Form Amd - Individual Income Tax Amended Return Reconciliation

ADVERTISEMENT

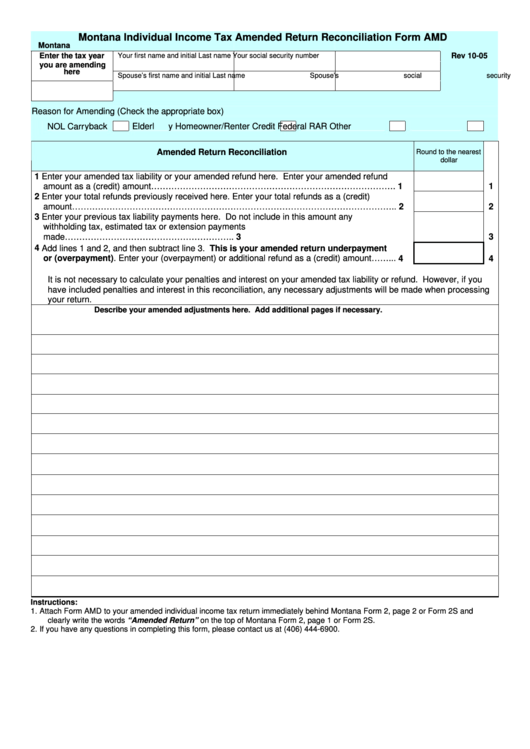

Montana Individual Income Tax Amended Return Reconciliation

Form AMD

Montana

Enter the tax year

Your first name and initial

Last name

Your social security number

Rev 10-05

you are amending

here

Spouse’s first name and initial

Last name

Spouse’s social security number

Reason for Amending (Check the appropriate box)

NOL Carryback

Elderly Homeowner/Renter Credit

Federal RAR

Other

Amended Return Reconciliation

Round to the nearest

dollar

1 Enter your amended tax liability or your amended refund here. Enter your amended refund

amount as a (credit) amount…………………………………………………………………………. 1

1

2 Enter your total refunds previously received here. Enter your total refunds as a (credit)

amount………………………………………………………………………………………………….. 2

2

3 Enter your previous tax liability payments here. Do not include in this amount any

withholding tax, estimated tax or extension payments

made…………………………………………………..

3

3

4 Add lines 1 and 2, and then subtract line 3. This is your amended return underpayment

or (overpayment). Enter your (overpayment) or additional refund as a (credit) amount……... 4

4

It is not necessary to calculate your penalties and interest on your amended tax liability or refund. However, if you

have included penalties and interest in this reconciliation, any necessary adjustments will be made when processing

your return.

Describe your amended adjustments here. Add additional pages if necessary.

Instructions:

1.

Attach Form AMD to your amended individual income tax return immediately behind Montana Form 2, page 2 or Form 2S and

clearly write the words “Amended Return” on the top of Montana Form 2, page 1 or Form 2S.

2.

If you have any questions in completing this form, please contact us at (406) 444-6900.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1