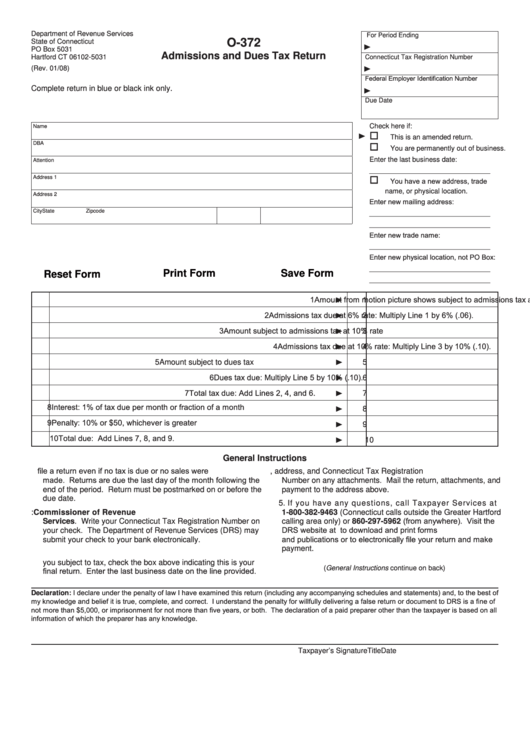

Department of Revenue Services

For Period Ending

O-372

State of Connecticut

PO Box 5031

Admissions and Dues Tax Return

Hartford CT 06102-5031

Connecticut Tax Registration Number

(Rev. 01/08)

Federal Employer Identification Number

Complete return in blue or black ink only.

Due Date

Check here if:

Name

This is an amended return.

DBA

You are permanently out of business.

Enter the last business date:

Attention

_______________________________

Address 1

You have a new address, trade

name, or physical location.

Address 2

Enter new mailing address:

City

State

Zipcode

_______________________________

_______________________________

Enter new trade name:

_______________________________

Enter new physical location, not PO Box:

_______________________________

Print Form

Save Form

Reset Form

_______________________________

1

Amount from motion picture shows subject to admissions tax at 6% rate

1

2

Admissions tax due at 6% rate: Multiply Line 1 by 6% (.06).

2

3

Amount subject to admissions tax at 10% rate

3

4

Admissions tax due at 10% rate: Multiply Line 3 by 10% (.10).

4

5

Amount subject to dues tax

5

6

Dues tax due: Multiply Line 5 by 10% (.10).

6

7

Total tax due: Add Lines 2, 4, and 6.

7

8

Interest: 1% of tax due per month or fraction of a month

8

9

Penalty: 10% or $50, whichever is greater

9

10

Total due: Add Lines 7, 8, and 9.

10

General Instructions

1. You must file a return even if no tax is due or no sales were

4. Write your name, address, and Connecticut Tax Registration

made. Returns are due the last day of the month following the

Number on any attachments. Mail the return, attachments, and

end of the period. Return must be postmarked on or before the

payment to the address above.

due date.

5. If you have any questions, call Taxpayer Services at

2. Make your check payable to: Commissioner of Revenue

1-800-382-9463 (Connecticut calls outside the Greater Hartford

calling area only) or 860-297-5962 (from anywhere). Visit the

Services. Write your Connecticut Tax Registration Number on

DRS website at to download and print forms

your check. The Department of Revenue Services (DRS) may

and publications or to electronically file your return and make

submit your check to your bank electronically.

payment.

3. If you have permanently discontinued the activities that made

you subject to tax, check the box above indicating this is your

(General Instructions continue on back)

final return. Enter the last business date on the line provided.

Declaration: I declare under the penalty of law I have examined this return (including any accompanying schedules and statements) and, to the best of

my knowledge and belief it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is a fine of

not more than $5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all

information of which the preparer has any knowledge.

Taxpayer’s Signature

Title

Date

1

1