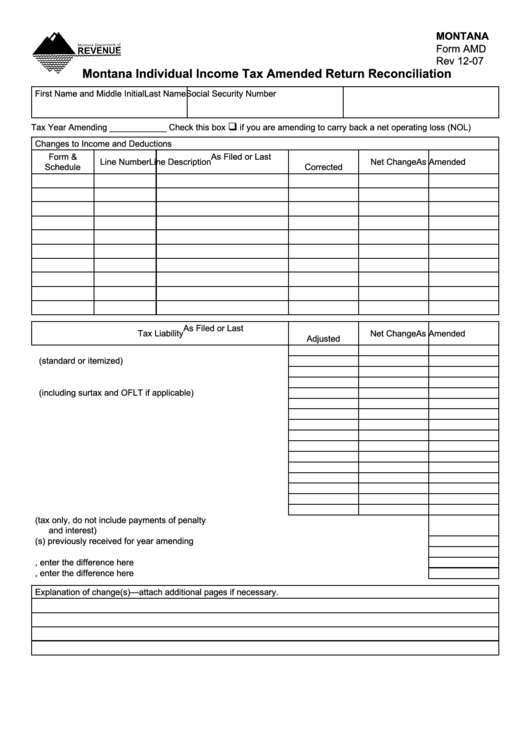

Form Amd - Montana Individual Income Tax Amended Return Reconciliation

ADVERTISEMENT

MONTANA

Form AMD

Rev 12-07

Montana Individual Income Tax Amended Return Reconciliation

First Name and Middle Initial

Last Name

Social Security Number

q

Tax Year Amending ____________

Check this box

if you are amending to carry back a net operating loss (NOL)

Changes to Income and Deductions

Form &

As Filed or Last

Line Number

Line Description

Net Change

As Amended

Schedule

Corrected

As Filed or Last

Tax Liability

Net Change

As Amended

Adjusted

1. Montana adjusted gross income.............................................1.

2. Deductions (standard or itemized)..........................................2.

3. Exemption amount..................................................................3.

4. Taxable income.......................................................................4.

5. Tax (including surtax and OFLT if applicable) .........................5.

6. Tax on lump sum distributions ................................................6.

7. Add lines 5 and 6 ....................................................................7.

8. Capital gains credit--only 2005 and after ................................8.

9. Other nonrefundable tax credits .............................................9.

10. Subtract lines 8 and 9 from line 7 .........................................10.

11. Recapture taxes ...................................................................11.

12. Voluntary check off contributions ..........................................12.

13. Add lines 10 through 12........................................................13.

14. Montana tax withheld............................................................14.

15. Estimated and extension payments......................................15.

16. Refundable credits................................................................16.

17. Amounts paid with original plus subsequent payments (tax only, do not include payments of penalty

and interest)................................................................................................................................... 17.

18. Total refund(s) previously received for year amending .................................................................. 18.

19. Add lines 14 through 17 then subtract line 18 ............................................................................... 19.

20. Refund. If line 19 is greater than line 13, enter the difference here ............................................... 20.

21. Tax Due. If line 19 is less than line 13, enter the difference here .................................................. 21.

Explanation of change(s)—attach additional pages if necessary.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1