Instructions For Form It-220 - Minimum Income Tax - New York State Department Of Taxation And Finance - 2004

ADVERTISEMENT

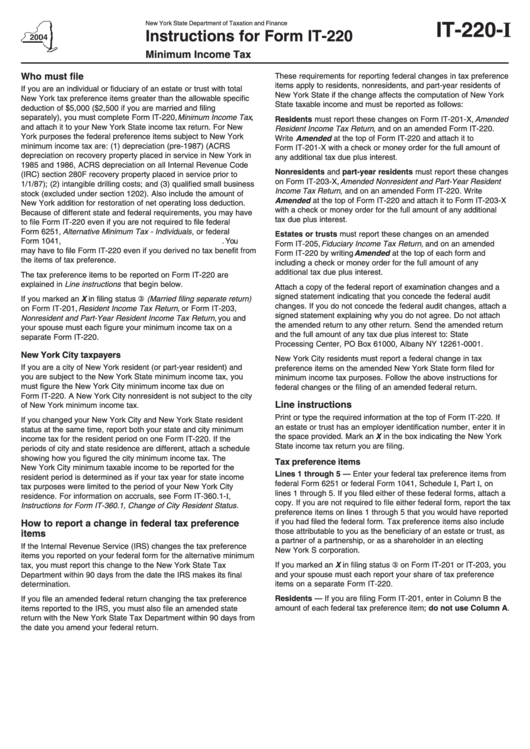

New York State Department of Taxation and Finance

IT-220-I

Instructions for Form IT-220

Minimum Income Tax

Who must file

These requirements for reporting federal changes in tax preference

items apply to residents, nonresidents, and part-year residents of

If you are an individual or fiduciary of an estate or trust with total

New York State if the change affects the computation of New York

New York tax preference items greater than the allowable specific

State taxable income and must be reported as follows:

deduction of $5,000 ($2,500 if you are married and filing

separately), you must complete Form IT-220, Minimum Income Tax ,

Residents must report these changes on Form IT-201-X, Amended

and attach it to your New York State income tax return. For New

Resident Income Tax Return , and on an amended Form IT-220.

York purposes the federal preference items subject to New York

Write Amended at the top of Form IT-220 and attach it to

minimum income tax are: (1) depreciation (pre-1987) (ACRS

Form IT-201-X with a check or money order for the full amount of

depreciation on recovery property placed in service in New York in

any additional tax due plus interest.

1985 and 1986, ACRS depreciation on all Internal Revenue Code

Nonresidents and part-year residents must report these changes

(IRC) section 280F recovery property placed in service prior to

on Form IT-203-X, Amended Nonresident and Part-Year Resident

1/1/87); (2) intangible drilling costs; and (3) qualified small business

Income Tax Return , and on an amended Form IT-220. Write

stock (excluded under section 1202). Also include the amount of

Amended at the top of Form IT-220 and attach it to Form IT-203-X

New York addition for restoration of net operating loss deduction.

with a check or money order for the full amount of any additional

Because of different state and federal requirements, you may have

tax due plus interest.

to file Form IT-220 even if you are not required to file federal

Form 6251, Alternative Minimum Tax - Individuals , or federal

Estates or trusts must report these changes on an amended

Form 1041, U.S. Income Tax Return for Estates and Trusts . You

Form IT-205, Fiduciary Income Tax Return, and on an amended

may have to file Form IT-220 even if you derived no tax benefit from

Form IT-220 by writing Amended at the top of each form and

the items of tax preference.

including a check or money order for the full amount of any

additional tax due plus interest.

The tax preference items to be reported on Form IT-220 are

explained in Line instructions that begin below.

Attach a copy of the federal report of examination changes and a

signed statement indicating that you concede the federal audit

If you marked an X in filing status ③ (Married filing separate return)

changes. If you do not concede the federal audit changes, attach a

on Form IT-201, Resident Income Tax Return, or Form IT-203,

signed statement explaining why you do not agree. Do not attach

Nonresident and Part-Year Resident Income Tax Return, you and

the amended return to any other return. Send the amended return

your spouse must each figure your minimum income tax on a

and the full amount of any tax due plus interest to: State

separate Form IT-220.

Processing Center, PO Box 61000, Albany NY 12261-0001.

New York City taxpayers

New York City residents must report a federal change in tax

If you are a city of New York resident (or part-year resident) and

preference items on the amended New York State form filed for

you are subject to the New York State minimum income tax, you

minimum income tax purposes. Follow the above instructions for

must figure the New York City minimum income tax due on

federal changes or the filing of an amended federal return.

Form IT-220. A New York City nonresident is not subject to the city

Line instructions

of New York minimum income tax.

Print or type the required information at the top of Form IT-220. If

If you changed your New York City and New York State resident

an estate or trust has an employer identification number, enter it in

status at the same time, report both your state and city minimum

the space provided. Mark an X in the box indicating the New York

income tax for the resident period on one Form IT-220. If the

State income tax return you are filing.

periods of city and state residence are different, attach a schedule

showing how you figured the city minimum income tax. The

Tax preference items

New York City minimum taxable income to be reported for the

Lines 1 through 5 — Enter your federal tax preference items from

resident period is determined as if your tax year for state income

federal Form 6251 or federal Form 1041, Schedule I, Part I, on

tax purposes were limited to the period of your New York City

lines 1 through 5. If you filed either of these federal forms, attach a

residence. For information on accruals, see Form IT-360.1-I,

copy. If you are not required to file either federal form, report the tax

Instructions for Form IT-360.1, Change of City Resident Status.

preference items on lines 1 through 5 that you would have reported

if you had filed the federal form. Tax preference items also include

How to report a change in federal tax preference

those attributable to you as the beneficiary of an estate or trust, as

items

a partner of a partnership, or as a shareholder in an electing

If the Internal Revenue Service (IRS) changes the tax preference

New York S corporation.

items you reported on your federal form for the alternative minimum

If you marked an X in filing status ③ on Form IT-201 or IT-203, you

tax, you must report this change to the New York State Tax

and your spouse must each report your share of tax preference

Department within 90 days from the date the IRS makes its final

items on a separate Form IT-220.

determination.

Residents — If you are filing Form IT-201, enter in Column B the

If you file an amended federal return changing the tax preference

amount of each federal tax preference item; do not use Column A.

items reported to the IRS, you must also file an amended state

return with the New York State Tax Department within 90 days from

the date you amend your federal return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4