.

Services Bureau, NYS Tax Department, Building 8 Room 924, W A Harriman

Campus, Albany NY 12227; telephone 1 800 225-5829. From areas outside the U.S.

Purpose of this Form

and outside Canada, call (518) 485-6800.

This form must be completed by every LLC or LLP required to file a

partnership return as a means of remitting the state filing fee or to indicate

Need Help?

why the LLC or LLP does not owe a fee for the current taxable year.

Telephone Assistance is available from 8:30 a.m. to 4:25 p.m. (eastern time),

Monday through Friday. For tax information, call toll free 1 800 225-5829. To order

forms and publications, call toll free 1 800 462-8100. From areas outside the U.S.

When to File

and outside Canada, call (518) 485-6800.

An LLC or LLP that is not requesting an extension of time to file

Fax-on-Demand Forms Ordering System - Most forms are available by fax 24 hours

Form IT-204 must attach this form to the front of Form IT-204 when it is

a day, 7 days a week. Call toll free from the U.S. and Canada 1 800 748-3676. You

must use a Touch Tone phone to order by fax. A fax code is used to identify each

filed. For calendar year 1998, the filing deadline is April 15, 1999. A full

form.

remittance of the filing fee due must be attached to the form. If the

Internet Access -

LLC/LLP is requesting an extension of time to file, see Extension below.

Access our website for forms, publications, and information.

Hotline for the Hearing and Speech Impaired - If you have access to a

Extension

telecommunications device for the deaf (TDD), you can get answers to your New York

An LLC or LLP that is requesting an extension of time to file Form IT-204

State tax questions by calling toll free from the U.S. and Canada 1 800 634-2110.

Assistance is available from 8:30 a.m. to 4:15 p.m. (eastern time), Monday through

must complete and attach this form to the back of Form IT-370-PF,

Friday. If you do not own a TDD, check with independent living centers or community

Application for Automatic Extension of Time to File for Partnerships and

action programs to find out where machines are available for public use.

Fiduciaries . The LLC or LLP must include with the extension request a full

Persons with Disabilities - In compliance with the Americans with Disabilities Act,

remittance of any filing fee due. There is no extension of time for payment

we will ensure that our lobbies, offices, meeting rooms, and other facilities are

of the filing fee. If the LLC or LLP fails to pay the full amount of filing fee

accessible to persons with disabilities. If you have questions about special

with its extension request, it must pay interest and a late payment penalty

accommodations for persons with disabilities, please call the information numbers

of

1

⁄

% per month, up to a maximum of 25% on the amount of fee not

listed above.

2

paid. There is no extension of time to file Form IT-204-LL or to pay the

Mailing Address - If you need to write, address your letter to: NYS Tax Department,

annual fee.

Taxpayer Assistance Bureau, W A Harriman Campus, Albany NY 12227.

342894

This is a scannable form; please file this original with the Tax Department.

IT-204-LL 1998

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1