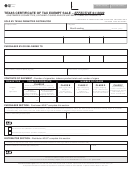

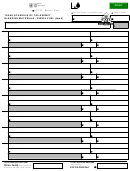

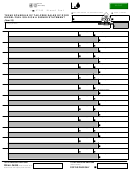

Form 69-302 (Back)(Rev.9-09/6)

INSTRUCTIONS FOR COMPLETING

TEXAS CERTIFICATE OF TAX EXEMPT SALE –

prior to 9/1/2009

GENERAL INFORMATION

Who Must File: Texas distributors who sell unstamped cigarettes and/or untaxed tobacco products to a federal or military establishment or to a Native

American reservation must complete the Texas Certificate of Tax Exempt Sale.

When to File: Mail the tax exempt sale form, along with your Texas Distributor Monthly Report of Cigarettes And Stamps (Form 69-100) and/or your Texas

Distributor Monthly Report of Cigar and Tobacco Products (Form 69-101) for the same filing period, on or before the due date listed on the Form 69-100

and/or the Form 69-101.

SPECIFIC INSTRUCTIONS

SOLD BY TEXAS PERMITTED DISTRIBUTOR

Item a – Taxpayer number - Enter the 11-digit taxpayer number as shown in Item c of the Texas Distributor Monthly Report of Cigarettes and Stamps or

Item c of the Texas Distributor Monthly Report of Cigar and Tobacco Products.

Item c – Filing period - Enter the report filing period. The filing period should be the same as the filing period shown in Item d of the Texas Distributor

Monthly Report of Cigarettes and Stamps or Item d of the Texas Distributor Monthly Report of Cigar and Tobacco Products.

Item d – Taxpayer name - Enter your entity/taxpayer name as in Item g of the Texas Distributor Monthly Report of Cigarettes and Stamps or Item g of the

Texas Distributor Monthly Report of Cigar and Tobacco Products.

Item e – Physical address of permitted location - Enter the physical address of your permitted location. Do not use a rural route or P.O. Box.

PURCHASED BY OR DELIVERED TO

Item f – Name – Enter the name of the federal or military establishment or the Native American reservation the unstamped cigarettes and/or untaxed

tobacco products were sold.

Item g – Address – Enter the physical address of the federal or military establishment or the Native American reservation. Do not use a rural route or P.O.

Box.

Item h – Purchaser or authorized agent requesting shipment – Enter the name of the purchaser or authorized agent requesting the shipment of the

unstamped cigarettes or untaxed tobacco products.

Item i – Date of delivery of shipment – Enter the date (Month, Day, Year) the shipment of the unstamped cigarettes or the untaxed tobacco products was

received.

Item j – Invoice number covering shipment - Enter the invoice number from the permitted distributor identifying the shipment of the unstamped cigarettes

or untaxed tobacco products.

CONTENTS OF SHIPMENT

Item 1 – Cigarettes - Enter the actual number of cigarettes (sticks) purchased or received from the permitted distributor.

Item 2 – Class A - Tobacco including snuff, pipe tobacco, twist, plug and chew purchased or received. Enter the value (sum of the manufacturer’s list price

for the products, in dollars and cents) of tobacco products for each Class A product.

Items 3 through 6 – Class B, C, D, & F - Enter the volume of tobacco products for each class.

Class B – Little cigars purchased or received with a weight of not more than 3 pounds per thousand.

Class C – Cigars purchased or received weighing 3 pounds per thousand selling for 3.3 cents or less each.

Class D – Cigars purchased or received weighing 3 pounds per thousand of natural leaf selling for over 3.3 cents.

Class F – Cigars purchased or received weighing 3 pounds per thousand of substantial non-tobacco filler selling for over 3.3 cents.

PURCHASER SECTION

Item 7 – Name of authorized agent - Print the name of the authorized agent receiving the unstamped cigarettes or untaxed tobacco products.

Item 8 – Title - Print the title of the authorized agent receiving the unstamped cigarettes or untaxed tobacco products.

Item 9 – Service number or Social Security number - Enter the service number if the authorized agent is a member of the armed forces or enter the Social

Security number if the authorized agent is a civilian employee.

DISTRIBUTOR SECTION

Item 10 – Name of distributor or authorized agent - Print the entity name of the permitted distributor or the authorized agent making the delivery of the

unstamped cigarettes or untaxed tobacco products.

Item 11 – Date - Enter the date (Month, Day, Year) the Texas Certificate of Tax Exempt Sales was completed.

FOR ASSISTANCE

For questions regarding Texas cigar and/or tobacco products tax, contact the State Comptroller at (800) 862-2260 or (512) 463-3731.

1

1 2

2